Dedicated locality research platform

Dedicated locality research platform

Enter your email address and you will receive

a link to reset your password

Fractional ownership platform hBits has acquired the 44,328 square foot CyberCity Magarpatta campus in Pune. The agreement duration for Tenant 1 is 60 months and Tenant 2 is 108 months with a lock-in period of 36 months for both. Located in the prestigious Magarpatta City township, the campus will provide a INR 55 crore investment opportunity for investors and increase hBits' assets under management to INR 365 crores. The acquisition price and rental income of the asset offers a gross entry yield of 9% and expected internal rate of return of 15.15%. This expansion underscores Pune's attractiveness as a commercial real estate market.

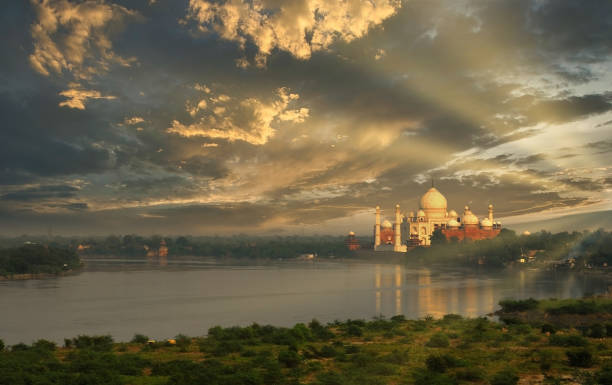

Indian Hotels Company Limited (IHCL) reported a 27.43% YoY rise in Q4 net profit to INR 418 crore, though net profit fell 8% QoQ. Revenue rose 18% YoY to INR 1,951 crore. For FY24, net profit grew 26% to INR 1,259 crore on a 17% revenue increase to INR 6,952 crore. IHCL achieved its 'Ahvaan 2025' goals ahead of schedule and will also launch upscale hotels under the re-imagined Gateway brand, expand internationally, and invest INR 3,500 crore over 5 years. IHCL is well positioned for continued growth, having already exceeded its strategic goals.

Zeassetz, India's largest co-living rental investing platform, has partnered with real estate developer Bramhacorp to introduce a new co-living standard called "Isle of Life" in Hinjewadi Phase II, Pune. The project consists of 484 fully furnished studio apartments across two sizes priced from INR 22.9 lakhs. Each unit is designed to offer premium amenities and managed living. This expands Zeassetz's buy-to-rent portfolio and provides investors with a straightforward way to earn rental income through tenant management. Emphasizing affordability, convenience and easy rentals, the project is suitable for modern investors seeking high returns.

Chennai emerges as a top destination for offshore multinational companies (MNCs) establishing Global Capability Centers (GCCs), surpassing traditional leaders Bengaluru and Hyderabad. Lower commercial rental rates, ample Grade A office space, and robust city infrastructure make Chennai an attractive choice. Its strong manufacturing sector, particularly in electronics and automobiles, complements offshore businesses. Bengaluru faces challenges with a global IT slowdown and layoffs, impacting office space leasing. Chennai's GCC market expands beyond IT sectors, attracting diverse industries like banking and R&D. This trend reflects a broader regional shift, with India and other Asian countries emerging as key hubs for cost-effective offshoring solutions.

NBCC Ltd., a prominent state-owned construction company in India, achieved remarkable success in project acquisition during the 2023-24 fiscal year. With a consolidated project value of INR 23,500 crore, marking 250% increase from the previous year, NBCC demonstrated its prowess in construction and infrastructure. Chairman K P Mahadevaswamy attributed this success to the company's robust order book and emphasized their focus on redevelopment and land monetization projects. Notable wins include securing significant FAR works in Amrapali and venturing into new sectors like agri-infrastructure. With a strong order book and diversification strategy, NBCC is poised for continued growth and impact on India's construction landscape.

India Ratings and Research (Ind-Ra) forecasts stability in the residential real estate market for FY25, focusing on affordability. Despite price increases, the market is expected to grow steadily, although at a slower pace compared to previous years. Stable interest rates will support affordability and spur home-buying activity. While sales growth is projected to moderate to 8%-10% year-on-year, demand for mid-income and upper mid-income housing segments remains strong. Price hikes are expected to slow to around 5% year-on-year, maintaining affordability. However, high unsold inventory levels in premium segments pose challenges. Overall, FY25 presents a cautiously optimistic outlook for the residential real estate market.

Macrotech Developers, renowned for its Lodha brand, reported a Q4 FY24 net profit decline of 10.61% to INR 667 crore, yet full-year FY24 profit tripled to INR 1,554 crore compared to FY23. They've raised pre-sales guidance by 20% to INR 17,500 crore for FY25, banking on strong demand, especially in the middle-income segment. With record pre-sales of INR 14,520 crore in FY24, they solidify their position among India's top real estate developers. Financially, they reduced net debt by over INR 4,000 crore in FY24, reaching a manageable INR 3,010 crore, and improved their net worth. Total income rose, with Q4 FY24 seeing a significant increase to INR 4,083.9 crore. Lodha plans to launch seven new projects in Mumbai and Pune, totaling 3.4 million square feet, and expand into Bengaluru after successful ventures.

Actor Matt Damon expands his real estate holdings with an USD 8.6 million condominium purchase at the prestigious 8899 Beverly building in West Hollywood. This 2,850-square-foot unit boasts two bedrooms, two and a half bathrooms, and panoramic views of the Hollywood Hills. Developed by Olson Kundig, 8899 Beverly offers luxurious amenities, including a 24-hour concierge, fitness center, and resort-style pool. Notably, the building promotes social equity by allocating its first floor to 15 affordable housing units. Damon's investment highlights the appeal of ultra-luxury high-rises in Los Angeles, positioning 8899 Beverly as a coveted address blending luxury, inclusivity, and convenience for high-profile residents.

Ghatkopar West, located in Mumbai's eastern suburbs, is a vibrant neighborhood known for its excellent connectivity and diverse housing options. In March, Wadhwa The Address Boulevard emerged as the top-selling building, with the closing of 7 deals. The Ghatkopar West area offers a mix of high-end luxury apartments and budget-friendly options, appealing to a wide range of homebuyers. Apartment sizes vary, from spacious units in Wadhwa The Address Boulevard to compact spaces in Hilton Enclave. With prices per square foot ranging from INR 3,667 to INR 43,911, Ghatkopar West caters to different budgets. Close to 50% of apartments sold were within the INR 1 crore range, showcasing its appeal to various segments of buyers.

Real estate developer Puravankara Group announced plans to redevelop a prestigious residential society in Mumbai's upscale Pali Hill neighbourhood. The large-scale project is estimated to have a gross development value of over INR 2,000 crore. The Bandra West area, particularly Pali Hill, has become the focal point of Mumbai's real estate scene in recent years. Along with this flagship redevelopment, Puravankara is exploring opportunities to redevelop several other housing complexes in Mumbai. The company aims to deliver over 2,000 units across major Indian cities in the current financial year through new launches and ongoing projects.

• A residential flat spanning 929 square feet sold in Sobha Lifestyle in Bengaluru's Devanahalli for INR 5 crores</br> • A residential flat spanning 3785 square feet sold in Mantri Espana in Bengaluru's Bellandur for INR 4.3 crores</br>

The Ludhiana Improvement Trust (LIT) was ordered by the District Consumer Disputes Redressal Commission to pay INR 1 lakh in compensation to a complainant for failing to provide possession of a flat for 14 years. Despite multiple attempts by the complainant to acquire possession and reschedule installment payments, the LIT did not respond, leading to the complainant seeking legal intervention for possession, rescheduled payments, and compensation. This case underscores the importance of timely delivery and communication in real estate transactions to prevent consumer grievances and legal disputes.

The Karnataka Real Estate Regulatory Authority (KRERA) has ordered a developer to return a plot to the initial homebuyer, reversing its earlier sale to a second buyer after an eight-year delay in delivering the property. The case is regarding a plotted development by Vega Spaces called Bella Palms in Belgaum. The homebuyer had invested INR 16 lakh in 2014 but the sale deed was not signed despite him paying INR 9 lakh by 2017. After submitting a revised plan, the developer cancelled the previous allotment and sold all the plots to a third party. However, KRERA ruled in favour of the initial homebuyer, citing the contractual agreement and substantial initial payment received by the developer.

Dubai announced the commencement of construction for a new terminal at Al Maktoum International Airport, slated to become the world's largest aviation hub. The ruler of Dubai emphasised its global preeminence, surpassing its counterparts with a capacity five times greater than Dubai International Airport. Sheikh Ahmed bin Saeed Al Maktoum outlined the phased trajectory of the project, aiming to accommodate 150 million passengers annually within a decade. Despite spatial constraints hindering expansion, authorities are resolute in their ambition to supplant the existing airport and establish a modern, thriving transportation hub at the heart of the city.

Under the present GST regime, landlords are not liable to pay GST against their real estate rental income, provided the premises is let out for residential purposes. Rent arising out of a residential property being used for business is however applicable for GST as services are being supplied. In addition, if the rental proceeds of a residential property exceed 20 lac rupees per annum, GST is applicable at the rate of 18%.

Gurugram based Experion Developers is set to invest approximately INR 1,500 crores in developing a luxury housing project named 'Experion Elements' in Noida. The project, registered with the Real Estate Regulatory Authority (RERA), will feature around 320 housing units on a 4.7-acre site, with the first phase offering about 160 units for sale. The project, boasting a total developable area exceeding 10 lakh sq ft, will offer modern amenities including electric vehicle charging infrastructure, a clubhouse, fitness centre, swimming pool, and landscaped gardens. The investment will be covered through internal accruals and advance collections from customers.

Gujarat's real estate market saw a slowdown in new project launches during FY 2023-24, with 1,721 registrations, down 7.7% from the previous year. Factors like rising land, construction, and labor costs, coupled with ongoing projects, contributed to the decline. Investor interest shifted towards other avenues like the stock market, impacting demand. However, office space demand surged as businesses normalized. Vadodara faces land scarcity, while Rajkot experiences mid-segment property slowdown. Ahmedabad sees a rise in redevelopment projects. Despite challenges, Gujarat's real estate outlook remains positive, driven by infrastructure development and employment growth. The affordable housing segment also declined, attributed to project completions and changing buyer preferences. Overall, developers are optimistic amid economic growth and evolving market dynamics.

The Guardians Real Estate Advisory celebrated a significant achievement on Gudi Padwa, generating a record-breaking INR 262 crore revenue through 181 real estate deals. Saurabh Phull, COO of The Guardians, attributed this milestone to the resilience of India's real estate market amid global economic challenges, exceeding INR 5,000 crore. Gudi Padwa's significance as a festival of new beginnings accentuated the success, as purchases made on this day are believed to bring good fortune. The Guardians' role in facilitating these transactions underscores their commitment to empowering homeownership aspirations and shaping the future of Indian real estate through innovation, customer satisfaction, and community engagement.

India's household debt has risen to 39.1% of GDP, surpassing the previous record of 38.6%. Motilal Oswal's report attributes this increase to a 16.5% rise in non-housing debt, outpacing corporate borrowings, which only grew by 6.1%. The pandemic aggravated this trend, especially impacting low-income families. While GDP has rebounded to 8.4% growth, household debt remains high. Non-housing debt increased by 18.3% in December 2023, surpassing housing loans' 12.2% rise. The household sector contributed 70% to non-government, non-financial debt growth. Low household savings, at 5.1% of GDP, highlight economic challenges post-pandemic, necessitating careful management of household debt for sustainable growth.

WeWork India, the leading flexible workspace provider in India, has announced plans to expand operations by signing lease agreements for two new buildings - HQ27 in Gurugram and Amanora Crest in Pune. HQ27 is located in Gurugram's MG Road market with over 96,000 sq ft across three floors and 1,480 desks. Amanora Crest is situated within Pune's largest mall complex, Amanora Mall, with over 87,000 sq ft and 1,700 desks. Scheduled to open in the next couple of months, both buildings offer strategically located, contemporary workspaces with amenities and will reinvent the workspace experience. WeWork India�s continued expansion across cities exemplifies its reliability as a brand and is a reflection of its strong relationships with all stakeholders, including landlords, IPCs and members.

The Gurugram Home Developers Association has strongly opposed the Haryana government's February 2023 ban on constructing a fourth floor plus stilt on residential plots. They have demanded the moratorium be lifted as developers have suffered significant losses. In October 2023, the association had suggested reinstating zoning plans requiring adequate open space. The association highlighted how housing supply and many property owners and contractors now face issues as they had taken loans or invested to construct the fourth floor before the restriction was announced.

IHG Hotels & Resorts aims to double its operating hotels in India to 100 properties over the next five years. Currently, it operates 46 hotels with nearly 50 more in the pipeline. In 2023, IHG recorded strong growth across brands in cities like Gurgaon, Mumbai and Amritsar. It is targeting tier 2/3 cities and focusing on mid-scale brands which reflect 70% of new deals. The expansion plan features brands like InterContinental, Crowne Plaza, Voco, Holiday Inn and more to meet India's demand for branded accommodations.

Private equity firm KKR has agreed to purchase a portfolio of 19 student housing properties from Blackstone Real Estate Income Trust (BREIT) for USD 1.64 billion. The portfolio consists of over 10,000 beds across 19 communities near top universities in 10 states. Upon closing, KKR's student housing platform University Partners will take over management as it expands its owned and managed portfolio to over 25,000 beds worth USD 4 billion. Blackstone, through its company American Campus Communities (ACC), is the largest owner of student housing in the U.S., with more than 190 properties, representing approximately 140,000 beds.

Mahindra Logistics Ltd. (MLL) recently disclosed its financial results for the quarter and year ending March 31, 2024, indicating a mixed performance. Standalone revenue slightly rose for both periods, while profitability dipped marginally. However, on a consolidated basis, MLL reported net losses for both Q4 FY24 and FY24, despite a modest revenue increase. Positive strides were observed in segments like 3PL supply chain services, with notable growth in the automotive, engineering, and consumer goods sectors. MLL emphasized its commitment to expansion through strategic acquisitions, exemplified by the recent investment in Zip Zap Logistics. While short-term challenges persist, MLL's focus on growth segments and strategic investments bode well for future prospects.

The National Real Estate Development Council (NAREDCO) Maharashtra and the Practicing Engineers, Architects and Town Planners Association (PEATA) hosted a knowledge session bringing together leaders from the real estate sector to examine recent regulatory changes and their effects on real estate in Mumbai. Industry icons like Niranjan Hiranandani, Rajan Bandelkar, Kamlesh Thakur, Manoj Dubal and Manoj Daisaria engaged in a panel discussion moderated by Aarti Harbhajanka. They debated issues such as the need for further government support given the substantial tax revenue from real estate. Presentations also evaluated Sections 33(11), 33(20)B of regulations and their implications for projects. Architects Karan and Devansh Daisaria shared insights into evolving design and construction trends.

The Enforcement Directorate (ED) provisionally attached properties worth INR 97.79 crore belonging to businessman and actor Shilpa Shetty's husband Raj Kundra under the Prevention of Money Laundering Act (PMLA) in connection with a Bitcoin investment fraud case. These include a residential flat in Mumbai's upscale Juhu area, a residential bungalow in Pune, and equity shares. The investigation is part of multiple FIRs registered by the Maharashtra and Delhi Police. Raj Kundra allegedly received 285 Bitcoins from the key accused to set up a Bitcoin mining farm in Ukraine. This is the second attachment in the case, with previous properties worth INR 69 crores attached. However, in India, real estate transactions in cryptocurrencies like Bitcoin are unlikely in the near future due to regulatory and banking system constraints.

• A residential flat spanning 372 square feet sold in Qualitas Gardens in Raigad's Panvel for INR 30 lakhs</br> • A residential flat spanning 229 square feet sold in Prakash Residency in Raigad's Kalamboli for INR 30 lakhs</br>

The Calcutta High Court, led by Chief Justice TS Sivagnanam and Justice Hiranmay Bhattacharyya, issued a crucial directive prohibiting the registration of buildings without approved plans. This decision was prompted by the collapse of an under-construction building in the Garden Reach locality, revealing its lack of a sanctioned plan. The court emphasised the necessity of adhering to sanctioned building plans to ensure structural integrity and safety. This ruling signifies a significant step towards regulating construction practices and preventing future mishaps in the region.

IRB Infrastructure Developers has committed most of its planned investments for 2024-25 towards expanding road capacity through the Build-Operate-Transfer (BOT) model of public-private partnership. The company plans to invest INR 10,000-12,000 crore, with around INR 8,000 crore expected from BOT projects. It is also targeting INR 4,000 crore from acquiring highway assets through Toll-Operate-Transfer deals. This focus on BOT comes as the government pushes greater private participation in developing highways. IRB currently owns and operates 15,000 lane km of roads across 12 states through various PPP models including BOT, HAM and TOT.

In the case of plotted developments, the developer, landowner, or authority undertaking the project must pay GST charges on the sale of developed land within the project. The GST is to be charged on super built-up basis and not the actual measure of the developed plot. Also, any lease, tenancy or right to occupy created for a plot of land is considered to be a provision of services and therefore liable for GST.

Sundaram Home Finance, a prominent provider of property-related financing, is expanding its presence beyond South India, recently opening a branch in Kota, Rajasthan, with plans for another in Udaipur. With existing branches in Rajasthan and a goal to disburse INR 300 crore in loans over the next few years, Sundaram aims to capitalize on Rajasthan's growing urban population and demand for housing units. Managing Director Lakshminarayanan Duraiswamy emphasized the company's growth strategy, targeting states like Rajasthan, Maharashtra, and Gujarat alongside their established presence in South India. Sundaram offers a range of financial products beyond home loans, catering to diverse property-related needs, reflecting a broader trend of financial institutions tapping into India's housing demand.

In India's major cities, rising rental yields signal challenges for young professionals seeking affordable housing. Historic highs in rental yields, reaching 4.5%, hint at future cost hikes for renters. Demand for rental properties in cities like Bengaluru, Mumbai, and Gurugram has surged, outpacing supply and giving landlords greater leverage to raise rents by over 50% in some areas. This trend, with some locations seeing a 60% increase since 2019, prompts consideration among renters to buy property. However, complexities such as limited transparency and high house price-to-rent ratios present hurdles for potential buyers, amid uncertainty regarding future rental yield stabilization.

Royal India Corporation Limited (RICL) is investing INR 450 crore into Kalyan Marina, a transformative project in Kalyan, Maharashtra. Spanning 2.2 acres, the development aims to create 5 lakh square feet of modern living, office, and retail spaces. Sunder Iyer and Mangal Keshav's family offices are backing the project with a preferential issue of INR 100 crore, showcasing confidence in Kalyan's growth. Kalyan Marina's strategic location near Kalyan Station aligns with the ongoing INR 900 crore modernization project, promising enhanced connectivity and convenience. This significant investment signals Kalyan's emergence as an attractive destination for residential and commercial ventures, bolstering its future prospects.

WeWork India is undergoing a significant transformation with Enam Holdings taking a substantial stake in the company. Enam Holdings, led by Akash Bhansali and his family, is acquiring a 40% stake for INR 1,200 crore (USD 145 million) through a secondary share sale, demonstrating confidence in India's flexible workspace market. Meanwhile, the Embassy Group, WeWork India's majority owner, is acquiring WeWork Inc.'s 27% stake for approximately INR 700 crore (USD 85 million), marking WeWork Inc.'s exit from India. Despite WeWork Inc.'s global challenges, WeWork India has shown strong growth, boasting over 70,000 members and plans for further expansion. This restructuring, with a total deal value of INR 2,100 crore (USD 230 million), signals a renewed commitment to India's flexible workspace market, positioning WeWork India for continued success under new leadership.

Accacia, spearheading the charge in sustainable real estate technology, has secured a significant USUSD 6.5 million pre-Series A funding round led by Illuminate Financial. Founded in 2022 by Annu Talreja, the company offers AI-powered software solutions to track and reduce greenhouse gas emissions in the real estate sector. This investment underscores the growing demand for environmental solutions within the industry, with Accacia poised to lead the charge in creating a more sustainable built environment. Other proptech innovators, like BuiltWorlds, Fundwise, and Patch, are also attracting investor interest with their unique approaches to tackling sustainability challenges in real estate.

The spring home buying season in the U.S. started slowly as mortgage rates rose and home prices increased. Existing home sales dropped 4.3% in March, the first decline since December, but slightly exceeded analysts' expectations at 4.16 million. Lawrence Yun, NAR's chief economist, attributed the stagnation to stable rates and limited inventory growth. While 60% of March home sales closed within a month of listing and 29% sold above asking price, inventory remains constrained. By month-end, there were 1.11 million unsold homes on the market, down 14.4% year-over-year. Economists anticipate a slight rate decline through 2022, which may boost affordability and reinvigorate the market.

In a first of its kind, the Uttar Pradesh Real Estate Regulatory Authority (UP RERA) imposed a penalty on a homebuyer for repeatedly filing complaints about the same issue, despite having received relief. The homebuyer had filed four petitions regarding compensation for delay in registration of his unit in a Noida project, even after receiving possession and over INR 2.68 lakh as interest from the promoter. Seeing this as a misuse of the legal process, the UP RERA chairman imposed a INR 5,000 fine. This landmark action by UP RERA sends a clear message that while it is committed to protecting home buyers' interests, repeated frivolous complaints on issues already addressed will not be tolerated.

MahaRERA has proposed mandating that sale agreements include an annexure detailing all amenities and facilities promised in housing projects. This would include specifications for amenities like swimming pools, gyms, courts etc as well as timelines for their completion. Previously, such crucial information was often omitted from agreements leading to unmet expectations. The proposed order aims to provide transparency and set accountability for developers on delivering amenities as agreed. It is a significant measure that protects homebuyer interests and prevents disputes over incomplete or delayed amenities. Public feedback has been invited on the draft order by May 27.

Ajit Isaac, Chairman and Managing Director of Quess Corp, has made headlines with his recent acquisition of a 10,000 square foot plot in Bengaluru's prestigious Koramangala area. Valued at INR 67.5 crore, this transaction, set at INR 70,300 per square foot, has established a new standard for real estate deals in the city. Koramangala's third block, also known as 'Billionaire Street', boasts upscale residences and exclusive ambiance, attracting prominent figures like Infosys co-founders Nandan Nilekani and Kris Gopalakrishnan. Isaac's strategic focus on Bengaluru's upscale neighborhoods aligns with the city's booming real estate sector, particularly in sought-after areas like Koramangala. With limited land availability and rising demand from discerning buyers, the area is poised for continued growth, solidifying its status as a preferred address for high-profile individuals and investors like Isaac.

• A residential flat spanning 427 square feet sold in Krrish Vraj Palace in Nashik's Ambad for INR 18.48 lakhs</br> • A residential flat spanning 568 square feet sold in Shivalik Shivanta in Nashik's Cidco for INR 28.9 lakhs</br>

Generally speaking, the sale of land is outside the purview of GST as it does not involve the transfer of any good or services. However, in the case of plotted development projects where in addition to the land, basic amenities are provided, GST becomes applicable. This is because the amenities of a plotted development may include the construction of roads, sewerage lines, landscaped gardens, drainage systems, overhead tanks, water harvesting systems, etc. which are construed to be services offered.

Sundream Group, a prominent Noida-based real estate developer, reveals plans for a substantial investment in its Anthurium Business Park. With an additional INR 250 crore earmarked for the project's second phase, the total investment now stands at approximately INR 522 crore. This move highlights Sundream's commitment to upscale commercial development. Located in Sector 73, Anthurium Business Park offers over 1,052,000 square feet of premium office space across two towers, equipped with cutting-edge AI technology. The expansion is poised to invigorate Noida's commercial landscape, attracting leading businesses and bolstering the local economy with new job opportunities and upscale retail options.

The Aqua line, Metro 3, in Mumbai, is reaching a crucial phase with loaded integrated trials set to begin on the Aarey-Bandra Kurla Complex route. These trials, involving filled coaches, ensure operational safety and functionality before passenger operations commence. With 96% of the project already completed, now the focus is on station beautification and multimodal integration to enhance the commuter experience. Metro 3's advanced features, including unmanned operation, signify a step towards delivering a world-class metro system for Mumbai residents.

Oberoi Realty, a leading luxury real estate developer in India, witnessed a 53% decline in sales bookings to INR 4,007 crore in the 2023-24 financial year, compared to INR 8,572 crore in the previous year. The company sold 228 units worth INR 1,775 crore in Q4 2023-24 and 705 units worth INR 4,007 crore for the entire fiscal year. Despite the drop, attributed to a higher base effect, Oberoi Realty's performance remains notable, given its focus on the luxury and ultra-luxury residential segments, which often exhibit higher price points and longer sales cycles.

Assetz Property Group, a leading Bengaluru-based real estate developer, has teamed up with Inspira Builders to introduce their latest venture, "Melodies of Life." situated off Hosa Road, the 39-acre project offers 505 spacious plots ranging from 1500-3000 sq. ft. Targeted at startup and IT professionals, prices start at INR 1.71 crores, boasting upscale amenities like multipurpose courts, swimming pools, and lush greenery cultivated using the Miyawaki technique. With connectivity to major job centers and educational institutions, the project promises a well-rounded lifestyle.

The Noida International Airport in Jewar is nearing completion, with trial operations expected to begin by the end of June. Recognized as the "Jewar airport," this project has transformed the region into an airport town, attracting real estate investments and economic opportunities. Local residents are capitalizing on this growth through land investment and property rentals. Land prices are expected to rise significantly post-operationalization, prompting investors to buy plots nearby. Additionally, the surge in housing demand has led residents to rent out rooms and buildings, fetching monthly rents ranging from INR 5,000 to INR 8,000. The state government is developing a metro connection to enhance connectivity. However, long-term prosperity depends on human capital development, prompting calls for improved educational facilities and vocational training institutes.

InvestoXpert, a leading player in the real estate sector, achieved remarkable success in fiscal year 2023-24, facilitating property sales worth INR 2050 crore, marking a remarkable 95% year-over-year growth compared to the previous fiscal year. This growth translated into revenue of INR 56 crore, a significant 55% increase over the previous year. Covering 2 million square feet of property space, InvestoXpert saw residential sales constituting 95% of the total volume. Looking ahead, InvestoXpert has set ambitious sales targets of INR 4000 crore for the upcoming financial year, with plans to hire 600 people to further fuel growth. Operating as a one-stop solution for all real estate needs, InvestoXpert remains dedicated to driving continued success in the evolving Indian real estate market.

In March 2024, Hyderabad witnessed a decline of 8% in residential property registrations, totaling 6,416 properties, although the total value surged by 12% year-on-year to INR 4,039 crore. The most common price range was between INR 25-50 lakhs, constituting 45% of registrations, while properties over INR 1 crore saw a significant increase to 16%. Apartments sized 1,000-2,000 sq ft dominated registrations, comprising 70% of the total. Rangareddy district led registrations with 46%, followed by Medchal-Malkajgiri at 40%. The weighted average transaction price rose by 12% year-on-year, with plush properties over 3,000 sq ft and valued upwards of INR 5.3 crores dominating the top deals. Q1 2024 launches primarily focused on 2-BHK and 3-BHK units. This underscores the dynamic nature of real estate demand and supply in Hyderabad, with developers adapting their strategies to meet changing preferences.

Mahatma Jyotiba Phule Mandai, commonly known as Crawford Market, is undertaking a phased redevelopment. After undergoing Phase 1 renovations from 2015-2018, the heritage market is set to open this summer. The redevelopment includes the iconic fountain as well as an open space in its center, and the new market building will cater to fish and meat sellers. The project aims to enhance the market's appeal and functionality to visitors while preserving its historical significance. Once complete, the revitalized market will honor its past while gaining amenities to better serve customers for years to come.

The State Housing Federation (SHF) has urged the Maharashtra government to slash the premium for converting government land to freehold from 10% to 5% of ready reckoner rates. This move was advocated before Lok Sabha polls and will benefit 5,000 housing societies, notably in Mumbai, Pune, Nagpur, Nashik, and Thane. SHF Chairman Suhas Patwardhan highlights the burden on old societies due to high rates. However, a government official suggests no imminent decision amidst ongoing elections. High premiums hinder urgent redevelopment, as emphasized by Ramesh Prabhu of the Maharashtra Society Welfare Association. Pending applications for conversion await finalized ready reckoner rates.

Malaysia unveils plans to construct Southeast Asia's largest integrated circuit design park, offering incentives like tax breaks and waived visa fees to attract tech companies and investors. The country aims to elevate Kuala Lumpur into a regional digital hub and ranks among the top 20 countries in the global startup ecosystem by 2030. Malaysia�s Prime Minister Anwar Ibrahim emphasised on Malaysia's transition to advanced front-end design work in the semiconductor industry, with collaboration opportunities with companies like Arm Holdings. Additionally, Malaysia's sovereign wealth fund, Khazanah Nasional, announced a 1 billion ringgit fund to invest in local innovative companies.

Manikonda, located in the western outskirts of Hyderabad, Telangana, is quickly becoming a popular choice for people looking for a peaceful place to live. The area has good infrastructure, modern facilities, and various housing options, suitable for different budgets and preferences. Last month, ARKA by TEAM4 LifeSpaces was the best-selling building, closing 45 deals out of the 64 registered in Manikonda. Surrounded by beautiful landscapes, close to major IT hubs, and with easy access to the Outer Ring Road, Manikonda offers a perfect mix of city life and suburban tranquility.

D'Decor, a leading home furnishing manufacturer, introduces Sansaar, a new brand focusing on sustainable and minimalist design. Partnering with Bollywood superstar Ranveer Singh as brand ambassador, Sansaar emphasizes conscious living and eco-friendly practices. The curated collection includes curtains, upholstery, bedsheets, rugs, blinds, and wallpapers, prioritizing quality craftsmanship and timeless design. D'Decor's reputation for sustainability and production capacity aligns with Sansaar's mission. This trend of celebrity endorsements for sustainable home furnishing brands reflects a shift in consumer preferences towards eco-conscious choices. Sansaar's launch signifies a growing demand for real estate that integrates sustainability into both construction practices and furnishing choices, shaping the future of mindful living spaces.

• A residential flat spanning 574 square feet sold in Wisteria Residency in Mumbai's Santacruz East for INR 95 lakhs</br> • A residential flat spanning 1102 square feet sold in Runwal Timeless in Mumbai's Sion for INR 1.42 crores</br>

Flat owners that pay upwards of INR 7,500 per month in maintenance fees are liable to pay GST at the rate of 18% on the full sum paid. An individual who owns multiple apartments in the same housing society, will be taxed separately for each unit. Housing societies and Residents’ Welfare Associations that collect more than INR 7,500 per unit per month and have an annual turnover exceeding 20 lac rupees must pay 18% GST. These entities are entitled to claim ITC on tax paid by them on capital goods, maintenance and repair services.

Suraj Estate Developers acquired a 1,073.42 square meter plot in Mahim West, Mumbai, for INR 33.10 crore, projecting a GDV of INR 120 crores. Settling litigations and filing consent terms, they secured additional development rights, estimating a GDV of INR 350 crores. Winning bid for another parcel, they anticipate a GDV of INR 225 crores. Utilizing IPO funds, they fully repaid outstanding loans. With 35 years of experience, the company focuses on strategic acquisitions and expansions, aiming to strengthen its position in Mumbai's real estate market, projecting over INR 500 crores in revenue growth in the upcoming years.

Mahindra Lifespace Developers Ltd. has achieved remarkable success with the launch of Bengaluru's first Net Zero Waste plus Energy residential project, Mahindra Zen. The project witnessed an outstanding response, with over 150 homes booked within just two days, amounting to over INR 350 crores. Offering 'nature-crafted living' with features inspired by the five elements, climate-responsive design, and sustainable amenities, Mahindra Zen caters to the growing demand for eco-friendly living solutions. Its strategic location near business hubs and amenities adds to its appeal. The project's success underscores Mahindra Lifespaces' commitment to sustainable real estate development and reducing environmental impact.

India's residential real estate sector is witnessing an increase in debt financing as developers seek to meet the escalating demand for homes amid rising project costs. With over 1.4 billion potential homebuyers in the country, developers require significant working capital, estimated at USD 30-35 billion, to complete ongoing projects. This demand has attracted private equity firms and real estate credit funds, exemplified by recent deals such as Prestige Group securing INR 2,001 crore and Nisus Finance investing INR 105 crore. With strong sales exceeding 74,486 units in Q1 2024, experts anticipate sustained growth, attracting a diverse range of investors and facilitating further development in the sector.

Proptech start-ups that use technology to transact real estate have become more prevalent as a result of the real estate market's explosive growth in India, especially in the residential segments. Notably, NoBroker and Livspace are two that have attained unicorn status, with more on the verge of doing so. Seeing this trend, CREDAI, in collaboration with Venture Catalysts and Neovon, established the USD 100 million Spyre Proptech Venture Fund. Promising proptechs are the focus of the investment, with a sizable chunk already secured through promises. Spyre Proptech Venture Fund aims to stimulate innovation in India's real estate technology industry by providing a varied pipeline of start-ups.

The Bombay High Court has issued a temporary injunction against the Maharashtra government's decision to redevelop 25 housing societies in the Guru Teg Bahadur Nagar (GTB Nagar) refugee colony, known as the Punjabi colony, in Sion. This injunction follows a challenge filed by developer Lakhani Housing Corporation, who had secured redevelopment agreements with some of these societies. The court's decision comes amidst concerns over jurisdictional authority and the legality of the government's redevelopment plan. Lakhani Housing Corporation argued that the decision infringed on their contractual rights and voided existing agreements. The court has temporarily halted the redevelopment plan and scheduled a further hearing for May 8 to examine the matter in detail. As the legal process unfolds, ensuring the residents' access to safe and dignified housing remains a paramount concern.

Spanish retail giant Inditex is making strategic moves in India, expanding beyond its successful Zara clothing stores to introduce Bershka, a youth apparel brand, and Zara Home, targeting the burgeoning home decor market. This expansion comes amid increasing consumer demand for trendy yet affordable clothing and stylish home furnishings in India, a market estimated to be worth over USD 20 billion. Inditex's decision reflects its recognition of India's evolving consumer landscape, driven by factors like rising disposable incomes and aspirations, especially in tier-2 and tier-3 cities with large populations. By offering diverse options ranging from budget-friendly collections by Zara Home to high-end offerings by Indian luxury brands, the Indian home decor market presents ample growth opportunities for both international and domestic players alike. Additionally, several Indian fashion designers and lifestyle brands, along with international players like Pottery Barn and West Elm, are also making their mark in the Indian home decor arena. This trend has implications for the real estate sector, as consumers seek homes with modern layouts and features to accommodate trendy home decor products.

• A residential flat spanning 2038 square feet sold in Delta Spark Plaza in Nagpur's Ajni for INR 1.55 crores</br> • A residential flat spanning 774 square feet sold in New Viraj Jagdamba Building No. 3,4,5 in Nagpur's Belgaon for INR 24 lakhs</br>

MahaRERA has received several complaints from homebuyers regarding issues with parking spaces sold by developers. To address this, MahaRERA has made it mandatory to include all parking details like lot numbers, dimensions and block location in sale agreements and allotment letters. This aims to provide upfront transparency and avoid future disputes. Developers must now clearly demarcate and label garage, covered and open parking spaces as per approved plans and must also tag these spaces to the allotted apartment. Open parking is considered a common area as per RERA and cannot be sold. The directives aim to protect buyer interests by resolving issues at the outset and ensuring allottees can use the parking facilities smoothly.

Shubhashish Homes, in collaboration with Gurnani Group, unveils a luxurious villa project on Main SEZ Road in Jaipur, set to redefine luxury living in Rajasthan. Spanning 10.6 acres, the project will offer approximately 7 lakh square feet of opulent living space, promising to be a landmark development. Targeting a launch later in the fiscal year pending approvals, Mohit Jajoo, CEO of Shubhashish Homes, emphasises its significance in Rajasthan. With four launches planned this year, Shubhashish Homes reaffirms confidence in Ajmer Road's micro-market potential, backed by their track record of quality projects. Positioned to meet the rising demand for premium housing, this project blends luxury with convenience, boasting a prime location near major commercial hubs and social infrastructure.

Amidst China's nationwide property market slowdown, smaller cities like Zhengzhou are facing challenges. To boost the local property sector, Zhengzhou is implementing a unique initiative encouraging residents to trade in their existing homes for new ones. Under this program, Zhengzhou Urban Development Group Co. will buy up to 500 second-hand homes from residents who then use the funds to purchase new properties within the city center. However, concerns linger regarding the effectiveness of such measures, given the persistent liquidity crisis and buyer hesitancy. Analysts are closely monitoring the program's outcome to gauge its impact on the broader property market and economic growth in China.

GST is applicable on the purchase of under-construction flats, apartments, bungalows, villas, etc in India. As of 1 April 2019, the GST applicable for such properties varies between 1% to 5%, depending upon the size and category of housing. Government led housing projects attract only 1% GST. GST is not applicable on ready-to-move flats that have received an OC certificate or on land deals where not further service is provided.

TARC Limited celebrated a remarkable year with record-breaking presales and collections in FY2023-24, marking a 200% increase to INR 1,612 crore in presales and achieving its highest annual collection of INR 415 crore. The success is attributed to the launch of TARC Kailasa in New Delhi, garnering exceptional sales. Construction has commenced with ACC as the EPC contractor. Anticipating further triumphs, TARC 63A's upcoming launch is highly anticipated, boasting prime location and market trends alignment. CEO Amar Sarin credits the achievement to TARC's commitment to excellence and innovation, projecting to surpass INR 5,000 crore pre sales target for FY2024-25 amid a promising real estate market outlook.

Trident Realty, a major real estate developer in North India, has undertaken a strategic shift in its business focus. Through the sale of non-core assets including Shipra Mall in Ghaziabad, it has managed to raise INR 1,200 crore. Trident will utilize the sale proceeds for planned residential launches over the next 2 years' worth INR 15,000 crore across major markets in NCR, Mumbai, Panchkula and Tri-City (Chandigarh). This strategic move will allow Trident Realty to concentrate its resources on residential developments, exit non-core holdings, and further cement its position as one of the leading residential real estate players in North India.

The Economic Offences Wing (EOW) of the city police has arrested Nasli alias Bunny Batliwala (49), a trustee of the HIMS Botawala Charitable Trust, for allegedly conspiring to defraud a developer of INR 21 crore in a property redevelopment scheme. Javed Hussain, the complainant and owner of Reliable Investment and Developers, had entered an agreement with the trust to jointly redevelop a property. However, the trust allegedly sold the property to another party without his consent. The arrest sheds light on the alleged fraud by the trustees, potentially undermining public trust in charitable organizations. The police aim to uncover the full extent of the conspiracy and ensure justice for the complaining developer.

NARCL has made a firm offer to acquire INR 988 crore of debt from lenders for Essel Infraprojects' road project in Ludhiana. NARCL's offer includes INR 270 crore for the debt, providing lenders with a recovery rate of 27%. The project involves constructing a 78-kilometer four-lane highway between Ludhiana and Talwandi Bhai, passing through Moga in Punjab. Lenders are also open to considering counter-offers from other asset reconstruction companies, as indicated in a notice from BoB Caps. The project has faced significant challenges, including changes in contractors and delays in obtaining necessary clearances from various authorities. These hurdles have delayed the completion of the project, which was initially aimed for a September 2014 finish.

The Bombay High Court upheld the Dahanu Taluka Environment Protection Authority's (DTEPA) order allowing the Jawaharlal Nehru Port Authority (JNPA) to develop a greenfield port at Vadhavan, Palghar district. It rejected petitions by Conservation Action Trust and National Fish-worker's Forum challenging the order. The court observed that DTEPA considered all relevant aspects and proposed mitigation measures. However, JNPA still needs clearances from various authorities. The court acknowledged DTEPA's earlier stance against a port in the 'ecologically fragile' Dahanu, but noted changes allowing ports in such areas. The INR 76,220 crore project, a JNPA-Maharashtra Maritime Board joint venture, spans 17,471 hectares.

The Yamuna Expressway Authority has relaunched its group housing scheme, offering six plots in sector 22D near Noida International Airport. Aimed at generating at least INR 450 crore in revenue, the scheme follows an unsuccessful tender in 2013. Plots vary in size, with prices ranging from INR 61.5 crore to INR 135.3 crore. Bidders must submit applications and earnest money by May 20, with an e-auction scheduled for June 10, 2024. Payment flexibility allows developers to pay in installments over five years. Proximity to key developments like the proposed film city and Eastern Peripheral Expressway enhances the scheme's appeal.

State-owned construction giant NBCC is considering establishing its own non-banking finance company (NBFC) to lower borrowing costs for critical infrastructure projects, a move unprecedented for an Indian public sector entity. Currently relying on external NBFCs with interest rates between 12% and 14%, NBCC anticipates potential savings of 1-2 percentage points with an in-house NBFC, translating to substantial savings. This initiative could save NBCC over USD 108 million in interest costs over two years. While awaiting approval from the new Indian administration and a license from the Reserve Bank of India (RBI), NBCC's proposed NBFC aims to streamline financing for its projects and potentially support redevelopment projects for other public sector entities. However, challenges such as expertise acquisition and regulatory compliance remain significant hurdles to overcome.

The Chateau d'Armainvilliers, situated in Seine-et-Marne, epitomizes luxury and grandeur. It was originally owned by the Rothschild banking dynasty and later renovated by King Hassan II of Morocco. The estate boasts 100 rooms, including opulent salons and themed suites, with additions such as a hammam spa and a medical facility. Despite its grandeur, its EUR 425 million listing price has sparked debate among real estate experts. Concerns persist about the adaptability of 1980s renovations and their marketability. Nevertheless, nestled amidst its natural surroundings, including majestic redwoods and a private lake, the chateau remains a timeless symbol of refinement and elegance.

Noida Authority's extensive crackdown targeted land mafias across various sectors and villages, particularly along the Noida Expressway, where encroachments on government land were rampant. Notorious for attempting to swindle unsuspecting buyers, these mafias had encroached upon areas like Sorkha Zahidabad, Salarpur, Asadullapur, Mohiyapur, Sadarpur, Mamura, Garhi Samastipur, Gulawali, and Salarpur Khadar. The authority's anti-encroachment drive aimed to reclaim control over these illegally occupied lands, freeing up approximately 18 acres valued at INR 308 crore.Encroachments were notably cleared from Sorkha Zahidabad and Salarpur, with a combined value exceeding INR 195 crore.

Prescon Group and House of Hiranandani have unveiled 'Belicia', a luxury residential project in Thane. This 48-storey tower promises elegant living and is slated for completion by June 2028. Located near Nitin Company Junction, it offers 2, 3 & 4 BHK apartments starting at INR 1.85 crore. Amenities include a clubhouse, swimming pools, and jogging tracks. The project benefits from its proximity to essential services, major transport hubs, and corporate parks. Thane's rapid infrastructure development and connectivity make it an attractive investment destination. 'Belicia' embodies modern luxury and represents a smart investment opportunity in the Mumbai Metropolitan Region.

Sales of homes valued at USD 10 million or more in Dubai surged by 6% in the first quarter compared to the previous year, driven by robust demand from international ultra-rich buyers. The market, dominated by cash purchases, saw Palm Jumeirah emerge as the top-selling area. Despite concerns about a potential downturn, Dubai remains a global leader in luxury home sales, offering relative affordability and attracting high-net-worth individuals seeking second homes.

SEBI is conducting an e-auction on May 20th for 22 properties owned by Rose Valley companies in West Bengal, with a combined reserve price of INR 8.6 crore. These properties, including flats and office spaces, are part of SEBI's efforts to recover investor dues exceeding INR 5,000 crore. Rose Valley Group faced accusations of running illegal investment schemes promising high returns. Despite SEBI's directive to refund investors in 2017, Rose Valley failed to comply, leading to further regulatory actions. The Enforcement Directorate also initiated investigations and attached assets worth INR 150 crore. The auction offers investors a chance to recover some losses, but it's crucial for interested buyers to conduct thorough inquiries into the properties' status before bidding.

Major tech companies like Amazon, Meta, and Google are scaling back on office space, a stark reversal from their pre-pandemic expansion. Remote work, accelerated by the pandemic, is driving this trend as employees successfully adapt. Coastal cities like Seattle and San Francisco are particularly affected, with Salesforce reducing its San Francisco office space by 700,000 square feet. Landlords face challenges due to oversupply, with office space values plummeting. Stanford University research suggests remote work boosts productivity and satisfaction, but concerns about collaboration persist. A hybrid model may emerge, necessitating new office designs prioritising collaboration for dispersed teams.

India's industrial and warehousing sector is witnessing unprecedented growth, driven by a surge in demand reaching nearly 7 million square feet in Q1 2024, the highest in two years. E-commerce, with its rapid expansion, is a primary catalyst, with leasing activity for online retail tripling compared to the previous year. Traditional retailers are also expanding their warehousing needs, reflecting evolving consumer habits. While 3PL companies remain dominant, the rise in demand from sectors like retail and engineering signifies a broader economic upturn. Chennai is emerging as a key market, with leasing activity doubling, underscoring its strategic advantages. However, meeting this demand requires substantial investment in infrastructure and modern warehousing facilities across India's key cities.

Homebuyers and residents in Noida and Greater Noida West are launching a "No Registry, No Vote" campaign ahead of the 2024 Lok Sabha elections to protest pending registries. Frustrated by years of unfulfilled promises, they refuse to cast votes or choose NOTA until their demands are met. With over 1.15 lakh stalled flats awaiting resolution, residents demand expedited action from authorities. Despite government directives, the situation remains unresolved, leaving buyers in limbo. The campaign serves as a powerful reminder of the importance of addressing systemic issues impacting citizens' lives, urging politicians to heed their voices and take meaningful action.

India's office space market is experiencing a surge in demand, driven by the practice of offshoring, wherein businesses relocate operations to foreign countries for cost savings or talent access. According to Knight Frank, India has become a top destination for offshoring, with companies leasing 46% (27.3 million sq. ft) of total office space in 2023. Gulf Cooperation Council (GCC) firms are major players, drawn by India's cost-effectiveness and skilled workforce, increasing their leasing share from 25% to 35% (20.8 million sq. ft) in 2023. While IT remains dominant, diversification into sectors like semiconductors and pharmaceuticals showcases India's appeal. This growth benefits both India's economy and global businesses, with projections indicating continued expansion.

Input tax credit (ITC) refers to a mechanism wherein credit can be claimed on account of GST paid on the purchase of goods and services used for the furtherance of business. This mechanism is available to businesses registered under the GST Act, including manufacturers, suppliers, e-commerce operations and others specified in the legislation. It aims to assist businesses in effectively reducing their tax liability while encouraging compliance and preventing double taxation.

SEBI is taking action against companies that illegally raised funds from the public, planning to auction 30 properties belonging to seven such companies on May 15th to recover over INR 100 crore. These companies operated across sectors like agriculture, solar power, and infrastructure, using tactics such as issuing unregistered securities and running unauthorized investment schemes. The auction, with properties primarily in West Bengal and Odisha, aims to compensate investors who lost money due to these illegal practices. Investors are urged to be vigilant and research companies before investing, with SEBI providing guidance and support to victims of illegal fundraising. This initiative reinforces SEBI's commitment to protecting investors and maintaining the integrity of India's securities market.

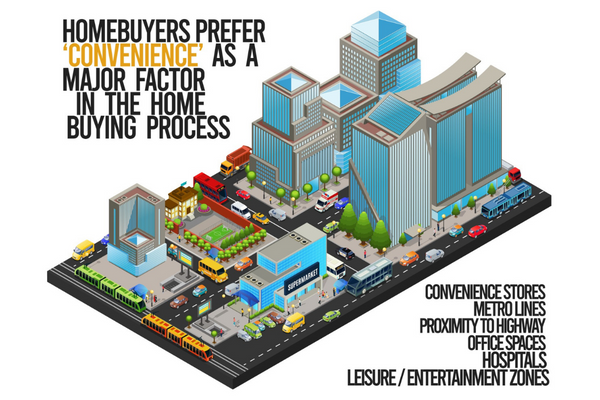

Pune's property market is experiencing significant growth, with a notable 52% year-on-year increase in property registrations in March 2024. The surge is primarily driven by demand for affordable housing, with properties priced between INR 25 lakh and INR 1 crore dominating transactions. Infrastructure development, a thriving economy, favorable interest rates, and government initiatives promoting affordability are cited as key factors fueling this trend. Young professionals aged 30 to 45 form the largest buyer segment, drawn to Pune's opportunities and lifestyle. With a focus on functionality and affordability, Pune's property market presents an enticing prospect for homebuyers.

The Punjab and Haryana High Court has ruled that paying maintenance to elderly parents does not prevent them from seeking eviction of their children from occupied property. In a case filed by 90-year-old Gurdev Kaur, the court ordered her son, a government employee, to vacate her house. Despite paying maintenance, he refused to relinquish possession. The court emphasized that accepting maintenance does not prevent eviction. The ruling underscores the Maintenance and Welfare of Parents and Senior Citizens Act's aim to protect elderly rights. It prevents the misuse of maintenance payments and ensures vulnerable senior citizens' welfare, setting a precedent for similar cases.

The National Highways Authority of India (NHAI) aims to raise INR 54,000 crores through project-based funding and asset monetization in the upcoming financial year. In the 2024 fiscal year, NHAI accrued INR 38,334 crores from project-based financing and its monetization program, including Toll Operate Transfer (ToT) and Infrastructure Investment Trust (InVIT). ToT allows private companies to operate select highways, while InVIT pools investments for infrastructure projects, generating returns for investors. NHAI plans to monetize 33 highways across India, totaling 2471 kms, generating INR 49,314 crores in the previous fiscal year. With asset monetization remaining a key financial strategy, NHAI has raised INR 1.08 trillion out of its INR 1.60 trillion target. The road sector, aided by initiatives like InVIT, has witnessed significant growth, attracting global investors and driving economic development while modernizing India's transport network.

Viman Nagar, Pune, stands out as a bustling residential and commercial hub, celebrated for its prime location near the Lohegaon Airport. Its robust infrastructure offers a mix of housing options, from high-rise apartments to independent bungalows, catering to diverse needs. March witnessed notable transactions with VNSVL Shubh Nirvana Phase 1 and Rohan Mithila leading sales. The market appeals to varied budgets, with prices ranging from INR 11.5 Lakhs to INR 3.17 crores. Apartment sizes vary, ensuring suitability for families and individuals alike. Average prices per square foot hover around INR 12,029, attracting buyers from different segments. Viman Nagar's allure lies in its balance of affordability, luxury, and convenience, solidifying its status as a sought-after real estate destination.

Anil Gupta, chairman of Wellknown Polyesters, alongside his wife and the company, purchased two sea-facing apartments in Mumbai's Lodha Malabar project for over INR 270 crore, marking one of India's priciest residential transactions at INR 1.41 lakh per square foot. The deal highlights the rising demand for luxury housing in Mumbai's upscale areas. The Lodha Malabar project, slated for completion by June 2026, has witnessed other record-breaking deals, indicating fierce competition for prime Mumbai real estate. Gupta's move signals a potential trend of large corporations investing in luxury real estate, potentially reshaping the sector's dynamics.

• A residential flat spanning 625 square feet sold in Mahalaxmi Heights in Thane's Badlapur for INR 19.92 lakhs</br> • A residential flat spanning 480 square feet sold in Maa Sherawadi Complex in Thane's Kalher for INR 16.9 lakhs</br>

The Senior Citizens Welfare Association of Signature View Apartments plans to file a plea in the Delhi High Court regarding the evacuation and rent payment promised by the Delhi Development Authority (DDA) for the structurally unsafe 336-unit Signature View Apartment housing complex in North Delhi. While over 100 families had already shifted after demolition orders were issued last year, full evacuation is still pending. The association will argue that DDA's clause to only pay rent after all apartments are vacated is unfair as most owners are still paying EMIs and cannot afford additional rent during the interim period.

After months of bureaucratic back-and-forth between the BMC and Aarey Milk Colony over clearing debris dumped along Mithi River's banks in Aarey, the National Green Tribunal (NGT) has intervened. The NGT has ordered for the formation of a committee, led by Maharashtra's chief secretary, to determine responsibility, relocation of debris, and funding. With BMC, MPCB, Aarey Milk Colony, and environmental experts onboard, the committee has a month to devise an action plan as monsoon approaches. The directive stems from Vanashakti's petition, highlighting environmental hazards. Urgent action is imperative before monsoon exacerbates the damage, underscoring the committee's crucial role in prioritizing ecological preservation.

As heat waves worsen water stress in major Indian cities, homebuyers are increasingly seeking homes built with sustainability in mind. Large developers recognize the need to proactively build climate resilience and water security into new projects. Established brands like Lodha, Prestige and Mahindra Lifespaces have implemented various water conservation measures like rainwater harvesting, greywater recycling, and passive design. These initiatives are differentiating projects and driving sales. Developers are also educating residents on water-saving habits and providing resources for sustainable living. By integrating climate resilience from the start, developers are helping prepare India's cities and real estate for water-related impacts of climate change.

The Delhi bench of the Income Tax Appellate Tribunal (ITAT) rejected an additional INR 328 crore tax demand against DLF Urban Pvt Ltd. DLF Urban had acquired land development rights from its parent company. The transaction was valued at INR 925 crore by real estate firm Cushman & Wakefield. However, the tax authorities felt the valuation was too high compared to the circle rates and imposed the additional tax. The ITAT overruled this and accepted Cushman & Wakefield's independent market valuation as a fair assessment of the transaction between related parties.

MahaRERA has directed L&T Realty to refund the deposit amount paid by an NRI homebuyer from Abu Dhabi. The buyer had booked a flat in L&T's Emerald Isle - T10 project located at Kurla in Mumbai by paying INR 25 lakhs as 10.5% of the total cost of INR 2.29 crore. However, the transaction could not be completed after the bank subvention scheme was discontinued, leaving the buyer unable to pay further amounts. L&T cancelled the booking and offered to refund INR 17 lakhs after deducting over INR 8 lakhs. But MahaRERA ruled that L&T can only deduct 2% of the flats value from the deposit amount, maintaining consistency with its earlier order involving Godrej Properties.

Sunteck Realty Ltd, a real estate developer in India, reported a 20% annual growth in sale bookings, reaching INR 1,915 crore in the last fiscal year. This impressive achievement reflects the strong housing demand in the country. The company witnessed a 26% increase in sale bookings during the fourth quarter, amounting to INR 678 crore. Sunteck Realty expanded its portfolio by adding seven large projects in the Mumbai Metropolitan Region, with a combined Gross Development Value of over INR 30,000 crore. Additionally, the company diversified into the annuity income segment by acquiring two leased assets at Bandra-Kurla Complex, positioning itself for steady rental income.

"The Tower," a 685-foot (207-meter) skyscraper, has reached its full height in Detroit's Hudson's Detroit development, becoming the city's second-tallest building. Designed by New York's SHoP Architects, the building features a sleek glass facade with vertical terracotta fins and a pyramid-shaped front. It will house residences and a hotel, with a nearby structure for retail and offices. Local developer Bedrock funded the project as part of efforts to revitalise Detroit's downtown, adding an iconic element to the city skyline.

India's housing market thrives despite rising rates and property prices. Sales surpassed 74,000 units for the second straight quarter, driven by a robust economy and focus on mid-income homes (INR 50-75 lakh). Major cities like Mumbai and Bengaluru lead the surge. Luxury segment grows, but mid-tier remains dominant. Analysts predict continued growth in 2024, with sales potentially reaching 315,000 units. While unsold inventory rose slightly, the market remains healthy. However, potential buyers should remain cautious and research thoroughly before investing, prioritizing factors like location, affordability, and developer reputation. This ensures a sound investment for the long term.

India's warehousing sector is experiencing a significant boom due to the rapid growth of the e-commerce industry and the increasing demand for efficient logistics services, which are valued at billions of dollars. As India's e-commerce market grows rapidly, consumers expect faster delivery times, driving the need for specialised warehousing solutions. Both domestic and global investors are investing heavily in the sector, with big players like Blackstone and LOGOS planning significant expansions. This investment influx, totaling more than INR 8,000 crore, promises accelerated growth and a wider range of high-quality warehousing options. Modern warehouses, built using standardized construction methods and optimised operational practices, are well-positioned to meet the changing needs of businesses, thereby reshaping India's logistics landscape.

Luxury developer Baashyaam Constructions is in talks to buy a prime 4.6-acre plot in Chennai's central business district for a whopping USD 800 crore (INR 6,400 crore). This reflects the high demand and scarcity of centrally located land in the city. The existing buildings on the plot suggest Baashyaam might redevelop it into a luxury project, aligning with their focus on high-end residences. This potential deal highlights Chennai's booming real estate market. Office space leasing hit record highs in 2023, with new office space supply also reaching a 10-year peak. Developers are bullish on Chennai's commercial future. While unconfirmed, the deal signifies investor confidence in the city's central business district.

GST stands for Goods and Services Tax. It is an indirect tax levied on the supply of certain goods and services and is applicable across India. In real estate, GST is applicable on the procurement of construction material and the service of construction. Therefore, a buyer of an under-construction flat must pay GST, as the builder continues to provide a service until the flat is ready. GST is not applicable on ready flats which have received an OC certificate or land transactions as there is no additional service provided by the builder or seller post the transaction.

The Maharashtra Real Estate Regulatory Authority (MahaRERA) has raised concerns about 212 housing projects across the state that have not provided construction status updates as mandated. These projects, launched between January and April 2023, were required to submit Quarterly Progress Reports (QPRs) to MahaRERA, but failed to do so. Non-compliance has led to strict actions including project suspension and freezing of bank accounts. To caution homebuyers, MahaRERA has published a district-wise list of these projects, with Pune having the highest number at 47. MMR and Konkan areas combined have 76 non-compliant projects. MahaRERA emphasizes the importance of regular updates to protect homebuyers' investments and ensure project completion as promised.

CBRE's report forecasts a significant surge in India's senior living facilities, estimating approximately 1.5 million new units within the next decade, driven by the doubling of the elderly population. Currently, India only has 18,000 units, indicating a vast scope for growth compared to more developed markets. The southern states, with their favourable climate and robust healthcare infrastructure, lead in senior living supply, attracting developers' attention. The market size is projected to reach USD 17.99 billion by 2029, with a 10% CAGR. Major players like Antara Senior Care and Ashiana Housing are investing heavily, signalling a shift towards tailored housing and care options for India's aging population. As awareness grows and options multiply, senior living is poised to become a mainstream housing choice, potentially emerging as a significant asset class in India's real estate landscape.

The Brihanmumbai Municipal Corporation (BMC) has identified 74 vulnerable landslide-prone areas in Mumbai, out of a total of 160. These areas, mostly natural hillocks and elevated lands, pose significant risks, with 15 in Ghatkopar, 9 in Kurla, and 5 in various other locations. The eastern suburbs have the highest number of vulnerable sections. Following a tragic landslide in Pune in 2017, the Geological Survey of India provided recommendations, prompting BMC to take action. Landslide-prone areas are categorized into high, medium, and low-risk zones, with population estimates for each. BMC's disaster management cell is training locals on landslide warnings and evacuation procedures. Recent incidents have led to temporary resettlement efforts.

• A residential flat spanning 299 square feet sold in Astha Padmavati Pearl in Raigad's Astha Padmavati Pearl for INR 57 lakhs</br> • A residential flat spanning 357 square feet sold in Thakur Ubora in Raigad's Taloja for INR 26 lakhs</br>

Premium real estate developer Ashiana Housing sold out 224 luxury flats worth INR 440 crores within 15 minutes of launch. The project 'Ashiana Amarah Phase 3' located in Gurugram sector 93 saw registration begin at 11 am, with 800 cheques received by 11:15 am for the 224 units. Company JMD Ankur Gupta attributed the incredible response to their quality offerings and strong brand value over the years, as well as the kid-centric amenities appealing to buyers seeking better quality of life for their children. Going forward, Ashiana Housing aims to continue expanding its premium portfolio across India.

Canada plans to extend the mortgage payment period to 30 years for first-time home buyers of newly built homes, aiming to aid younger consumers and stimulate the housing supply. Finance Minister Chrystia Freeland announced the move, part of the upcoming federal budget, to make monthly payments more manageable. However, experts warn of potential consequences, including driving up home prices and wealth transfer implications. Despite intentions to address affordability, concerns remain regarding the policy's broader impact on the housing market.

Kolte-Patil Developers' annual sales in FY24 reached 3.92 million square feet, marking a significant 20% increase compared to the previous fiscal year's 3.27 million square feet. This surge underscores the company's robust performance and growing market presence. The uptick reflects strong demand for their real estate offerings. In Q4 FY24 alone, the company recorded quarterly pre-sales of INR 743 crore, indicating a 6% YoY growth. Kolte-Patil also launched projects worth INR 3,800 crore across Pune and Bengaluru during the fiscal year.

The National Company Law Tribunal (NCLT) bench in Mumbai resolved the corporate insolvency proceedings against Mumbai Metro One Private Limited, which operates Mumbai's busiest metro line. This resolution followed a one-time debt settlement between the company and its lenders led by State Bank of India and IDBI Bank. The resolution could enable the Maharashtra government to acquire Reliance Infrastructure's majority stake in MMOPL. The Maharashtra cabinet had recently cleared a sum of INR 4000 crore for purchasing this majority stake.

The Supreme Court will examine the validity of the Income Tax department's assessment of INR 33,000 crore in disputed taxes on Jaypee Infratech Ltd. (JIL). JIL has been going through insolvency proceedings since 2017 over its stalled housing projects that have left over 22,000 homebuyers without homes. In 2023, the National Company Law Tribunal approved a resolution plan by Suraksha Group to acquire JIL assets and complete projects. However, the Tax department notified the tax claim in August 2023, jeopardizing the resolution process. The Court will review the assessment order to help resolve issues stalling project completion for homebuyers even after years of litigation.

Wyndham Hotels is expanding aggressively into India's booming branded residences sector. By 2025, the hospitality giant aims to have at least five branded residential projects operational across major Indian cities like Bengaluru, Mumbai, and Delhi. According to Dimitris Manikis, President of Wyndham for Europe, Middle East and Africa, the company sees strong potential given rising demand from consumers who prioritize security, health, and unique experiences from trusted brands. With a robust pipeline, Wyndham is well-positioned to capitalize on the growing demand in the residential and hospitality market in India.

Century Real Estate Holdings has secured INR 450 crores in debt financing from Edelweiss Alternative Asset Advisors. Around 40% of the funds will be used to acquire a 72-acre land parcel near Devanahalli airport in Bengaluru to develop a plotted residential project. The rest will be used to repay existing debt and provide working capital for new and existing projects. Managing Director Ravindra Pai said Bengaluru's residential market has been robust, with Century achieving INR 1,000 crores in sales in FY24 and aiming for INR 2,000 crores in FY25. Property consultants note debt transactions in housing have increased due to sales momentum and need for working capital.

Canada aims to address its housing shortage by leasing public land for affordable housing construction, with plans to build 3.9 million homes by 2031. However, this falls short of the 1.2 million units needed between 2023 and 2030. Prime Minister Justin Trudeau announced measures to tackle the crisis, including changes to tax structures and combating mortgage fraud. Critics emphasize the substantial investment required, estimated at CAD 2 trillion. Housing responsibilities in Canada primarily rest with provinces and major municipalities, with Ottawa relying on policy measures and funding despite lacking direct involvement in construction.

PNB Housing Finance is transitioning to offer a wider range of mortgage solutions, focusing on affordable home loans and emerging markets. With a strategic shift towards retail lending, the company has improved its credit ratings and aims to reduce corporate loans. Despite potential short-term challenges in net interest margins, the company's focus on affordable housing and digital enhancements is expected to drive growth. Projections indicate strong growth in assets under management and profits, positioning the company for positive performance and potential re-rating in valuation.

IndiaLand, the Dubai-based arm of Americorp Group, led by COO Salai Kumaran, is poised to inject over INR 1,500 crore into India's real estate sector in the next three years. With an aim to increase its asset valuation to INR 7,000 crore within five years, the company plans extensive expansions in key cities like Chennai, Pune, and Coimbatore. Primarily focusing on office spaces and industrial estates, IndiaLand eyes Bengaluru for Grade A standalone office complexes while actively pursuing land acquisitions. Currently managing 6 million sq. ft. of office parks and industrial spaces, the company envisions adding 2.2 million sq. ft. in Pune's Hinjawadi and expanding its footprint in Coimbatore. Expansion plans also include doubling leased industrial space in Pune and initiating an industrial park near Chennai.

Reliance MET City in Haryana's Jhajjar district exemplifies India's prowess in creating futuristic urban centers. Led by Reliance Industries Limited (RIL), the project boasts over 540 companies across diverse sectors, with a surge in plot bookings to INR 1913 crore in the past financial year. Featuring essential amenities like hospitals and schools, MET City aims to accommodate a diverse workforce while promoting a vibrant social environment and work-life balance. With a focus on sustainability, community development, and collaboration with Reliance Foundation, MET City emerges as a model for integrated, eco-friendly urban development, poised to drive economic growth and innovation in North India.

Deepak Builders and Engineers, a leading construction company in India, has filed paperwork with market regulator SEBI to raise funds through an initial public offering. The company aims to issue 1.44 crore shares to strengthen its balance sheet and meet working capital needs. Funds raised will repay debt, support operations and explore opportunities. Deepak Builders specializes in various project types like buildings, hospitals and facilities. It has a proven track record of executing turnkey projects. Through the IPO, the company wants to enhance capabilities to sustain growth in the competitive engineering sector.

• A residential flat spanning 850 square feet sold in Ambika Hill Crest in Nashik's Govind Nagar for INR 40.7 lakhs</br> • A residential flat spanning 628 square feet sold in Sagar Sparsh E & F Wing in Nashik's Amrutdham for INR 21.58 lakhs</br>

Multi-Modal Logistics Park (MMLP) refers to a freight-handling facility encompassing a minimum area of 100 acres (40.5 hectares), with various modes of transport access. It comprises mechanized warehouses, specialized storage solutions such as cold storage, facilities for mechanized material handling and inter-modal transfer container terminals, and bulk and break-bulk cargo terminals. It is a type of Logistics Park where various value-added services are rendered in addition to rail/road-based transportation. The purpose of MMLP is to reduce coordination among different parties during transfer of cargo from one mode to another.