Dedicated locality research platform

Dedicated locality research platform

Enter your email address and you will receive

a link to reset your password

Bhutani Infra, a Delhi-NCR based real estate developer, is set to construct a commercial high-street mall in Noida sector 133, investing Rs 500 crore in the endeavour. The project will span around 3 lakh sq ft in its first phase and is expected to be completed within 30 months. This initiative is in addition to Bhutani Infra's ongoing projects, including Bhutani Cyberthum and Avenue 62, both located in Noida. The upcoming mall will offer premium retail space, a food court, and wellness facilities, contributing to the region's commercial landscape.

Reliance Retail Ventures Ltd, under Mukesh Ambani's leadership, plans to raise approximately Rs 3,048 crore through an infrastructure investment trust (InvIT), as per a draft document submitted to Sebi. The company, already having registered a trust with the market regulator, intends to utilize it to house the warehouse assets intended for monetization. A minimum of 25% of the trust's units will be retained by Reliance Retail, with the remaining portion open to incoming investors. The initiative aligns with the company's broader strategy of capitalizing on its warehousing and logistics assets, aiming to drive growth and innovation.

.png)

Reliance Industries and The Oberoi Hotels and Resorts are joining forces to manage three prestigious hospitality projects, including the Anant Vilas Hotel in Mumbai's Bandra Kurla Complex, Stoke Park in the UK, and an upcoming project in Gujarat. This strategic partnership aims to redefine luxury hospitality by blending urban luxury with bustling business districts and enhancing world-class destinations. The collaboration underscores their commitment to innovation, quality, and guest-centric experiences, promising to reshape the hospitality industry landscape.

.png)

Telangana RERA's Chairman, N Satyanarayana, has revealed that the organization is in the process of developing a comprehensive module for aspiring property agents. Engaging various stakeholders, the initiative aims to enhance the credibility of realtors, who frequently represent property transactions. This move underscores the significance of agents in property deals and their pivotal role in maintaining transparency and trust within the real estate sector. Collaboration with industry associations and premier institutions is underway to ensure smooth implementation and promote transparency within the sector.

The Bombay High Court has directed the BMC's Technical Advisory Committee to independently assess structures damaged by unauthorized tenant demolitions along Old Agra Road in Kurla. Justices Patel and Khata emphasized excluding private audit reports and ruled reconstruction should halt. The move addresses widespread damages caused by tenants and ensures proper authorization for repairs. The court ordered the landlord to present repair plans on September 13 and warned tenants against obstructing the assessment, hinting at potential contempt proceedings.

In a strategic decision aimed at enhancing efficiency and impact, authorities have announced the implementation of a Direct Benefit Transfer (DBT) system for construction worker welfare programs. This measure is anticipated to reduce inefficiencies and ensure precise allocation of benefits. Notably, this step seeks to enhance working conditions, elevate quality of life, and uphold the well-being of construction laborers. The move is aligned with the overarching goal of curbing wastage, while also fostering more targeted and impactful support for this essential workforce.

.png)

The Margao Municipal Council (MMC) has chosen caution over immediacy in deciding on revised plinth area rates, which are crucial in calculating construction license fees for buildings. The MMC deferred discussions on the proposed rates, which were met with resistance due to significant fee increases. The Shadow Council for Margao and real estate developers expressed opposition to the surge in fees ranging from 38% to 45%. The cautious approach indicates responsiveness to public sentiment and stakeholder concerns. While this deferral may be temporary, it offers an opportunity for deeper deliberation on potential implications before reaching a conclusive resolution.

In Anni, Himachal Pradesh's Kullu district, eight multi-storey buildings collapsed in a domino effect following relentless monsoon showers. Fortunately, local authorities had evacuated these structures by August 15, preventing any casualties. While the exact cause remains under investigation, some point to the unusually heavy rainfall this season, while others highlight inadequate drainage systems in the region. This incident underscores the urgent need for reinforced construction standards in areas susceptible to extreme weather.

A recent report by Knight Frank India and NAREDCO predicts India's real estate sector to soar to a worth of USD 5.8 trillion by 2047, effectively doubling its contribution to the national GDP from 7.3% to 15.5%. This growth, backed by private equity investments and an evolving housing demand, indicates a major economic shift. With a surge in luxury housing demand and expanding sectors like warehousing, India's real estate landscape is poised for unprecedented expansion.

.png)

The rental and housing landscape in Greece presents challenges as prices surge. Research by Potamianos Real Estate Group indicates a 35% rise in average rent since 2017, with some areas witnessing increases exceeding 50%. For Greek renters, affordability remains a concern, as 74.2% allocate over 40% of income for rent and necessities. Financial struggles are evident, with 36.4% of adults behind on housing payments and utility bills in 2021. Single-member households face tougher conditions. Meanwhile, mortgage takers encounter high prices for older flats in central Athens, averaging €1,780 per sq meter, demanding significant financial liquidity for repayment.

.png)

Rents in Hong Kong are set to surge by 8 to 10 percent this year, marking the highest increase in 11 years. This rise is attributed to mainland Chinese students and professionals arriving through talent-import programs, creating a landlord's market. The average rent for private residential properties reached HK$35.26 (US$4.50) per square foot in July, the highest since October 2021. Around 75,000 individuals were approved under talent-import initiatives in the first seven months, almost doubling the previous year's count. This surge is expected to outpace the home buying market, with an anticipated 5 percent rise in home prices compared to forecasts of a 10 percent decline.

In a recent ranking of living conditions in Polish cities, Poznan emerged as the top choice due to its low unemployment, decent wages, and high-quality air. Katowice secured the second spot with impressive housing accessibility and low unemployment, although it lagged in crime rates. Opole claimed the third place, excelling in air quality and scoring well on crime. On the contrary, Bialystok, Kielce, and Warsaw ranked the lowest due to high unemployment, poor wages, and subpar living conditions. The ranking considered factors like employment, wages, crime rates, housing, medical care, and air quality, offering insights into the cities’ overall desirability.

Embassy Office Parks REIT, managed by Embassy Office Parks Management Services, plans to raise Rs 500 crore through debentures for debt refinancing. The debenture committee approved the allocation of 50,000 Series VIII NCDs on a private placement basis. These NCDs will have a 60-month tenure with an 8.10 percent coupon rate per year. Embassy REIT aims to list them in BSE's Wholesale Debt Market Segment. The company received Rs 500.15 crore against the principal amount. In Q1 of the current fiscal year, Embassy REIT reported a 9 percent increase in net operating income to Rs 737.6 crore and distributed Rs 510 crore to unitholders.

Lenders of Mumbai's Rajesh Lifespaces are utilizing corporate and personal guarantees by promoters to recover dues while awaiting NCLT approval for the company's hotel business sale. Promoters and entities linked to Rajesh Lifespaces offered guarantees for insolvent hospitality division loans. Led by ICICI Bank, banks are using these guarantees for better recovery as they await NCLT's nod. NCLT delay adds challenges to the promising recovery. The outcome not only impacts recovery rates but also Mumbai's hospitality and real estate sectors.

.png)

Realty giant DLF Ltd plans to introduce two luxury housing ventures worth Rs 15,000 crore in Gurugram during this fiscal year, capitalizing on robust demand for upscale residences. Following the successful Rs 8,000 crore sales within days of 'The Arbour' project launch, DLF aims for Rs 13,000 crore bookings this year. Their 2022-23 sales surged to Rs 15,058 crore, driven by ambitious launches totalling Rs 20,000 crore. The upcoming projects in Gurugram, on Southern Peripheral Road and Golf Course Road, are expected to yield approximately Rs 15,000 crore in sales. Additional residential towers are slated for Moti Nagar, Chandigarh, and Mumbai.

Bollywood icons have long exhibited a keen interest in real estate investments. Recently, actress Kajol expanded her property holdings by acquiring a commercial unit in Mumbai's Andheri suburbs. The "DDLJ" star purchased a 2,100 sq ft space in the Signature Building. Similarly, Ajay Devgn bought commercial units in the same building earlier this year, paying a substantial Rs 45 crores for five units. Hrithik Roshan's production house secured office space, while Alia Bhatt's production house purchased a lavish apartment. Singer Sonu Nigam also invested in multiple office spaces in Andheri West. These instances highlight how Bollywood's influence intertwines with real estate, shaping Mumbai's property landscape.

The Delhi Government is set to increase circle rates by 35% for residential and commercial properties to align them with rising market values. The move aims to bridge the gap between property market rates and government valuation. Similar revisions are observed in Gujarat due to economic growth, while Maharashtra maintains rates to sustain the real estate sector amid challenges. Karnataka's Guidance values also witnessed a spike recently. These adjustments highlight the dynamic nature of real estate and its interaction with economic factors and policies. Despite rate hikes, the real estate markets in major Indian cities continue to flourish.

The Mohali administration is proactively addressing the welfare of residents affected by upcoming demolitions near the Air Force Station's boundary wall. To provide alternative housing, the administration is taking control of land within Economically Weaker Sections (EWS) colonies within housing society projects. Displaced residents will be allotted this land to rebuild their homes before demolition occurs, following a Punjab and Haryana High Court directive. This approach demonstrates the administration's commitment to balancing development with citizens' well-being. The initiative highlights the challenges of urban development and the importance of inclusive housing solutions, emphasizing collaboration among governments, developers, and regulatory bodies.

The "Puneeth Rajkumar Housing Complex," a project by the Bangalore Development Authority (BDA) that includes 322 upmarket villas in north Bengaluru, is almost finished. The property, which is situated on 31 acres of land, has necessary features including a clubhouse, park, and sports facilities. On a first-come, first-serve basis, the villas will be sold through an online application process. A 320-unit residential building has also been built by BDA nearby. The project demonstrates BDA's dedication to improving Bengaluru's housing alternatives and is projected to generate significant interest from purchasers looking for contemporary and well-equipped homes.

Around 1,100 homebuyers involved in the Amrapali Group's housing projects are facing a "final" ultimatum from the Supreme Court receiver overseeing the projects. Those who haven't validated their flat allotment documents or taken possession of their units despite examination have been targeted. The National Buildings Construction Corporation (NBCC) is working to complete stalled projects due to the incarceration of Amrapali Group's promoters. Homebuyers must submit supporting documents to receive No Objection Certificates (NOCs) for ownership. Deadlines have been set for document submission and possession, with penalties for non-compliance. Failure to comply may lead to flat allotment cancellations and unsold inventory status.

Renowned Ahmedabad-based real estate developer, Saanvi Nirman, has launched a creative brand campaign named "Yeh Ghar Ki Baat Hai." Rooted in customer-centricity, ethics, and trust, the campaign emphasizes the company's commitment to elevating lifestyles. The phrase "Yeh Ghar Ki Baat Hai," representing familial bonds, encapsulates Saanvi Nirman's connection with customers through residential projects and reliable home-buying experiences. The monologue, narrated by actor Sharad Kelkar, highlights the emotional value of a home. The multichannel campaign spans YouTube, radio, digital platforms, and influencer collaborations, reaffirming the company's dedication to creating thriving communities and a brighter future in real estate.

DRA Homes is making its entry into North Chennai on the occasion of the 384th Madras Day. With a reputation for customer-centricity and on-time delivery, DRA Homes is announcing joint development projects in Madhavaram. These projects strategically capitalize on the area's growth potential, benefiting from improved metro connectivity and infrastructure. Their landmarks across Chennai, including Truliv Olympus, DRA Ascot, and Tuxedo, showcase their commitment to quality and transparency. The upcoming projects in North Chennai aim to continue this legacy, capitalizing on their strategic location near metro stations and essential amenities, ensuring completion around the time of metro operationalization.

The uncertainty surrounding the stilt-plus-four floors policy in Gurugram is causing distress for plot owners and homebuyers. The policy's approval has been on hold since February, hindering construction plans for residential buildings. Despite receiving recommendations from an expert committee to revise building codes and address concerns back in February, the government's decision remains pending. This indecision impacts those who purchased plots under the policy, leaving them in limbo. Additionally, developers are raising concerns about lacking infrastructure upgrades in licensed colonies, compounding the challenges faced by residents. The delay underscores the need for a timely resolution to provide clarity and enable property development in the region.

Officials from BBMP have issued notices to nearly 9,736 alleged illegal A-khata property holders in Bengaluru, giving them 15 days to prove the legitimacy of their A-khatas or have their properties shifted to the B-khata registry. An investigation revealed that over 45,000 A-khatas were issued since 2014, with suspicions that many were illegally obtained due to erroneous development charge collections. Zonal teams are currently reviewing all A-khatas, potentially leading to more reclassifications.

The Competition Commission of India (CCI) has directed the Chandigarh Housing Board (CHB) to cease anti-competitive practices related to unfair terms in a housing scheme. While CHB held a dominant market position, no penalties were imposed as CHB had already taken corrective measures to address concerns regarding non-disclosure and penal interest. The CCI's decision reflects the importance of regulatory bodies in ensuring fair competition and highlights the significance of prompt and effective responses by entities to allegations of anti-competitive behaviour. This case underscores the need for transparent and equitable practices to maintain a level playing field in the market.

IndoStar Capital Finance has successfully sold distressed loans worth Rs 790 crore from Puranik Builders and Kanakia Spaces Realty to Phoenix ARC, achieving an impressive 86 percent recovery from the outstanding loan of Rs 915 crore. This recovery rate is notable as the loans were 60 days overdue. Phoenix ARC, in collaboration with IndoStar and backed by Kotak Mahindra Bank, will oversee the real estate projects of Puranik Builders and Kanakia Spaces Realty, partially funding their completion. The transaction enhances IndoStar's retail loan portfolio from 85 percent to around 95 percent, reflecting its strategic focus on asset quality improvement.

Indiabulls Housing Finance has successfully repaid ?2,232 crore of external commercial borrowings (ECBs) raised in 2018 from various international banks, effectively clearing all its $3 billion foreign currency borrowings. The repayment marks the culmination of a deleveraging process initiated after the IL&FS crisis in 2018. CEO Gagan Banga noted that the company would now focus on growing its assets under management (AUM), with debt repayments of ?400 crore to ?700 crore per month, comfortably covered by loan portfolio repayments. The company aims for steady AUM growth and mid-teen return on equity by FY26, while pursuing an asset-light approach through co-lending partnerships.

Reliance Capital executes a strategic move by divesting 45% stake worth Rs 54 crore in Reliance Home Finance, boosting recovery prospects for lenders. Amid corporate insolvency proceedings, Reliance Capital retains a mere 2.5% ownership in the subsidiary. Authum Investment & Infrastructure leads an innovative resolution process for both Reliance Home Finance and Reliance Commercial Finance, securing significant debt for a fraction of the value. Authum's decision for voluntary liquidation adds a twist, while a sequential share sale strategy aims to maximize lenders' recovery potential. The episode highlights regulatory effectiveness and the importance of protecting retail investors' interests.

Prestige Group has unveiled Forum Kochi, a cutting-edge retail destination developed in collaboration with Thomsun Realtors. This lifestyle mall promises an all-encompassing experience in shopping, dining, entertainment, and hospitality, showcasing Kerala's heritage in its design. The mall features a curated mix of premier brands, an upscale food court, Kerala's first Funcity entertainment centre, luxury watch stores, and upscale fine-dining venues. Additionally, the development includes The Artiste Kochi, a Tribute Portfolio Hotel, providing a luxurious retreat. Forum Kochi aims to redefine retail in Kochi by blending culture, luxury, and convenience in perfect harmony.

Recent well-received film releases have led to a 10% to 15% increase in foot traffic at movie theatres, positively impacting sales within the malls that house them. This trend shows a strong correlation between movie releases and increased activity in shopping and dining experiences within the same complexes. Despite the rise of home viewing during the pandemic, theatres have adapted by offering improved amenities and discounts to attract audiences back. Successful films like "Rocky aur Rani ki prem kahani," "Gadar 2," and "OMG 2" have contributed to this resurgence, boosting food, beverage, and apparel sales. The trend has created a ripple effect, benefiting both theatres and other retail outlets within malls.

Mumbai's Arkade Group is set for a transformative debut, aiming to launch an initial public offering (IPO) in December 2023. With plans to submit a draft red herring prospectus (DRHP) to SEBI by August 31, the real estate powerhouse seeks to raise approximately ?600 crores. Anticipating a valuation of ?4,000 crores, the IPO involves a 15 percent reduction in promoter equity. Arkade Group is engaged in multiple residential projects across Mumbai's micro-markets, while also eyeing the commercial real estate sector through a leasing model. The company's sales momentum has surged, reflecting upgraded offerings and a strategic shift in project focus.

In the first half of 2023, Malaysia's property sales have surged over two-fold, poised to surpass 2019 levels, according to the Real Estate and Housing Developer's Association Malaysia. Despite unsold completed units, the industry rebound is driven by a thriving Services sector benefiting from revived tourism, a buoyant real estate market, and enhanced business services. Sales data from the association's survey of 148 members revealed a 120% rise in property sales compared to H2 2022, exceeding 2019 figures. While challenges like unsold properties persist, the sustained recovery signifies positive economic conditions, boosted by increased employment opportunities, robust international trade, and stable politics, complemented by impactful government policies.

.png)

In a strategic endeavour to rejuvenate Mumbai's urban landscape, Housing Minister Atul Save has focused on the refurbishment of 68 aging cessed structures owned by the Life Insurance Corporation of India (LIC). The Maharashtra Housing and Area Development Authority (MHADA) will issue formal notices under the new section 79 (A) of the Maharashtra Housing and Area Development Act to address the revitalization of these structures deemed hazardous by the Municipal Corporation of Greater Mumbai. Spread across different areas of Mumbai, these buildings house 1,764 occupants. MHADA will facilitate the redevelopment process, with LIC expected to propose comprehensive plans within six months, ensuring a modernized cityscape while preserving its historic charm.

In a consecutive second day crackdown, DTCP's enforcement unit targeted illicit commercial setups within private residential colonies. A total of 14 establishments were sealed in DLF Phase 2, and over 150 businesses in DLF Phase II received warnings and restoration directives from DIP Enforcement. Led by DTPE Manish Yadav, the enforcement team sealed 14 operations spanning seven houses along Jacaranda Marg and Bougainvillea Marg. With 100 businesses already sealed in various licensed colonies, the enforcement drive remains ongoing, urging voluntary cessation to avoid immediate sealing actions.

India's office sector is poised for a strong finish in 2023, with expected gross leasing of 40–45 million square feet across top markets. Domestic demand remains resilient, driven by a positive economic outlook. The global economic forecast for 2023 has improved, influencing India's office demand. Q2 2023 saw 50 percent QoQ growth in leasing, reflecting positive sentiments and a domestic economic revival. Tech and domestic occupiers play pivotal roles in office space leasing. H1 2023 witnessed 22 million square feet of new supply, showcasing developers' adaptability. This growth trajectory underscores responsiveness to evolving dynamics, with robust supply projected for 2023.

.png)

Concorde, a prominent real estate developer, has planned an expansive investment of around Rs 1200 crore over the next three years. The focus will be on launching 3.5 million square feet of premium residential spaces in North and East Bangalore, capitalizing on demand and absorption rates. With six projects in the pipeline, the company anticipates an annual sales of about Rs 500 crore. Concorde envisions innovation, vibrant communities, and smart features in its designs. The commitment to green living and spatial harmony remains strong. This strategic move redefines luxury living in Bangalore, presenting exceptional value to clients and stakeholders alike.

Nisus BCD Advisors LLP, managing Nisus Finance's RESO-1 Fund, has infused Rs 95 crore into Ahmedabad's Swaminarayan Business Park, partnering with Phoenix ARC and Kotak's Asset Reconstruction Arm. This signals Nisus Finance's entry into Ahmedabad's real estate market, focusing on projects with robust cash flows and risk-mitigated returns. The project, owned by Dharmadev Group, is nearly 80 percent complete and aligns with RESO-1's strategy. This investment underscores Nisus Finance's expansion beyond its target markets, including Indore and NCR, and marks its debut in late-stage commercial projects.

Canada's housing market is under scrutiny as a financial strategist, Iva Poshnjari, warns of a significant housing bubble due to soaring debt-to-income ratios and escalating housing prices. The analysis raises concerns about the market's vulnerability to unravelling, potentially impacting the broader economy. Historically low interest rates have driven demand and borrowing for housing, while speculative activity adds to the risks. Policymakers are urged to take precautions to avert a potential housing market crash, aiming to safeguard economic stability and citizens' well-being.

Amid the post-pandemic prevalence of remote work, New York City is unveiling a plan to convert vacant office buildings into affordable housing units. Mayor Eric Adams and Dan Garodnick, the director of New York's Department of City Planning, unveiled the "City of Yes for Housing Opportunity" initiative, aiming to repurpose commercial spaces for housing needs. The proposal envisions creating 20,000 homes to accommodate 40,000 residents, addressing the city's mounting housing crisis. However, realizing this plan hinges on state approval to increase affordable housing.

.png)

Bandhan Bank, a private sector lender, is making strategic moves to expand its presence in Mumbai and beyond. With an investment of around Rs 160 crore, the bank is acquiring commercial space in Mumbai's Bandra Kurla Complex (BKC), marking its entry into the city's financial hub. The new corporate office, covering 40,000 sq ft, will also house a treasury and is expected to be completed by the end of the fiscal year. Additionally, the bank is setting up a zonal office and government business centre in New Delhi to enhance communication with government departments. A 65,000 sq ft back-office space in Navi Mumbai is also in progress to strengthen operational capacities. Bandhan Bank is not only expanding its physical footprint but also advancing its digital offerings, with plans to open more branches and diversify its portfolio.

.png)

Metamor Software Solutions directors, Meghna Dilip Bhanushali and Tummala Vipul Reddy, have acquired a property in Hyderabad's Jubilee Hills for Rs 48 crore, marking one of the city's recent high-value residential transactions. The property, spanning 13,000 sq ft with a built-up area of 3,951 sq ft, was purchased from Manoj Kumar Tibrewala. This purchase was driven by both family and business requirements, as evidenced by the sale deed. The real estate market in Hyderabad has been witnessing a surge in significant land and mansion deals, largely from business figures and film actors.

Digital marketing agency Wiredus and real estate developer Silverglades have partnered to raise awareness about senior citizen living projects, focusing on The First Citizen by Melia. This initiative aims to redefine the lives of senior citizens by emphasizing health, wellness, and comfort in luxury senior living communities. The collaboration combines Silverglades' expertise in crafting contemporary residences with Wiredus' digital solutions. The project offers one and two-bedroom apartments equipped with amenities like fitness centres, spas, pools, libraries, and medical facilities. The partnership aims to transform the narrative of senior community living, providing seniors with an enriching and fulfilling retirement experience.

Housing and Urban Affairs Minister, Hardeep Singh Puri, pressed for the rapid integration of innovative construction technologies to meet the surge in urbanization. Addressing a CREDAI conference, he cited the need to transition from traditional methods to modern techniques. Puri highlighted successful projects utilizing such technologies, including reduced construction time, cost savings, and enhanced sustainability. The minister's call underscores the drive to reshape India's urban landscape with cutting-edge practices and sustainable growth.

.png)

Reserve Bank Governor Shaktikanta Das led a crucial meeting to enhance governance and assurance mechanisms in non-banking financial companies (NBFCs), including housing finance companies (HFCs), aiming to fortify the financial sector's stability. CEOs of prominent NBFCs and government entities, along with the RBI's Deputy Governors, participated in discussions focused on governance standards, risk management, and compliance. With these entities holding 50% of overall NBFC assets and serving underserved areas, the RBI emphasized vigilance, resource diversification, cybersecurity, fair practices, and IT enhancements. The meeting showcases the RBI's commitment to maintaining financial resilience and transparency in the sector.

.png)

In a bid to clamp down on the rise of unauthorized constructions and instil transparency, officials from the building branch in Ludhiana will now maintain comprehensive online records via the challan management system (CMS). Previously, the uploading of challans occurred monthly or yearly, with many languishing as "pending." This approach shift involves daily data monitoring and necessitates officials to promptly upload solutions. Amid multiple complaints about construction persisting post-sealing, the MC commissioner's transfer has taken place. The civic body, facing financial loss and criticism, aims for effective enforcement via digital reforms.

A home project that is now under construction in Chennai has received a total investment of Rs. 206 crores from Shriram Properties and ASK Property Fund. The project, known as "Shriram 122 West," is situated in Mangadu close to IT hubs and the future metro corridor. It spans 1.9 million square feet across two phases and has a projected five-year revenue potential of Rs. 1,200 crores. The partnership demonstrates the strategic skill of both parties and their dedication to improving the real estate market. With this agreement, Chennai will take another step toward producing high-quality residential areas and leveraging the city's expanding real estate market.

Roha Realty, a renowned real estate developer focused on upscale residential apartments in Mumbai and Thane, has partnered with MHADA for the redevelopment of two large societies in Subhas Nagar, Chembur. Demonstrating its prowess as a premium developer, Roha Realty aims to enhance residents' lifestyles through modern spacious apartments, top-tier amenities, and sustainability measures. The project will merge the two societies into a unified entity, reflecting Roha's commitment to quality and design. Chembur's strategic location and connectivity make it an attractive market for luxury living, further bolstering the investment potential of this development. Roha Realty's dedication to transparency and client satisfaction drives its mission to be Mumbai's premier real estate developer.

.png)

The residents of NOIDA's Kasna B-Block, living on abadi plots designated under the kisan quota, are facing dire conditions due to the absence of proper infrastructure. Despite being in proximity to administrative offices, the area lacks essential amenities like sewage systems, drains, and functional roads. The single access road is unpaved and filled with potholes, worsened by recent monsoon rains and nearby drainage overflow. Complaints to the GNIDA have reportedly yielded little action, leaving residents disillusioned. Water connections have been paid for but remain absent, sewers are non-functional, and road repairs are incomplete. Residents are grappling with neglect and unfulfilled promises, despite their legal entitlement to basic infrastructure.

.png)

Shriram Housing Finance embarks on Vision 2026, aiming to triple its size by capitalizing on the surging demand for affordable homes. With assets of Rs 10,000 crore, it plans to expand branches, workforce, and products, aspiring to achieve Rs 30,000 crore in AUM by FY26. Notably, 75 percent of its clients are from low- to middle-income groups. Its growth journey has witnessed a 44 percent CAGR in 4 years, doubling AUM in 17 months to reach Rs 10,000 crore. It seeks to establish a pioneering position in the affordable housing finance sector while upholding asset quality.

.png)

Real estate firm Casagrand has made a notable land acquisition in Hyderabad, securing over 4 lakh square feet of land valued at approximately Rs 57 crore. This move reflects Casagrand's strategic expansion in the thriving Hyderabad real estate market, highlighting their confidence in the city's growth potential. With Hyderabad's mix of tradition and modernity, booming technology and business sectors, and diverse cultural scene, it has become a hotspot for real estate investment. This move by Casagrand aligns with the trend of companies capitalizing on Hyderabad's economic growth and urban development.

Hayes Village, a Barratt London regeneration project, welcomed UK Prime Minister Rishi Sunak, who announced £200 million funding for housing development in London. The project, transforming a Nestlé factory site into high-quality homes, has grown significantly since his earlier visit. It is favoured by Indian investors for its stable market and strong returns. Sunak’s visit aims to boost housing and brownfield development near London Underground stations. Hayes Village offers a range of homes from studios to three-bedroom properties, attracting overseas buyers. Expected 19% capital growth and up to 5.9% rental yields make it attractive. Barratt’s partner in India will host events to engage potential buyers.

Continued demand in Dubai’s real estate sector has propelled home prices upwards, with Knight Frank’s recent findings showing a 4.8% Q2 2023 increase and a 17% surge over a year. Apartment prices have risen 21% since January 2020, averaging AED 1,290 per square foot. Meanwhile, sought-after villa prices surged by 51%, reaching AED 1,520 per square foot. This sustained momentum points to ongoing pressure on prices due to population growth. The sector’s vitality is underscored by 76,119 transactions worth 283 billion dirhams ($77 billion) in H1 2023, aided by the coveted Golden Visa boosting foreign investor demand.

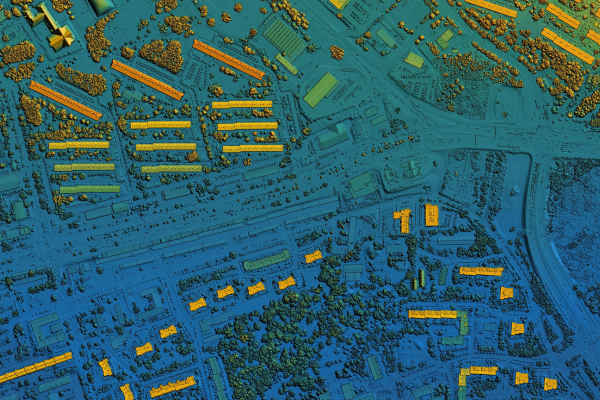

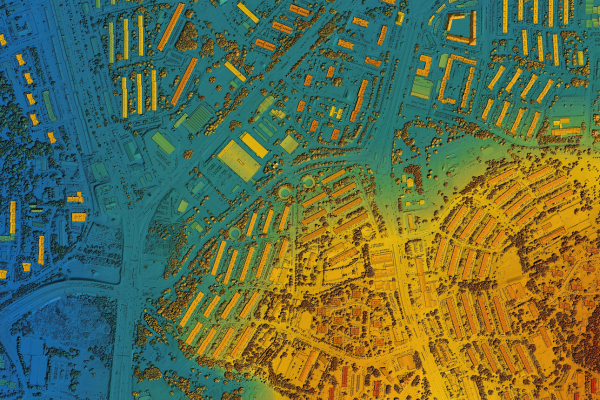

Utilizing drone technology, the state government has completed mapping rural land parcels in 97% of villages, expediting boundary fixing, property validation, and card issuance. With 31,069 villages surveyed out of 31,984, this innovative approach has resolved disputes and generated over 12,496 maps and 8,846 property cards, enhancing property rights for rural households. Despite pandemic setbacks, the initiative underscores a transformative shift in land management.

Uttar Pradesh RERA Chairman Sanjay Bhoosreddy has urged real estate promoters to register projects with the authority to safeguard stakeholders, particularly homebuyers. This move aligns with a broader vision for a balanced and transparent real estate sector. With 3,467 projects already registered, including 1,598 in the NCR, Bhoosreddy anticipates increased registrations, boosting a robust real estate landscape. UP RERA's role in promoting transparency, protecting interests, and resolving disputes is crucial for growth and accountability. Bhoosreddy's call underscores the importance of compliance in fostering a thriving and consumer-centric real estate industry in Uttar Pradesh.

Anarock Group has partnered with the Madhya Pradesh Housing Board to implement its AI-driven customer relationship management system (ACRM), designed to boost real estate sales efficiency. ACRM's success in automating tasks, managing leads, and enhancing marketing strategies has led to rapid adoption, even by non-tech-savvy teams, as it streamlines operations across the Indian real estate market. The partnership showcases Anarock Group's commitment to innovative solutions within the sector.

Sumir Chadha, co-founder of WestBridge Capital, acquires a luxurious Mumbai apartment for over Rs 96.12 crore. The lavish 7,459 sq. ft residence on the 60th floor of the Oberoi Three Sixty West tower sets a new benchmark with a value of Rs 1.29 lakh per sq. ft. Chadha's stamp duty of Rs 3.59 crore finalizes the deal, also granting exclusive access to car parking slots. The WestBridge Capital leader's investment aligns with Mumbai's robust real estate market, showcasing resilience amid challenges. Oberoi Realty's strategic acquisitions and Mumbai's soaring property records contribute to the city's impressive real estate performance.

.png)

The Municipal Corporation of Gurugram (MCG) is modernizing property tax management by collaborating with a private agency to distribute tax assessment bills to 6.4 lakh property owners. This innovative approach enables residents to review and update property tax details without visiting MCG's office. A dedicated team delivers bills door-to-door, promoting engagement and accuracy. Property owners can communicate changes to agency representatives, ensuring up-to-date records. This effort covers both residential and commercial properties, integrating with digital platforms and offering a 15% tax rebate incentive. MCG's initiative emphasizes efficiency, transparency, and resident involvement for improved property tax administration.

Global alternative investment firm Varde Partners has reportedly provided around Rs 750 crore in mezzanine debt to Hyderabad's Phoenix Group for construction purposes. The funds are intended for a project where the developer is converting a special economic zone (SEZ) project into a non-SEZ venture. Due to changes in project scope, traditional bank lending was not possible, leading Phoenix Group to seek private lending from Varde Partners. Despite the relatively high interest rates associated with Varde Partners' loans, the move is seen as strategic given the current market conditions. Varde Partners has shown consistent interest in India's real estate market and has invested over $3 billion across 20 transactions in the country over the last four years.

Qatar Investment Authority (QIA) has struck a deal to invest Rs. 8,278 crore in Reliance Retail, a key player in India's burgeoning retail sector. The strategic investment will grant QIA a 0.99% minority equity stake in Reliance Retail Ventures Limited (RRVL), a subsidiary of Reliance Industries Limited. RRVL operates an extensive network of over 18,500 stores across various segments in more than 7,000 cities. This collaboration aims to leverage QIA's global experience and Reliance Retail's strong presence to further elevate the company's position. The investment from QIA follows previous investments by other entities, including Saudi Arabia's Public Investment Fund and Abu Dhabi Investment Authority.

Celebrity power-couple, Shahid and Mira Kapoor, have been named brand ambassadors for Shapoorji Pallonji Real Estate’s luxury project, VANAHA, in Pune. Nestled near the renowned Oxford Golf Course within a sprawling 1000-acre township, VANAHA promises an unmatched blend of residential, commercial, and green spaces. This collaboration seeks to magnify the project’s allure, blending the couple's elegance with the property’s promise of harmonious luxury living. The Kapoor endorsement is set to give VANAHA a unique spotlight in Pune's real estate market.

In a tragic turn of events, an under-construction railway bridge in Mizoram's Aizawl district collapsed last week leading to the death of 18 workers, primarily from West Bengal. Five workers remain missing. The Indian Railways cites a gantry collapse as the cause. Prime Minister Narendra Modi announced an ex gratia of Rs 2 lakh for the deceased's families. Mizoram and West Bengal Chief Ministers have expressed their condolences and pledged support for ongoing rescue efforts. The event has ignited discussions on the need for enhanced safety in infrastructure projects.

.png)

Thiruvananthapuram's Municipal Corporation is set to undertake a transformative Rs 20-crore housing initiative, targeting residents of Vikalanga Colony and those enlisted under the LIFE Mission. The project, located at Muttathara, aims to relocate approximately 100 families currently enduring substandard conditions. This move, coupled with the upcoming housing for the fishing community, underscores the city's determination to improve living standards for its marginalized communities.

The Bankers Institute of Rural Development (BIRD) convened in Lucknow, has discussed the potential of Svamitva cards—documents certifying rural property ownership—as eligible collateral for loans. Attended by representatives from major national and regional banks, as well as state commissioners, the meeting examined the card's validity as a conclusive property title and its implications for rural financial stability. This initiative could transform rural lending dynamics, providing villagers with enhanced financial avenues.

The Lucknow Development Authority (LDA) has revealed plans for a 'second innings' apartment complex in Viraj Khand, Gomtinagar, specifically designed for senior citizens. LDA Vice-Chairman, Indramani Tripathi, shared that the 2,500 sq mt project will feature seven-story buildings, each housing eight studio apartments tailored for seniors. The community will also boast amenities like a gym, meditation centre, and an on-site ambulance service. Unique leasing provisions allow residents aged 60 and above to transfer their flats to another senior citizen, ensuring the facilities cater exclusively to the elderly. Surrounding areas will see development of parks and wide roads.

A three-storeyed building in Navi Mumbai's Nerul area collapsed last week, resulting in two fatalities and injuring two others. The incident, which took place around 9:11 pm in Sarsole Sector 6, saw a major section of the building's third floor crash onto the lower levels. While the interior was severely damaged, the exterior surprisingly remained intact. Immediate rescue operations were launched, with victims rushed to DY Patil Hospital. The cause of the collapse is under investigation.

Zara's founder, Amancio Ortega, through his private firm Pontegadea, is engaging in a global property acquisition spree that has significantly impacted the net worth of the Ortega family. With strategic purchases in logistics centres and residential properties, Pontegadea is diversifying its investments across various locations. Recent acquisitions include a Los Angeles warehouse for $109 million, a former BBC office building in London for $102 million, a luxury residential skyscraper in Seattle for $323 million, and properties in New York, Toronto, and Glasgow. These moves highlight Ortega's visionary investment approach, expanding his real estate portfolio across borders and property types.

.png)

Despite administration efforts to recover outstanding dues, Pune Municipal Corporation (PMC) faces a substantial property tax liability of Rs 8,500 crore. About 41% of property owners missed the payment deadline, with 5 lakh of the 12 lakh property owners yet to pay. The PMC employs tactics like sealing properties and property auctions to recover dues, sealing 1,400 properties and recuperating Rs 100 crore in the past year. However, civic activists emphasize stricter actions against defaulters over amnesty schemes. PMC aims to generate Rs 2,618.15 crore from property tax this year, playing a pivotal role in its revenue generation.

Omkara ARC has secured a significant loan of Rs 784 crore from PNB Housing Finance through an all-cash deal facilitated by Joyous Housing Limited. This move aids PNB Housing Finance in addressing a substantial non-performing asset on its balance sheet. Joyous Housing, who defaulted on a secured construction finance of Rs 800 crore from PNB Housing, played a role in this transaction. The loan resolution was accomplished through the 'Swiss Challenge' method, marking a strategic step for both parties. PNB Housing Finance had recently raised capital through a successful rights issue involving key stakeholders like PNB, Carlyle, Ares SSG, and General Atlantic. The company has been working on improving its asset quality and reducing its stressed portfolio through various means.

The majority of commercial banks align home loan rates with the RBI's repo rate, factoring in eligibility criteria such as age, income, and property value. Bank choice affects the interest rate, with a margin and risk premium added to the external benchmark rate as per RBI guidelines. The top 10 banks offering competitive home loan rates in August 2023 include HDFC, Indian Bank, and Punjab National Bank, ranging from 8.5% to 10.1%. Floating rates linked to market changes determine EMI fluctuations. Additional charges for loan processing, verification, inspection, legal opinion, and more may apply, varying by bank. Early loan repayment may incur penalties based on the source of funds.

.png)

The Knight Frank MENA report highlights Egypt's real estate resurgence, attracting global investment from the US, UK, UAE, and more. Despite the pandemic, cities like Lagos, Nairobi, and Cairo are gaining attention. Egypt's Cairo emerges as a prime investment hub, backed by Middle East sovereign wealth funds with plans for up to $120 billion investment. Zeinab Adel, Knight Frank's Egypt Head, emphasizes Egypt's allure due to history, strategic location, and growing economy. The thriving residential sector in Cairo garnered $16 billion in investments in 2022, with 10% property price rise. The North Coast gains traction as a second home market, solidifying Egypt's global investment appeal.

The Greater Mohali Area Development Authority (GMADA) has taken a significant stride by awarding a tender for the development of infrastructure in the "Aerotropolis" township. Estimated at Rs 195 crores, the project aims to create a modern living space, with completion expected by April 2025. Covering 5,500 acres, the development will proceed in phases, starting with grid roads across 1,650 acres. M/s SBEIPL-HRG (JV) has been chosen for this task, encompassing civil, public health, and electrical services. Aerotropolis's strategic location near the international airport and established townships positions it as a future-focused and sought-after destination.

.png)

China's government land sales revenue declined for the 19th consecutive month in July, amplifying pressure on debt-laden municipalities. With a 10.1% year-on-year drop in land sales, followed by a 24.3% decrease the previous month, local governments are strained. A 19.1% drop in sales from January to July underscores the impact. Weakening financial health, primarily due to a property sector slowdown, is leading to developer debt defaults. This industry shift towards a reduced economic contribution is eroding land sales and fiscal revenue for regional and local governments. Prudent financial management is essential as China's property market transforms and challenges persist.

Singapore is combatting soaring public housing prices by bolstering affordability measures. Prime Minister Lee Hsien Loong unveiled heightened grants, subsidies, and new secondary market restrictions. Despite prior efforts, the resale market persists, constituting 80% of housing for residents. COVID-19 disruptions amplify the issue. Overseas wealth influx post-pandemic further drives property prices up. Policies include means-tested grants, sales limits, and repayment obligations for prime-location flats. Extended occupancy requirements and income ceilings are set for secondary market flats. Singapore's multifaceted approach strives to balance housing dynamics and equitable access amidst evolving real estate trends.

Star Housing Finance has secured a Rs 50 crore loan from State Bank of India (SBI), as per an official filing with the Bombay Stock Exchange. The company has also received loans from other institutions like Tata Capital Financial Services (Rs 6 crore), IDBI Bank (Rs 10 crore), and ICICI Bank (Rs 2.92 crore). Notably, shareholders have approved the reappointment of Ashish Jain as the chairman and managing director. Star Housing Finance's financial performance has been impressive, with Q1 FY24 witnessing a 99.51% YoY growth in total income to Rs 12.29 crore and a significant rise in net profit to Rs 1.55 crore. The company plans to raise funds through unsecured/secured redeemable NCDs or bonds for growth.

.png)

The Hyderabad Metropolitan Development Authority (HMDA) recently conducted an auction of vacant plots in the city, but the response was lacklustre. Out of the 26 plots put up for auction, only nine were successfully sold, contributing 120 crore rupees to the state government's revenue. HMDA officials explained that these unsold plots had various challenges like small size, vaastu concerns, and their proximity to other properties. The plots were located in areas such as Kokapet, Nallagandla, Manchirevula, and others across different districts. The auction revenue fell short of expectations, highlighting the complexities of property sales and local factors affecting demand and pricing.

.png)

After a 23-year-long legal dispute, Noida Authority is finally moving forward with the development of Sector 42 as a residential area. The original plan for the sector's development was approved in 1997, but it was delayed due to a legal challenge from the Central Employees Cooperative Housing Society, which claimed ownership of land within the sector. After years of legal proceedings, the Supreme Court ruled that the cooperative society members would receive apartments and the remaining land could be developed by the Authority. The Authority has now approved a revised layout for Sector 42, which includes residential plots and various amenities. This move is expected to generate significant revenue for the Authority while addressing the city's need for residential space.

In a move towards greater efficiency, the three industrial development authorities in Gautam Budh Nagar are collaborating to establish uniformity in building bylaws, plot allocation charges, and allocation procedures. Directed by the infrastructure development commissioner, officials are presently reviewing existing policies and are expected to finalize a uniform framework within two months. The initiative aims to simplify new scheme implementation and offer convenience to diverse allottees. Currently operating under distinct policies, the authorities will harmonize processes, addressing concerns arising from disparities. The strategy also extends to public transport, road construction, and traffic management through a regional connectivity plan.

Coimbatore Corporation is gearing up to launch a novel initiative that involves affixing QR codes to the exteriors of both residential and commercial buildings across the city. This move aims to establish a convenient and efficient system for garnering feedback from citizens and business owners alike. The QR code-based feedback system is anticipated to streamline the process of gathering opinions, complaints, and suggestions, enabling the corporation to better address the community's needs. This widespread implementation of QR codes underscores the corporation's commitment to embracing technological advancements for enhanced urban governance.

Prominent real estate developer Vaishnavi Group has secured significant office space leases at Vaishnavi Silicon Terraces, strengthening its status as a preferred developer for occupiers in Bengaluru. Aon and Mensa have leased half of the premium office space, joining prestigious occupants like Navi Technologies and Smartworks. Spanning 1.10 million square feet in Koramangala, Bengaluru, the strategically located Silicon Terraces offer efficient space utilization, connectivity, and amenities. As India's office market thrives, Vaishnavi Group's 25 years of experience and commitment to quality real estate make it a trusted partner for companies expanding in Bengaluru's dynamic commercial landscape.

Mumbai's Omkar Realtors has begun delivering homes in the world's tallest rehabilitation towers at Dhobi Ghat, Mahalaxmi. Around 1000 families have received new homes and retail units in Phase 1 of the project. Developed under the Maharashtra government's slum rehabilitation scheme, the initiative aims to house 16,000 slum residents across phases. The project, in collaboration with Piramal Realty, focuses on laundry-related labour and includes luxury housing. Omkar has a strong track record in slum redevelopment, delivering over 3,000 houses in a recent project. The iconic Dhobi business faces modernization challenges, adapting to water-efficient and healthier techniques.

In Mumbai's Matunga West, Sumit Woods Ltd. has presented exhibition apartments and a distinctive exercise facility for its Sumit Atulyam project. The building, which was finished in 15 months, features opulent residential units and facilities, such as three show flats and a cutting-edge exercise facility. Construction was sped up by the development of aluminum shuttering technology. With 60% of the project's sales completed, the managing director, Mitaram Jangid, expressed delight in its advancement and invited potential buyers to tour the sumptuous living quarters. P.N. Bhobe, Chief Architect of P.N. Bhobe & Associates oversaw the project's renovation.

Apeejay Surrendra Park Hotels Ltd, renowned for its opulent "The Park" hotel brand, has submitted preliminary documentation to SEBI for an IPO to raise Rs 1,050 crore. The IPO involves issuing fresh equity shares of Rs 650 crore and an offer for sale (OFS) of Rs 400 crore, with participation from promoters and investor shareholders. In the hospitality sector, ITC Hotels is considering an IPO, while ITC Limited approved a plan to segregate its hotel business. Samhi Hotels Ltd also re-submitted IPO documents, and OYO Hotels & Rooms plans to secure $1-1.2 billion through an IPO. The industry's dynamic nature requires careful analysis, and while IPOs offer investment opportunities, a thorough understanding of the sector's complexities is crucial before investing.

.png)

Around 30 Resident Welfare Associations (RWAs) from Greater Noida recently met with the CEO of Greater Noida Industrial Development Authority (GNIDA) to address various civic issues. They raised concerns about poor water quality and low pressure, a 10% annual increase in water tariffs, inadequate garbage collection, and the absence of a dedicated dog policy. Despite the meeting taking place nearly two weeks ago, the RWAs report no noticeable action on the ground. The GNIDA officials have promised to tackle these issues, including water problems and sanitation, within a specified timeframe.

.png)

Thrikkakara and Edapally areas in Kerala are witnessing a surge in flat registrations, accounting for over 50% of registrations in the district over the last four months. Despite this growth, overall property registrations, including flats and lands, have decreased compared to last year. The pandemic caused a registration dip in 2020 and 2021, leading to higher numbers in 2022. This year, the shift towards reselling properties shortly after purchase and the high cost of new flats might be affecting registration rates. Stakeholders believe that the implementation of Kerala's Real Estate Regulatory Authority is motivating builders to complete projects within specific timeframes.

.png)

Despite challenges like higher home loan rates and property prices, the desire for homeownership in India remains strong, especially for luxury properties above Rs 1 crore. Demand for properties exceeding Rs 2.5 crore has also surged, reflecting a steadfast commitment to ownership. An interesting trend is the increased interest in owning land, driven by security and potential capital appreciation. NoBroker's report highlights a shift in sentiment, with 86% considering it a good time for property investment, and 77% intending to buy in 2023. Gated communities are favoured, while plots gain popularity for price appreciation potential. Budget constraints and amenities drive purchase decisions.

.png)

The 2023 amendments to Goa's Land Development and Building Construction Regulations by the TCP department embrace balanced urban growth. Changes include allowing farmhouses in agricultural zones under conditions, streamlining FAR regulations in villages, and prioritizing fire safety and compliance with the National Building Code. The collaborative approach, incorporating public input and committee reviews, underscores responsible development. The regulations ensure a harmonious blend of development, safety, and sustainability in Goa's evolving urban landscape.

.png)

The surge in illegal constructions in Pune's Kondhwa area is exacerbated by lax tenant police verification. Recent events, like the Pune ISIS module arrests, highlight the significance of this issue. Many property owners avoid verification due to fear of repercussions. Police aim to raise awareness and warn of legal consequences. A former corporator states about 3,000 illegal properties exist, with inadequate PMC vigilance. Kondhwa's history with terrorism suspects compounds the problem, with an influx of residents from various regions and foreign nationals. Challenges arise from the lack of proper property identification and a need for stronger police presence. Efforts are being made for cooperation between property owners, authorities, and law enforcement.

.png)

To address building norm violations, the Department of Town and Country Planning (DTCP) has formed specialized teams to inspect 30 residential properties in licensed colonies where unauthorized construction allegedly occurred even after obtaining occupation certificates (OCs). Prompted by rising complaints, this move aims to investigate violations thoroughly and take necessary actions. Architects were empowered to issue OCs through self-certification, but concerns about ethical compliance prompted District Town Planners (DTPs) to review 10% of OCs issued. If violations are found during inspections, actions range from show cause notices to blacklisting architects and revoking OCs. This initiative reinforces the DTCP's commitment to maintaining construction integrity.

.png)

The Tamil Nadu Urban Habitat Development Board (TNUHDB) is overseeing the finalization of the Manjalmedu apartment complex in Madurai, replacing previous slums demolished in October 2020. Pandemic-related disruptions and funding challenges slowed construction on the 2.5-acre site, featuring 320 individual residences measuring 400 square feet each. The State government has committed to subsidizing the project, with contributions from both State and Central governments, and beneficiaries. A completion date of October 23rd is anticipated. The TNUHDB is also constructing another 396-unit apartment complex in Subramaniyapuram, spanning 1.43 acres, aimed at improving living conditions for low-income families and government employees.

.png)

Chandigarh's property landscape is set for transformation with two ground breaking policies on the horizon. The UT administration plans to introduce policies allowing the conversion of leasehold properties to freehold and changes in land use. The conversion policy will let commercial and industrial plots become freehold properties through a conversion process, while the land use conversion policy will shift industrial plots to commercial zones, enabling business-to-consumer activities. The draft CLU policy is close to completion and has involved stakeholders' input. These policies mark significant shifts, aimed at shaping Chandigarh's real estate and economy, guided by meticulous planning and stakeholder engagement.

.png)

The PMC's plea for citizens to declare self-occupancy for a 40 percent property tax reduction has received a meagre response. Around 40,000 responses were received in two months, significantly fewer than the expected 4.5 lakhs. The initiative aimed to ease high taxes for property owners who reside on their premises. PMC urged property owners to submit a PT3 form, the society's no-objection certificate, ID proof, and a tax bill from another property owned by the same taxpayer within PMC's limits. PMC released tax bills on May 15, deviating from April 1, following the state government's 40 percent rebate reintroduction.

.png)

The Municipal Corporation of Manesar (MCM) has successfully amassed Rs 18 crore in property tax since April 1. A significant development is the issuance of 30,000 notices to defaulting property owners across Manesar, urging prompt settlement of their dues. A notable shift has been the MCM's decision to outsource bill distribution to a private firm, resulting in its highest tax collection to date. This approach has primarily targeted property owners seeking no-dues certificates. The accrued funds are designated for driving development projects within emerging sectors. Additionally, notices have been issued to 100 defaulters owing Rs 10 crore. Efforts are underway to ensure billing accuracy and facilitate corrections.

.png)

For a future IT Park, the Maharashtra Industrial Development Corporation (MIDC) has selected a 100-acre area in Rajur Bahula, close to Nashik. Once the final pieces of the property have been acquired, the IT Park will help Nashik expand economically and create new jobs. This action fits with the general national trend that emphasizes technological growth. The program demonstrates the government's dedication to encouraging innovation and luring capital to the technology industry. Nashik's advantageous location and expanding industrial landscape place it in a position to become a prospective IT centre with room to grow and modernize in the future.

.png)

Wonderla Holidays, a leading amusement park chain, is in advanced discussions to expand in Punjab and Madhya Pradesh. Confident in its scalable model, the company eyes Chandigarh's untapped potential and evaluates locations in Indore and Bhopal. Ongoing projects include parks in Bhubaneshwar and Chennai, expected to complete in the coming years. With healthy cash flows and a debt-free standing, funding concerns are minimal. Wonderla plans to increase its workforce and explore international markets like Saudi Arabia and Sri Lanka within three years.

.png)

Land prices between Nandankanan and Trisulia, where the proposed route will traverse, have increased dramatically as a result of the announcement of the Bhubaneswar Metro Rail project. Depending on the region, land values have increased by 25% to 50%, with prices rising from Rs 3,000 to Rs 5,000 per square foot. Even though the precise metro line has not been finalized, the news itself has affected pricing, especially for plots close to busy roadways. Developers are now considering marketing projects based on their metro accessibility, which is helping the local real estate market flourish as a result of the expectation of increased connection.

.png)

Since early 2023, apartment rents in Barcelona have surged to €1,087 a month, reaching a new high. Rent controls set in 2020 were ruled unconstitutional in 2022, letting landlords charge market rates. The city has seen a 40% drop in available rentals in four years, with tech industry growth increasing demand from foreign workers. Pre-pandemic, prices were rising, now almost back to 2019 levels. High costs stem from foreign investors, Airbnb-style rentals, and a supply shortage. Barcelona's mayor plans to review previous social housing measures. High prices make it hard for locals to buy homes, despite seemingly reasonable costs compared to foreign cities.

.png)

Australia is set to miss its target of building 240,000 new homes in the first year of a housing affordability program by over 60,000. The Housing Industry Association predicts only 178,839 new homes will be constructed next year, rising to 195,105 in 2025. A recent national cabinet meeting aimed to address the housing shortage by adding 200,000 homes to a goal of one million new residences by 2029. Economists suggest state governments should attract foreign investors, reconsider property taxes, and hasten planning processes to meet targets and enhance affordability.

.png)

China's second-largest privately-owned real estate developer, Longfor Group, reported a slight 0.6% increase in core profit for the first half of the year. Despite this, the company's shares saw a 3.8% decline following its announcement of a 35% drop in revenue compared to the previous year. Longfor's net gearing ratio also rose by 2 percentage points to 57%. The decline in China's real estate market has raised concerns due to multiple property developers struggling with debt commitments since mid-2021, impacting sales and investor confidence. Longfor participated in discussions with regulators and expressed hope for market dynamics to change with new policies. The company aims to elevate its investment and property services divisions' contribution to over 50% of its profitability, up from the current 20%

.png)

Foreign investors from Singapore, South Korea, Taiwan, Japan, and Malaysia have contributed around $1.4 billion to merger and acquisition (M&A) transactions in Vietnam's real estate sector in the first seven months of the year. The total value of M&A activities in Vietnam during this period reached nearly $3.2 billion, a 62% decrease compared to the same period last year. Challenges within the legal framework for foreign ownership of real estate in Vietnam have slowed down M&A processes, leading to extended timelines and higher costs. Experts anticipate a more active M&A landscape in the real estate sector starting from 2024.

Between January and August 2023, the Indian real estate market experienced a notable rise in land deals. ANAROCK Research's study reported 59 transactions covering 2,018 acres, a significant increase from the previous year's 50 deals spanning 1,438 acres. Ahmedabad stood out, contributing to almost 37% of total transactions. While 2022 saw smaller plot deals, 2023 witnessed Ahmedabad closing three mega deals for 740 acres. Residential projects dominated, with 38 deals and 283 acres across major cities. Township projects also gained momentum, with five deals for 1,136 acres. This active land market indicates robust growth and evolving urban development trends in India.

A temple that was initially erected in the parking lot of Gaur City 2 society disappeared following objections from residents. Following discussions involving GNIDA officials, police, builders, and residents, a new location near the society park was identified and approved for the temple. GNIDA's formal approval will be obtained once NOCs are secured from the majority of flat owners, while ensuring that utility lines are unaffected. Builders in the area must adhere to approved layouts and obtain authority approval before making any modifications or introducing new structures.

Gurugram's Resident Welfare Associations (RWAs) are opposing the establishment of healthcare facilities within residential colonies, citing potential negative consequences. Concerns include increased traffic congestion, insufficient parking, and strains on utilities like water and electricity. RWAs recognize healthcare accessibility's importance but propose evaluating alternative locations with better infrastructure. Balancing convenience with the potential burdens on existing resources becomes crucial in addressing the residents' quality of life and maintaining the area's overall functionality

South Indian real estate developer Casagrand has appointed cricket legend Sourav Ganguly as its national brand ambassador as part of its expansion strategy into new markets, including Maharashtra. With an investment of around 8000 crores, Casagrand aims to construct 20 million sq. ft in the next three years. The collaboration with Ganguly, known for his leadership style in cricket, will drive a marketing campaign titled "Transforming Lives." Casagrand has completed over 140 projects and 40,000 homes in Chennai, Bengaluru, Coimbatore, and Hyderabad, with plans to become one of India's top 5 builders within five years.

.png)

According to the latest SRA circular, new proposals from developers, firms, and their associates with outstanding transit rent payments will not be considered until all outstanding dues are settled. The directive highlights a strict stance against defaulting parties, emphasizing the need for clearances on all dues before new projects are accepted. The move follows court pressure and the SRA's pursuit of overdue rent payments from around 150 builders involved in 150 projects. Builders who fail to provide project-affected persons' tenements also face proposal rejection.

.png)

The State Real Estate Appellate Tribunal (BREAT) in Bihar has ruled that the Real Estate Regulatory Authority (RERA) lacks the autonomy to appoint "officers and employees" without collaboration with the state government. The verdict emerged from an appeal by a developer contesting an execution order involving a property transfer. BREAT highlighted RERA's inability to function like a private company. The ruling, specific to Bihar, could potentially influence similar appointments by RERAs nationwide. BREAT labelled the appointment of a senior legal consultant "illegal" and called for the verdict's dissemination to address the issue, shedding light on RERA's powers and government involvement.

.png)

Streamlined process enables citizens to secure building permits for residences and small commercial properties under 500 sqm in Mangaluru without MCC office visits. Zonal commissioners will decide on applications using assistant town planning officers' reports, within 15 days, via Nirman 2 online software. Joint commissioner oversight ensures efficacy. Around 150 monthly applications are anticipated. Previously, only the MCC commissioner handled applications exceeding 250 sqm. Public notice by MCC commissioner Anand CL cites system flaws and inconvenience as reasons for the change.

.png)

The Kerala State Consumer Disputes Redressal Commission has sentenced a Chennai-based builder to six months of simple imprisonment for failing to comply with compensation orders to a petitioner. This marks the first instance of such legal action against a builder. The builder, Ajith Thomas Abraham, Managing Director of Southern Investment, refused to pay Rs 1.1 crore compensation to Cherukat Vijayakumar, who had suffered losses due to a fraudulent scheme. Despite repeated chances, the builder failed to fulfil his obligations, leading to imprisonment. This case underscores the commission's commitment to consumer rights and sends a stern message against non-compliance with consumer protection laws.

.png)

The BDA is set to implement the BDA Property (Management and Allotment) Regulation, 2023, as they release the draft for public review. Citizens are encouraged to provide feedback and raise objections before the rule's official enforcement, expected upon publication in the Odisha gazette. The draft outlines dual allocation modes – lottery or auction – for housing projects. Notably, property owners in the city won't qualify for BDA property allotment. Registration with BDA, leading to a universal account number, is mandatory for their participation.

.png)

The Income Tax Department's recent changes to the valuation of employer-provided houses will have a significant impact on employees' finances nationwide. Effective from September 1, the amendments by the Central Board of Direct Taxes (CBDT) alter how rent-free accommodations are valued for tax purposes. High-earning employees with employer-provided housing will likely see increased take-home pay and savings. The revisions adjust valuation percentages based on city population size using 2011 census data. Employees not part of the central or state government and residing in employer-owned unfurnished accommodations will see reduced valuations. The changes are likely to prompt discussions on income distribution and taxation strategies. Both employees and employers will need to navigate these adjustments to optimize their financial situations.

The Securities and Exchange Board of India (SEBI) has introduced new regulations to elevate corporate governance standards in financial markets, particularly for Real Estate Investment Trusts (REITs). These rules empower REIT unitholders with special privileges, including the ability to nominate representatives to serve on boards. The concept of self-sponsored REITs has also been introduced. Unitholders holding at least 10% of total units can now nominate directors to investment manager boards, ensuring equitable representation and influence over decisions. SEBI's rules mandate minimum sponsor unitholding over time to align interests, and they allow the emergence of self-sponsored investment managers for REITs. These regulations signify SEBI's commitment to investor participation and sustainable growth.

.png)

India advances its strategic infrastructure initiatives in Eastern Ladakh, gearing up to unveil the world's highest motorable road, bi-lane tunnel, and fighter jet base. Spearheaded by the Border Roads Organisation (BRO) under Lt. General Rajeev Chaudhry, these projects aim to boost both defense readiness and civilian connectivity. The Nyoma Airfield, poised to be among the globe's loftiest, will be operational by next December. With these developments, India firmly positions itself as a global infrastructural frontrunner.

HDFC Capital, in partnership with TVS Emerald, is on the brink of finalizing three land acquisitions, covering 45 acres in Chennai and Bengaluru's emerging residential sectors. This move is part of their recent collaboration targeting plotted and low-rise constructions in South India. With a shared vision, the duo aims to develop properties across 250 acres in the region, offering a blend of affordable to mid-tier housing options. This initiative comes amid a growing demand for personalized residential spaces in the post-Covid19 landscape.

.png)

Rizin Advisory Private Limited has accomplished a significant transaction within Gurgaon's prestigious Grand View Towers, resulting in a remarkable valuation of Rs 32 crore. This acquisition involves an entire 18,000 square feet floor within the iconic tower, which is part of a mixed-use complex housing the esteemed Grand Hyatt hotel. Notably, the buyer is renowned lawyer Rohit Kochhar from Kochhar & Co. The tower, designed by Foster + Partners, boasts luxury office spaces, upscale shopping, and dining establishments. With its exceptional specifications, prime location, and blend of luxury and functionality, the Grand Hyatt Office Tower exemplifies excellence in commercial real estate.

.png)

The German real estate industry encounters significant hurdles as building permits for apartments plummet by 27% during the first half of the year. Elevated construction costs and financing difficulties contribute to the decline, exacerbating stress within the broader sector. With insolvencies among property developers and a sharp dip in property prices, the nation's construction ambitions waver. As Germany grapples with the repercussions of decreased demand, political and industry leaders are set to meet to brainstorm solutions, while similar vulnerabilities surface in real estate markets globally.

.png)

China's property landscape faces turmoil as Evergrande's colossal $330 billion debt default sparks a wave of concerns. The country's top privately-run developer, Country Garden, also grapples with missed interest payments and uncertain bond redemption. The aftermath of Evergrande's default triggers a domino effect, leaving thousands of incomplete homes across China and casting shadows on international mega projects. Meanwhile, Evergrande unveils a debt restructuring proposal while grappling with a net loss surpassing $113 billion. Investors, uncertain of the future, watch as the fate of China's real estate giants continues to unfold.

.png)

The UK housing market has exhibited a mixed performance in the past year, with average house prices showing a 1.7% increase in the 12 months leading up to June 2023. This growth, however, slightly dipped from the 1.8% rise in May 2023. The Office for National Statistics' UK House Price Index (HPI) reported the average house price at £288,000 in June 2023, up £5,000 from the previous year. Regionally, the North East saw a remarkable 4.7% increase in house prices, while London experienced a marginal decline of -0.6%. Additionally, the rental market recorded record annual rent increases, with London reaching the highest rate since 2006 and the North East witnessing the lowest inflation in rents.

Amid intricate conditions in Asia Pacific's commercial real estate, CBRE advises patience for favourable risk-adjusted returns. Escalating interest rates, slow price adjustments, and a gradual mainland China recovery shape the landscape. CBRE revises projections, estimating a 15% drop in APAC commercial real estate investments for the year, foreseeing a rebound by H1 2024. Australia's yields surge, Japan performs well, and Korea shows recovery signs. DWS focuses on Australia's residential built-to-rent properties, prime logistics, and monitors Japan and Korea sectors with low vacancy rates. Prime logistics shine with 7.5%-9% returns due to e-commerce, while selected cities offer potential in the sector. Office leasing may drop 5%, but tenant-friendly dynamics prevail. DWS supports multi-family housing potential, considering tax incentives for new residential built-to-rent projects.

During H1 2023, Ras Al Khaimah's real estate market showcased distinct rental trends. Al Hamra Village led in sought-after rental apartments, witnessing up to 9.86% rent growth. Al Marjan Island and Mina Al Arab also drew attention. Villa rentals mirrored this trend, with Al Hamra Village being the prime choice. Apartments for purchase were favoured in Al Hamra Village, showing over 4% price per square foot increase. Al Marjan Island stood out for buyers, while Mina Al Arab saw a slight price decrease. Ras Al Khaimah's waterfront developments, especially Al Hamra Village and Mina Al Arab, attracted investors, reflecting the emirate's rising prominence in real estate. Anticipated projects like Wynn Al Marjan Island contribute to its continued appeal.

.png)