Dedicated locality research platform

Dedicated locality research platform

Enter your email address and you will receive

a link to reset your password

• A residential flat spanning 1,192 square feet on the 14th floor sold in Fortune Avirahi in Borivali West for INR 3.1cr <br>• A residential flat spanning 1,192 square feet sold in Meher Apartment in Altamount Road for INR 8.75cr

The Mumbai Repairs and Reconstruction Board (MRRB) has taken action against Satra Property Developers and Firstwave Developers, who are managing the redevelopment of Mahavir Building complex in Matunga. The MRRB issued a stop-work notice after the builders failed to settle outstanding rent payments to original occupants, consisting of more than 200 shopkeepers and tenants, despite a prior order to do so. Consequently, the MRRB revoked the No Objection Certificate (NOC) for the project and halted construction activities related to the property's sale component. The project is one of the largest redevelopment projects in Mumbai and aims to redevelop an area of 5560 sq.m. in Matunga East.

Shravan Kumar Chaudhary, director of Gujara Construction Pvt Ltd, was arrested at Delhi's airport over a fraudulent property deal involving over Rs 2.3 crore. The victim, Sushil Kumar of Noida, filed a complaint alleging Chaudhary duped him in a fraudulent property transaction. Chaudhary had claimed ownership of a seven-story building in Harola village, Sector 5, and promised to sell half of it for Rs. 9.50 crores. The real owner was later identified as the Noida Authority. Chaudhary is now in police custody.

The Prestige Group is embarking on a range of real estate projects across India, with a notable focus on luxury housing in Central Delhi in collaboration with TDI. They are actively seeking additional land in Delhi-NCR for more housing projects. In Aerocity, a significant commercial project featuring two large hotels is in progress, set to be completed by 2025-26. The group is also partnering with ACE Group for a mid-income housing project in Noida's Sector 150, with pending approvals related to a sports city. In Goa, the Prestige Group is working on the Prestige Ocean Towers and planning a hotel project in Morjim. Their diversification strategy spans various segments, including senior living, warehousing, retail, and office spaces, with a strong focus on the Indian market.

The Bombay High Court has criticized the BMC for inaction and permitted a tenants association to seek permission for the reconstruction of a demolished building. Chandralok building on Aarey Road, Pahadi village, was constructed in 1965. It was dubbed a C-1 category dangerous building by the BMC in 2014. In July 2019, the 103 tenants vacated the building and it was demolished. The owner - who is also lessee of the land - failed to take steps for reconstruction or redevelopment or provide alternative accommodation. The HC noted the obligation of the BMC to act when there is no owner-led proposal and upheld tenants' statutory right to reconstruction.

The Yamuna Expressway Industrial Development Authority (YEIDA) plans to launch a new residential plot scheme in January-February 2024 following the success of a recent scheme. The new scheme will offer over 2,000 residential plots near the upcoming Noida International Airport. While the exact sectors for these plots are yet to be finalized, the move comes in response to strong demand for residential plots in the region. A recent draw for 1,184 plots saw a remarkable 1.4 lakh applicants, indicating a robust demand for affordable housing options. The land acquisition process is underway, and the scheme is expected to be launched early next year, supporting housing and infrastructure development in the area.

The Ghaziabad Development Authority (GDA) has introduced an online platform to facilitate the sale of 1,629 units across various housing schemes, making property purchases more accessible. The units span a wide range, from affordable 1BHK and 2BHK apartments in Koyal Enclave and Indraprastha, to premium 2BHK, 3BHK, and 3BHK with a study in Madhuban Bapudham Pocket C. There are also 19 affordable MIG flats in Madhuban Bapudham Pocket B. Prices vary from Rs 10.8 lakh to Rs 69.4 lakh. Prospective buyers can reserve units by paying 10% of the flat’s cost online and can spread the remaining amount over 12 instalments within three years.

Embassy Office Parks REIT reported notable achievements in Q2 FY2024, leasing 2 million square feet of office space across 25 deals, resulting in a 4 percent revenue growth to Rs 889 crore. The diverse nature of these deals, with 1.2 million square feet from new leases and seven large deals over 1 lakh square feet, highlights the REIT's strong market position. Bengaluru and Mumbai drove 90 percent of leasing activity, while Embassy 247 in Mumbai achieved full occupancy. Infrastructure development included a 1 million square feet office tower in Bengaluru. The hospitality segment thrived with a 52 percent occupancy rate, 24 percent ADR growth, and an EBITDA of Rs 37 crores. The leasing pipeline for the full year is promising, leading to a revised FY2024 leasing guidance of 6.5 million square feet.

The Bank of New York Mellon Corporation (BNY Mellon), a prominent American investment banking services company, has expanded its presence in Pune, India, by leasing over 162,000 square feet of flexible workspace in Raheja Woods through a partnership with leading co-working provider 315Work Avenue. Situated in Pune's bustling Kalyani Nagar commercial hub, BNY Mellon now occupies five entire floors in this strategic location. This expansion is part of BNY Mellon's ongoing efforts to grow its presence in India, including a recent lease for a million square feet in Pune's Kharadi locality. With roots dating back to 1983 in Mumbai, BNY Mellon continues to enhance its operations across multiple Indian cities, serving its expanding client base.

Bengaluru's luxury real estate market is experiencing unprecedented demand, driven by high-net-worth individuals and start-up founders seeking opulent residences for tax-saving benefits. Exclusive properties like Adarsh Palm Retreat and Radical Rhapsody are highly sought after, resulting in surging property prices. The resale luxury home market is also flourishing, fuelled by employees cashing in their ESOPs. With the introduction of a capital gains deduction limit, HNIs are investing in luxury properties, and the future looks bright as India's population of wealthy individuals is predicted to grow significantly.

In order to reduce total debt while taking on new projects, Macrotech Developers has obtained Rs 650 crore from Standard Chartered Bank and Deutsche Bank to refinance expensive debt. The money was given out as non-convertible debentures (NCDs) with different interest rates and terms. The corporation wants to lower its net debt after making significant cuts since 2021. The company's rating was raised by Crisil, a sign that a plan to lower gross debt in fiscal 2024 is in place. This action demonstrates Macrotech Developers' deliberate attempt to streamline its debt and improve its financial structure in the midst of continuous operational growth.

Indian Bank has announced the winding up of its subsidiary, Ind Bank Housing Ltd, after the Reserve Bank of India (RBI) cancelled the certificate of registration (CoR) for the Housing Finance Company (HFC). The subsidiary, which had been non-operational for the past two decades, faced ongoing challenges, including mounting non-performing assets (NPAs). Indian Bank's Managing Director and CEO, S L Jain, emphasized that the decision to wind up the subsidiary is final, as the bank has entered the housing loan market itself, rendering the subsidiary redundant. Despite challenges, Indian Bank has reported strong financial results, including substantial growth in net profit and advances, and effective NPA management through recoveries from corporate clients.

The Panvel Municipal Corporation is proactively addressing property tax defaulters, serving pre-seizure notices to 750 individuals. These include owners of 100 industrial, 301 residential, and 349 commercial properties. The corporation has recorded its highest-ever property tax collection of Rs 200 crore in a six-month period. To encourage compliance, a 2% discount is offered for online payments via the 'PMCTAX APP.' Deputy Municipal Commissioner Ganesh Shete emphasizes including the property ID in property transactions. Teams responsible for issuing notices to high defaulters will be expanded, and the Superintendent of Taxes will lead a mobile number update initiative for seamless property tax transactions.

Two government offices in Nashik, including a central government establishment, have made headlines by clearing their property tax arrears, amounting to Rs 4.2 crore, owed to the Nashik Municipal Corporation. This follows the NMC's proactive campaign to prompt government offices to settle their property tax dues, as a collective Rs 20 crore in unpaid taxes looms over approximately 60 state and central government offices. One central government office opted for a service charge agreement, contributing Rs 1.7 crore to resolve their tax dues, while another office on Nashik Road, delinquent for nine years, paid an impressive Rs 2.5 crore in property tax. The NMC's pursuit of service charges from central government establishments aims to meet its property tax target of Rs 210 crore by year-end, and the engagement continues with various government offices to expedite tax settlements.

The Indian hotel sector is on track for a double-digit revenue growth in FY24 powered by robust domestic and international tourism, states a recent report by ICRA Limited. The growth got a boost from global events like the G20 Summit and ICC World Cup 2023 held in India. ICRA anticipates a 70-72% occupancy rate in premium hotels across India in FY24, with average room rates expected to hover around Rs 6,000 to Rs 6,200. The report highlights improved infrastructure, enhanced air connectivity, and a rise in MICE (Meetings, Incentives, Conferences, and Exhibitions) events as key drivers behind this optimistic outlook, indicating a resilient rebound for the industry post-pandemic.

The Navi Mumbai Municipal Corporation (NMMC) has been releasing 37 million litres of untreated sewage daily into Thane creek due to the shutdown of its sewage treatment plant (STP) amid a land dispute with CIDCO. The landowner claimed that he had not received compensation for the land acquired by CIDCO, leading to the dispute. The release of untreated sewage violates a Supreme Court order and could incur penalties from the National Green Tribunal. NatConnect Foundation, an NGO, raised concerns about this issue, emphasizing the threat to marine life and biodiversity in the creek. The NMMC is working to resolve the matter and reopen the STP. Swift action is essential to mitigate the ecological and public health risks posed by the untreated sewage discharge into the creek.

The Municipal Corporation of Delhi (MCD) is taking determined steps to address pollution and enforce environmental standards. Over a two-week period, they issued 24 challans with fines totalling Rs 8.2 lakh for violations related to construction and demolition guidelines. The MCD has deployed 511 surveillance teams to monitor environmental concerns, including open burning, illegal construction, waste dumping, and road dust. They've stationed anti-smog guns at high-rise buildings, landfills, and hotspot areas to combat air and dust pollution. The MCD's efforts are aimed at ensuring environmental compliance, especially in anticipation of the upcoming winter smog and pollution.

California grapples with a severe housing crisis, marked by a scarcity of affordable housing options and a substantial homeless population. Governor Gavin Newsom has responded by signing more than 50 housing-related bills, with SB 4, known as "Yes in God’s Backyard," drawing significant attention. This legislation streamlines the process for non-profit colleges, universities, and faith-based organizations to construct affordable housing on their existing land, allowing them to bypass certain environmental regulations and permitting requirements. UC Berkeley's Terner Centre for Housing Innovation has identified over 170,000 acres of underused land, presenting a significant opportunity to address housing needs, particularly for low-income and homeless individuals, through religious institutions and mission-driven organizations.

Chinese developer Country Garden Holdings Co has defaulted on a dollar bond and it has been declared for the first time. Trustee Citicorp International Ltd declared the default after the company failed to pay $15.4 millions of dollar bond interest within the grace period. This default, affecting one of China's largest developers, raises concerns about the nation's economy as the property market constitutes about 20% of its GDP. The firm has yet to officially default on any onshore bonds. Country Garden's default highlights the challenges faced by China's property sector and emphasises broader concerns in the global financial market. Experts are closely monitoring the situation for potential global economic implications.

CIDCO's 'Maha Nivas' housing scheme offers luxurious apartments to Maharashtra's legislators, judges, and bureaucrats at a fraction of the market rate, with price at about Rs. 19,500 per sqft, significantly lower than the area's market price of Rs. 30,000 to Rs. 60,000 per sqft. The scheme is part of a government initiative for specific VIPs and CIDCO is entrusted to construct and allocate the apartments on a lottery basis. It is designed by renowned architect Hafeez Contractor and encompasses 350 apartments on Palm Beach Road with carpet areas of 1270 sq ft and 1800 sq ft. CIDCO is welcoming applications till November 12 and has received 270 applications so far. While some praise the initiative, concerns have been raised within the real estate community about the pricing disparities and eligibility criteria.

Macrotech, a developer in Mumbai, has secured a Bombay High Court directive for a 50% premium rebate on the development of the Bradbury Mills plot in Byculla. The court determined that if a party or developer couldn't pay the premium due to reasons beyond their control, such as issues with the planning authority (BMC in this case), they should not be disqualified from the rebate scheme. The scheme, established to revitalize economic growth post-COVID-19, required applications to be submitted by December 31, 2021. The court upheld the developer's right to the rebate, emphasizing that they were not at fault for the delay due to BMC's misclassification of their application.

• A residential flat spanning 1,352 square feet on the 19th floor sold in One Marina in Marine Lines for INR 5.7cr <br>• A residential flat spanning 456 square feet on the 3rd floor sold in The Oasis in Belapur for INR 1.18cr

Kosmos Developers and West Avenue Realty have unveiled Eirene, an 18-storey luxury residential project in Dadar, Mumbai. The project features spacious 800 sq.ft. two-bedroom apartments, with opulent sea-view options on higher floors. Notable for its easy accessibility to key locations in Mumbai, Eirene is within walking distance of Dadar railway station and boasts proximity to landmarks like Siddhivinayak Mandir and Shivaji Park. The Bhoomi Pujan ceremony, attended by dignitaries including Deputy Chief Minister Devendra Fadnavis, marked the project's launch. Both developers expressed their commitment to delivering high-end luxury residences at affordable prices to meet market demand for modern smart living.

Roop Bansal, a promoter in the M3M group, has filed an anticipatory bail application in response to a corruption case he was implicated in earlier this year. The case involves Bansal, former CBI judge Sudhir Parmar, and Parmar's nephew, Ajay Singh Parmar, all held in Ambala jail for distinct legal issues instigated by the enforcement directorate. Bansal's legal woes began with his arrest in a 2021 money laundering case involving Ireo Realty Group's Lalit Goyal. His defence argues the case lacks credible evidence, mainly relying on WhatsApp messages and intercepted conversations. They challenge investigative procedures and emphasize the need for preliminary investigations, supported by legal precedents. This case remains a complex and high-profile legal battle with an upcoming bail application that has garnered significant attention and controversy.

In a pivotal ruling, the Bombay High Court reaffirmed the right of tenants in cessed buildings to receive 405 sq ft of carpet area for their rehabilitation flats. This decision came as a result of a writ petition filed by 59 residents of Mohamed Taibhai Chawl in Worli, contesting a developer's attempt to provide them with only 351 sq ft of carpet area under Section 33(7) of the Development Control and Promotion Regulations (DCPR) 2034. Armed with building plans obtained through the RTI Act, the residents argued for larger rehab flats, more parking space, and increased amenity open space.

The High Court of Bombay at Goa has taken a decisive stance against illegal construction in ecologically sensitive No Development Zones (NDZ). In a case involving a four-storeyed hotel built near the seashore without any necessary permissions, the court has ordered the structure's immediate sealing. The judgment emphasises the need for strict enforcement of environmental regulations and highlights the alarming prevalence of such illegal constructions near shorelines. This resolute action serves as a warning to potential violators and underscores the importance of protecting the environment and upholding regulatory compliance.

Almost 100 days after its launch, the Delhi Development Authority (DDA) has successfully sold nearly 2,300 flats. The housing scheme, which began on a 'first-come, first-served' basis in June, offered 5,600 flats in various configurations across Jasola, Rohini, Dwarka, Lok Nayak Puram, Narela, and Siraspur areas. 2BHK units in Dwarka, priced between Rs 1 crore and Rs 1.2 crore, were quickly snapped up. The surge in sales was attributed to measures like allowing the combination of two flats and physical property visits before purchase.

Justice Subodh Abhyankar of the Madhya Pradesh High Court has issued a directive to the Madhya Pradesh Housing and Infrastructure Development Board (MPHIDB), instructing them to settle their outstanding dues totalling Rs 435 crore. The court ordered the board to make the entire payment within a strict two-week timeframe upon receiving the certified copy of the order. Additionally, the order stipulates that the MPHIDB should transfer a sum of Rs 6.54 crore directly to a labour union as part of a settlement agreement. This legal action marks the end of a long standing dispute over a land where Hukumchand mills stood.

Antriksh NRI City, a Haridwar-based developer, has been ordered by the Uttarakhand state consumer commission to repay Rs 3 lakh plus 6% interest to petitioner Vikas Malik. Malik had initially paid Rs 6.4 lakh as part payment for a Rs 34 lakh plot but later wished to cancel the deal. The developer argued that the COVID-19 pandemic prevented the refund, a stance the commission rejected. They ruled in favour of Malik, emphasizing that banks and government institutions were operational during the pandemic, rendering the developer's excuse insufficient. In addition to the refund, the developer was directed to pay Rs 10,000 in litigation charges. This case underscores the importance of upholding contractual agreements even during unforeseen circumstances.

Alta Capital has secured a significant deal in India's largest student housing transaction by acquiring a 100 percent stake in Good Host Spaces for $320 million, marking the complete exit of Goldman Sachs and Warburg Pincus. Good Host Spaces operates purpose-built on-campus student housing assets at key universities. Founded in 2017, it manages an operational portfolio of around 25,000 beds across five cities, with plans for further expansion. The company partners with universities to offer specialized accommodations, enabling institutions to monetize non-core housing assets. The strong investor appetite for Indian real estate and the student housing sector is evident in this transaction.

Infibeam Projects Management, a subsidiary of Infibeam Avenues, has acquired a partially constructed Sintex Group corporate house near Vaishnodevi Circle in Ahmedabad for a reported sum of Rs 90–100 crore. The property spans 7,000 square metres with 4.20 lakh square feet of built-up area. Infibeam intends to transform it into a commercial space tailored for start-ups and IT companies. Vaishnodevi Circle is becoming a burgeoning corporate hub, drawing prominent companies to the area. Infibeam Avenues established Infibeam Projects Management to provide workspaces for fintech start-ups and IT firms, aligning with the growing appeal of Ahmedabad's cost-effective and talented IT workforce.

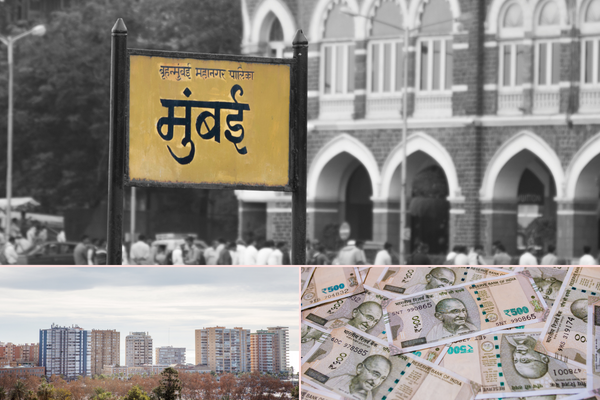

During the nine-day Navratri festival from October 15 to October 23, 2023, Mumbai witnessed a remarkable 37.4% year-on-year increase in property registrations. Knight Frank India, a prominent real estate consultancy firm, reported that 4,594 units were registered, up from 3,343 units in Navratri 2022. This surge generated a revenue of Rs 435 crore for the state exchequer. The daily average registration rate rose from 371 units in 2022 to 510 units in 2023. The surge was attributed to improved buyer confidence, stable interest rates, and a growing interest in larger homes.

The government of Maharashtra is actively tackling the issue of high premiums on real estate development projects in Mumbai, with plans to reduce them by 50%. This move aims to make Mumbai more affordable for homebuyers and businesses. It has garnered support from real estate developers and industry representatives. The reduction in premiums is expected to ease the financial burden on buyers and boost tax revenue for the government, ultimately promoting long-term economic growth for the city. A comparative analysis underscores the economic growth disparity between Mumbai and other major Indian cities and highlights the need for such measures to rejuvenate Mumbai's appeal as a thriving economic centre.

The Indian finance ministry has instructed state-owned banks to accelerate the development of an advanced property auction platform and mobile app. This move aims to enhance transparency in the sale of approximately 500,000 properties seized due to loan defaults. Prospective bidders will have access to property details, ownership type, photos, and videos. The new platform, an upgrade to the existing Indian Banks Auctions Mortgaged Properties Information (IBAPD) portal, is expected to go live by the end of the year. PSB Alliance Ltd. will oversee the upgrade of the IBAPD portal, further promoting transparency in property auctions.

Leasing of industrial and warehouse spaces in India's premier cities declined by 12% in Q3 2023, with a total of 6.2 million square feet leased, as per a Colliers report. While Pune dominated with a 24% share, Mumbai closely followed at 23%. Third-party logistics firms (3PLs) maintained their lead in the sector, contributing to 40% of the warehousing demand, followed by FMCG and automobiles. In terms of these substantial deals, Mumbai stood first, followed by Chennai. Despite the current dip, experts anticipate a resurgence in leasing activity in the final quarter of 2023.

The restoration of Mumbai's Haji Ali Dargah, a project initiated over 17 years ago, continues to face significant delays and challenges. Trustees and government officials, including the guardian minister and representatives from various agencies, have held multiple meetings to address the project's sluggish progress. The renovation effort is divided into two components: the restoration of the shrine complex and structures, managed by the dargah trust, and the reconstruction of the pathway leading to the shrine, overseen by the state government. The estimated costs for these components have significantly increased. The restoration aims to preserve the historical significance of the dargah, emphasizing the need for efficient project management in cultural heritage preservation.

Mumbai's present real estate construction boom has contributed to worsening air pollution. The ongoing real estate construction activity spanning approximately 3.24 crore square feet is equivalent to five times the size of Nariman Point. Since 2022, incremental construction in Mumbai has grown by 68%. This surge in construction is attributed to a government initiative in 2021 which halved premiums for developers, sparking a rush by developers to get projects approved. While this construction surge has driven housing production and the state's economy, it has come at the cost of increased pollution, with a noxious haze enveloping the city.

Lidl has become London's third-largest supermarket, claiming a staggering 91% market share. With over 100 stores in the M25 area and £9.3 billion in UK sales, their rapid rise is clear. Asda, now in fifth place, plans to counter this by opening 17 new convenience stores, having acquired 132 sites from the Co-op. Lidl's CEO, Ryan McDonnell, highlights their dedication to affordability and quality. Their vision includes 247 potential store locations in the UK and aims to reach 1,100 stores by 2025, underscoring London's evolving retail landscape.

The United States has witnessed a significant surge in the interest rate for the most popular home loan, reaching levels not seen since 2000. This is the seventh consecutive weekly increase, leading to a notable drop in mortgage applications to a 28-year low. Surprisingly, this surge is occurring despite the Federal Reserve pausing its rate-hike campaign. The rise in the 30-year fixed-rate mortgage closely follows the upward trajectory of the 10-year Treasury note yield, a key benchmark for long-term borrowing rates. This situation raises concerns about housing affordability, compounded by rising home prices and supply chain disruptions. The complex interplay of economic factors is challenging for prospective homebuyers and the real estate market. The housing sector's evolution in the coming months will be closely watched.

DNE Group, a Shanghai-based company formed through a merger in 2021, is partnering with Bain Capital in a $250 million joint venture to invest in manufacturing park assets in China. DNE specializes in smart manufacturing facilities for products like automobile parts and integrated circuits. They also develop and manage real estate in sectors such as logistics, cold chains, life sciences, and office buildings. In this joint venture, DNE will handle project management, while Bain Capital is the strategic investor. This collaboration comes as China seeks to upgrade its manufacturing sector by encouraging investment in advanced fields like chipmaking, data centres, and robotics.

Dubai’s real estate market witnessed substantial growth in the third quarter of the year. Property consultancy ValuStrat reported a 6.1% quarterly increase in the ValuStrat Price Index (VPI) for the residential market, with villa and apartment prices rising by 7.6% and 4.8%, respectively. Additionally, prime properties experienced significant gains, with prime property valuations increasing by 16.5% annually. The economic impact of Expo 2020 Dubai and higher oil prices further contributed to this growth. Off-plan property transactions also saw a surge, with a 19.1% annual increase, representing Dh36.9 billion in investments. Popular transaction areas included Jumeirah Village, Dubai Marina, Business Bay, Downtown Dubai, and International City.

Piramal Group has profitably divested Rs 531 crore in distressed loans linked to its Advantage Raheja exposure, including prominent properties like the JW Marriott in Bengaluru and Crowne Plaza in Pune, to Omkara Asset Reconstruction Co. This strategic transaction concluded at a premium, yielding a substantial gain exceeding Rs 700 crore. In addition, Piramal successfully sold an outstanding loan pool worth Rs 3,656 crore to Omkara ARC, achieving a commendable 17 percent recovery. Piramal's current focus involves building a new asset-backed wholesale portfolio called 'Wholesale 2.0,' prioritizing real estate and corporate mid-market lending while resolving stressed loans to enhance asset quality and reduce the wholesale AUM.

Jailed builder Jayesh Tanna, along with his brother Deep and son Vivek, face a ninth FIR for allegedly cheating 28 flat buyers of Rs 40 crore. Tanna, imprisoned at Arthur Road jail, is implicated in multiple cases across Mumbai, primarily involving the sale of flats to third parties. The latest complaint revolves around a 2012 redevelopment project in Goregaon, where Tanna was redeveloping a building. A buyer, Bhavin Barot, booked a flat for Rs 1.6 crore with possession due in 2013, but encountered disputes in 2016. Eventually, he found that 27 more flat buyers were affected and approached the police. The case may be transferred to the economic offenses wing.

The Indian government has announced an accelerated timeline to achieve its 'housing for all' initiative in rural India, now targeting completion by December 2023, three months ahead of the previous deadline. Under the Pradhan Mantri Awas Yojana (Gramin), the government aimed to build 29.5 million houses for rural families. As of September 30, 24.5 million houses were constructed, with the rest set to be finished by the new December target. The initiative reflects the government's proactive approach toward fulfilling housing promises, highlighting its commitment to rural development and providing housing for millions of families across the country.

Delhi's 2018 land pooling policy, designed to revamp 105 villages within P-II, K-I, L, N, and J zones, has hit a roadblock as it garners limited interest from landowners. The policy mandates that landowners form a consortia to collectively pool land, with 70% of the land required for development needing to be contiguous and free from encumbrances. Despite its potential to unlock urban development opportunities, the low uptake underscores challenges and skepticism faced by landowners, possibly due to complexities and uncertainties associated with the policy. Delhi Development Authority (DDA) continues to encourage participation, hoping to boost this redevelopment initiative.

In its ongoing investigation into Kerala's LIFE Mission, the Enforcement Directorate (ED) has confiscated assets totalling Rs 5.38 crore. LIFE Mission was meant to aid flood victims who lost their homes. The assets, linked to alleged money laundering, include properties and bank balances of Santhosh Eappen and Swapna Suresh. The probe reveals a suspected conspiracy involving officials from the UAE consulate and Kerala government to divert funds from the Red Crescent donation. Further revelations point to illicit overseas transfers and involvement of several high-profile names. The investigation continues and more details emerge.

Eight individuals have been charged by Division 8 police in Ludhiana following a nearly 8-year investigation into a property fraud in Ghumar Mandi. The accused allegedly forged documents to claim and sell a property originally owned by the complainant's maternal grandfather. The fraud came to light when Vinod Kumar, a descendant and rightful heir, raised suspicions after discovering discrepancies in property records. While charges have been filed, no arrests have been made yet.

Qualcomm is set to bolster its presence in the technology hub of Bengaluru with a significant expansion. The company has secured 600,000 square feet of office space at Bagmane Capital-Angkor, an established location for tech enterprises. This expansion will be executed in two phases, ultimately spanning the ground floor and 12 additional levels within the forthcoming facility. According to official documents, Qualcomm is committed to a lease term of 108 months, pointing to the company's commitment to the region and its mission to be part of the flourishing tech ecosystem in Bengaluru.

The state has generated a significant revenue of Rs 3,597 crore through the Metro cess, a 1 percent stamp duty imposed on property registrations in major cities. Initially introduced in 2019 to fund crucial public infrastructure projects, the cess was briefly suspended in 2020 due to the pandemic and reintroduced in 2022. Revenue is collected through stamp duty on property transactions. Mumbai's stamp duty increased from 5 percent to 6 percent, while other cities went from 6 percent to 7 percent, adding around Rs 50,000 to property costs. Despite concerns, experts believe the cess will persist as long as property sales remain robust.

PNB Housing Finance has released impressive financial results, with a striking 45.83% increase in consolidated net profit during Q2 FY24, reaching Rs 383 crore compared to the previous year. Their total income also saw robust growth, surging by 5.70%. The credit for this achievement goes to successful efforts in resolving a major corporate account, which significantly reduced their non-performing assets. With a solid financial position, boasting a strong CRAR of 30.38%, PNB Housing Finance demonstrates robust performance and a commitment to affordable housing, reflecting its unwavering dedication to financial excellence and growth.

Karma Group, led by Chairperson and CEO John Spence, is redefining luxury hospitality with its unique members-only model. They plan to invest $100 million for expansion and have partnered with EY to explore diverse financing options. Their focus on exclusivity and tailored experiences, akin to elite membership clubs, has garnered them around 85,000 members, including 25,000 from India. Recognizing evolving consumer preferences, Karma Group emphasizes the entertainment aspect of hospitality, creating memorable experiences. Their prudent financial strategy, with minimal debt exposure, and a global presence, including 15 resorts in India, mark them as pioneers in the luxury hospitality industry.

Construction of Navi Mumbai airport faces delays, with anticipated commercial operations in 2025 instead of 2024, per CAPA. The Adani Group, responsible for the project, insists it will meet the original December 2024 target. Mumbai International Airport Limited (MIAL), another Adani Group entity, is also investing in enhancing efficiency and capacity. The proximity of the Navi Mumbai Airport aims to alleviate congestion at the Mumbai Airport. The Navi Mumbai Airport is set to accommodate up to 20 million passengers initially and expand to 90 million by 2032. Mumbai Airport, even before the pandemic and Jet Airways' 2019 bankruptcy, faced infrastructure challenges, operating at near full capacity.

Ludhiana Municipal Corporation (MC) officials are anticipating the introduction of a one-time settlement (OTS) policy to regularize illegal buildings, mirroring a similar policy applied in areas outside the MC's jurisdiction, under GLADA's control. The impending municipal corporation elections are expected to prompt this move, although it has stirred criticism from city activists who accuse the government of promoting violators. An MC official stated that the policy could lead to the regularization of many illegal buildings, though the exact number remains unknown as no survey has been conducted yet.

Aurum PropTech has reported a net consolidated loss after tax of Rs 23.89 crore for the quarter ending on September 30, 2023, in contrast to a loss of Rs 10.82 crore in the corresponding quarter of the previous fiscal year. However, the company displayed robust growth in net consolidated total income, with Q2 FY24 witnessing a substantial income of Rs 57.53 crore, marking an 86.54% increase from the same quarter in the previous year. The company's Executive Director, Onkar Shetye, highlighted a significant reduction in losses incurred by NestAway, putting them on track to break even by the end of this financial year.

China's real estate market continues to face challenges as new home prices decreased for the third consecutive month in September. Data from the National Bureau of Statistics shows a 0.2% monthly drop, and there is still a 0.1% decrease year-on-year. Property sales and investment are also declining, despite government policy stimulus measures aimed at boosting the property sector. Stabilization of buyer sentiment is being observed, but the complete recovery of the property market hinges on the fourth quarter's performance. Lower-tier cities face more significant challenges due to weaker economic fundamentals and oversupply issues, highlighting the need for effective debt resolution for private developers.

The Ontario government is embarking on an ambitious plan to address the housing crisis in the Greater Toronto Area by creating vibrant transit-centred communities around upcoming transit stations. This initiative, featuring over 5,900 new housing units and enhanced public transit access, is poised to revolutionize urban living and generate more than 1,900 jobs. Minister of Infrastructure Kinga Surma underscores the need for affordable, accessible, and community-rich neighbourhoods, aimed at lightening the financial burden on taxpayers. The proposal envisions diverse transit-centred communities and underscores a commitment to public engagement for shaping sustainable, inclusive urban spaces.

The Hong Kong government's Town Planning Board has defended its decision to temporarily rezone part of the Fanling Golf Course from “residential” use to "undetermined" to facilitate a controversial public housing plan. This rezoning provides a buffer period for a review of the land's layout and development parameters. The golf club had launched a legal challenge to the government's approval of an environmental report for the housing plan, citing a lack of public consultation and ecological concerns. The court suspended the report, emphasizing environmental and cultural heritage risks. The long-term use of the site will be confirmed after reviews and legal proceedings.

"• A residential flat spanning 810 square feet on the 1st floor sold in Green Acres in Andheri West for INR 3cr. • A residential flat spanning 1,412 square feet sold in Sheth Beaumonte in Sion West for INR 5.18cr "

Bollywood actress Preity Zinta has acquired a luxurious apartment in the posh Pali Hill area in Bandra for a whopping Rs 17 crore. Located on the 11th floor of the exclusive Rustomjee Parishram residential tower, this 1,474 sq ft apartment includes two reserved parking spaces and an additional 90 sq ft of exclusive space. The property was purchased from Keystone Realtors Limited, a listed entity of the Rustomjee Group. The actress paid a stamp duty of Rs 85.07 lakh for the property. This purchase follows a trend of high-profile acquisitions by Bollywood actresses in Mumbai's thriving real estate market.

Greater Noida is leading the charge in India's residential real estate market, with a remarkable 38.9% increase in property searches during Q3 2023, positioning it as the top city out of 13 major Indian cities. This surge is attributed to rising demand and a 6.7% decrease in supply, potentially signalling a supply-demand gap. Notably, 3BHK units are in high demand, making up over 47% of all property searches, in line with the growing preference for luxury residential properties. Other cities, like Delhi and Gurugram, also saw an increase in searches and property prices. These findings reflect significant transformations in India's real estate landscape, attracting attention from industry stakeholders.

Signature Global (India) has acquired 25.75 acres of land in Gurugram for a significant group housing project, withholding deal details. The acquisition involves prime land in Gurugram, offering a vast development potential of 3.25 million sq. ft. The company is also in advanced negotiations for joint development agreements for 16.12 acres and collaboration agreements for 4.26 acres in the same vicinity. Financially, it experienced a 37.57% increase in pre-sales in H1 FY24 and reported a 64.92% growth in collections. Signature Global recently launched a successful initial public offering to raise Rs 730 crore, further solidifying its presence in real estate.

• A residential flat spanning 381 square feet on the 25th floor sold in Dynamix Avanya in Dahisar East for INR 64 lacs <br>• A residential flat spanning 585 square feet on the 19th floor sold in Address 51 in Bandra West for INR 1.92cr

The Rustomjee Group, in partnership with Keppel, has introduced the magnificent La Vie at Rustomjee Uptown Urbania. This grand project, spanning 8.5 acres within a vast township, features eight independent towers, each rising to 55 stories, designed by acclaimed architect Hafeez Contractor. La Vie offers a variety of residential options, with Tower B providing 2-bedroom apartments, and Tower C offering spacious 3-bedroom homes. The location in Thane offers easy access to major business hubs, making it a preferred choice for urban convenience and natural beauty. La Vie redefines modern living, community harmony, and the promise of a brighter future.

The Atal Apartments project in Ludhiana faces mounting discontent among its allottees due to prolonged construction delays. The ambitious initiative, with 576 flats and a budget of Rs 250 crore, has been in progress since 2008, testing the patience of homebuyers. The Ludhiana Improvement Trust (LIT) had received state government approval for the project but construction remains stagnant. Tenders for crucial amenities like a community centre and multi-storey parking have also been halted. LIT officials cite the need to renew environmental clearance, which was granted in 2017 and is valid until 2027, after project redesign. While they assure construction will begin soon, allottees are concerned that upcoming elections may further delay the project.

Arvind SmartSpaces Ltd, a leading real estate developer, is set to undertake a new residential project in Bengaluru's thriving Bannerghatta Road micro-market. This venture, acquired through HDFC Platform 2, offers an estimated 4.6 lakh square feet of saleable area and a revenue potential of around Rs 400 crore. This strategic expansion aligns with Arvind SmartSpaces' commitment to diversify its real estate offerings, addressing both horizontal and vertical developments in Bengaluru and Ahmedabad. With the buoyant real estate market and fresh investments of Rs 1,000 crore, the company aims to achieve a record-breaking year in new project additions.

In Gurugram, homebuyers in nine affordable housing projects, linked to developers Mahira Homes, Ocean Seven Buildtech (OSB), and Orris Infrastructure, may find relief from their long wait for possession of their flats within the next three to four months. The Department of Town and Country Planning (DTCP) is actively addressing these issues following complaints from around 5,000 homebuyers. They have been plagued by various problems, including financial irregularities and suspended construction. With around 15,000 affected homebuyers, they are hopeful that government intervention will bring a resolution to their prolonged anxieties and uncertainties.

In a recent development, the Madras High Court has rejected a set of petitions filed by Neomax and its subsidiary companies, including Garlando Properties, Transco Properties, Tridas Properties, and Glowmax Properties. The pleas sought the appointment of a commission, led by a retired high court judge, to address land settlements for depositors. Allegations of money fraud were raised against the companies by the Madurai EOW police in June. Deposit-holders had made advance payments for land purchases, backed by booking confirmation receipts.

The Bombay High Court has expressed deep disappointment with the police investigation into a multi-crore housing scam involving Karrm Infrastructures (Pvt) Ltd. In their written order, the justices reprimanded the investigating police and directed the Director General of Police, State of Maharashtra, to transfer the case to a police officer with the rank of Commissioner of Police. They also mandated that the inquiry report be submitted within four weeks. The court raised serious concerns about the police's inability to respond adequately to its queries and directed the initiation of mediation to devise a comprehensive scheme for the victims. The housing scam involved thousands of flat buyers who were deceived by the developer.

The Bangalore Development Authority (BDA) is facing a lack of interest from potential buyers in its auction of corner sites due to the absence of geo-tagging. The BDA presented 123 corner and middle sites for auction, but since these sites are not geo-tagged, prospective buyers are finding it challenging to locate and assess the plots using platforms like Google Maps. The absence of geo-tagging has raised concerns among buyers who fear that friends and family may have difficulty finding the plots if they decide to construct a home there. The BDA has acknowledged this issue and is working to address it. Some customers have also highlighted the challenges of locating sites in the rapidly changing Bengaluru landscape. The absence of geo-tagging has become a significant concern for both authorities and potential buyers in the region.

The Delhi Development Authority (DDA) has achieved an impressive milestone by selling approximately 40% of its previously unsold inventory of 2,236 flats in Phase 1 of its housing scheme. This accomplishment, which generated Rs 506 crore in revenue, underscores the enthusiastic response from potential homebuyers in Delhi. Despite initial concerns regarding the sale of economically weaker section (EWS) flats, the DDA has successfully sold various flat categories in different locations. The LG has set ambitious targets for the current fiscal year, aiming to sell at least 40% of the total unsold inventory. The DDA's proactive measures to enhance the appeal of certain areas have contributed to this success.

The Maharashtra state cabinet has approved various initiatives, including Rs. 25 crore for a cluster redevelopment project in Thane, focusing on providing affordable housing in underprivileged areas. The funds were allocated from the Mahatma Phule Backward Class Development Corporation, and the redevelopment will be executed by a subsidiary of the corporation. Additionally, the cabinet sanctioned government banking transactions through the state cooperative bank, aimed at supporting the cooperative sector. The cabinet also greenlit a power project in Koradi, and extended a scheme to pay interest on loans for cooperative spinning mills. Other amendments and initiatives were also passed.

The Karnataka Real Estate Regulatory Authority (KRERA) has taken an important step in addressing an issue with a housing project near Bengaluru. KRERA has ordered the developer, Shree Senior Homes, of a senior living project named Sharadindu State III, to transfer a corpus fund of Rs 62.26 lakh to the Resident Welfare Association (RWA) of the project. This directive follows the RWA's request for relief due to the developer's failure to transfer the corpus fund, despite maintaining the project since 2016. The decision highlights KRERA's commitment to protecting the rights and interests of homebuyers and RWAs in real estate developments.

Property developers in India are underutilizing available credit lines for construction finance due to their strong residential sales and substantial collections. Despite having access to low-interest construction finance, developers typically utilize only 70-80% of sanctioned limits. Robust residential sales in major Indian cities have created cash surpluses, reducing the need for external funding. The strong cash flow allows developers to sell properties at current prices without higher borrowing costs, while selectively using credit lines to pay off expensive debt and boost credit ratings. This shift in the property market reflects the current economic cycle, with developers relying less on external construction finance.

The Department of Town and Country Planning (DTCP) in Gurugram has conducted sealing drives against unauthorized construction and illegal commercial activities in licensed colonies, recovering a total of Rs 1 crore in penalties and bank guarantees from violators. Around Rs 50 lakh was collected through penalties and bank guarantees for de-sealing buildings closed citing various violations. Additionally, approximately Rs 50 lakh was collected by granting permissions to property owners for running non-nuisance commercial activities. The DTCP has issued permits for various non-nuisance activities, including those by lawyers, doctors, tax consultants, and architects, and collected revenue of around Rs 59 lakh from these permits.

Darjeeling's Gorkhaland Territorial Administration (GTA) has leased out nine tourism properties in the Sandakphu-Phalat area to private parties due to their failure to generate sufficient revenue. These properties, mostly lodges and trekking huts along the Himalayan trail, were found to be in need of repairs estimated at Rs 6.72 crore. Sandakphu, the highest point in Bengal at 12,000 feet, is renowned for its trekking trail. The leasing decision has sparked controversy, with some alleging favouritism in property selection. GTA member Noran Sherpa defended the process, noting that a committee assessed properties' financial health before leasing them.

The Mumbai Metropolitan Region Development Authority (MMRDA) has received approval from the State Board of Wildlife to cut down 122 trees in the core area and eco-sensitive zone of Sanjay Gandhi National Park (SGNP) to construct twin tunnels connecting Borivali to Thane. These tunnels, part of a project valued at Rs. 18,795.70 crore, will also involve drilling 27 holes using explosives. The decision was taken at a board meeting chaired by the forest minister but kept confidential due to fears of potential backlash. Environmentalists have expressed concerns, noting the potential harm to wildlife and the need for further clearances for the project.

Jewar, a town in Uttar Pradesh, has been experiencing significant transformation due to the construction of the Noida International Airport. The area has attracted real estate developers, investors, warehouses, hotels, universities, and even Bollywood actors and producers. The Yamuna Expressway Industrial Development Authority (YEIDA) has launched various schemes linked to the airport, including residential, commercial, industrial, education hub, and film city sectors. High-rise residential projects by renowned developers like ATS, Oasis, and the Gaur Group have already been completed, boosting the real estate market. The government aims to turn Jewar into a thriving corporate hub akin to Gurugram, driven by the airport's strategic location and connectivity.

Fashion designer Stella McCartney and her husband, Alasdhair Willis, are facing objections from local residents over plans to build a modernist home on a coastal site in the Highlands of Scotland. More than 50 objections have been raised, with critics expressing concerns about the impact on the natural environment. They urge McCartney, known for her environmental advocacy, to adopt a more eco-friendly design that blends with the surroundings and preserves the local landscape. The proposed construction aims to be site-specific, prioritizing privacy and seclusion. The plans are under review by the Highland council, and the location, known as Commando Rock, holds historical significance from World War II, with stunning views of nearby islands.

In Chicago’s Hermosa neighbourhood, Walt Disney’s childhood home recently opened to the public for the first time during the Chicago Architecture Centre’s Open House event. The tour showcased the modest cottage where Walt and his family lived, with fascinating insights into the life of his father, Elias Disney, a multifaceted man who worked as a construction worker during the 1893 World’s Columbian Exposition. Visitors explored the parlour where Elias might have played the fiddle and heard stories of the fair’s innovations. The tour also included a look at the family’s dining room, kitchen, and bedrooms, shedding light on the early years of the Disney family. Despite initial resistance to designating the property as a historical landmark, efforts are now underway to restore it to its 1901 state.

China Evergrande Group, facing a severe debt crisis, has announced plans to revise its offshore debt restructuring deal amidst challenges, including its founder's investigation for unspecified crimes and the inability to issue new debt due to ongoing investigations. The lack of specific details in the announcement has left stakeholders in a state of unease, raising concerns about the company's financial stability. Evergrande's struggles have sent shockwaves through global financial markets, prompting increased vigilance among investors and policymakers. The outcome of its restructuring attempts holds immense significance for the real estate sector and the broader Chinese economy, leaving stakeholders eagerly awaiting updates.

Maharashtra has introduced transliteration software to simplify access to land records for citizens from outside the state. This tool enables users to read and understand land records in 22 regional languages. In response to difficulties caused by linguistic barriers, this initiative aims to facilitate property transactions and legal matters across state borders. The Record of Rights (RoR), typically maintained in local languages, contains essential information about land holdings. The software allows users to transliterate RoR details into their preferred regional language, making land records more accessible and comprehensible. Further enhancements, including translation tools, are in the pipeline.

• A residential flat spanning 1,233 square feet on the 5th floor sold in Runwal Elegante in Andheri West for INR 4.65cr <br>• A residential flat spanning 1,201 square feet on the 5th floor sold in Lodha The Park in Worli for INR 5.69cr

Godrej Landmark Redevelopers, now part of Godrej Projects Development, a subsidiary of Godrej Properties, has been issued a GST demand order of Rs. 129.39 crore along with interest and a penalty of Rs 129.39 crore by the Additional Commissioner of CGST & C. Ex. in Navi Mumbai. This order is related to alleged non-payment of GST concerning a Mumbai project by GLRPL. The company intends to challenge the order through the appropriate legal channels, stating no significant impact on its operations. Recently, Godrej Redevelopers (Mumbai), another subsidiary, also faced a similar order. Furthermore, CIDCO also cancelled the allotment of plots to Godrej Properties but the company has challenged this cancellation in court.

Builder from Mumbai, Suresh Bhatade, has been placed under judicial custody in connection with the illegitimate sale of six apartments at Pioneer CHS, Panvel, for a total of Rs 4.3 crore. After eluding authorities for more than two months, Bhatade's arrest represents a major step in combating fraudulent activities in India's real estate market. The dismissal of the anticipatory bail requests of two additional builders, one of whom was a former assistant commissioner of income tax, highlights the necessity of strict regulatory measures and open property transactions in order to rebuild confidence in the real estate market.

91Springboard, a major player in India's coworking and flexible workspace industry, has launched its Platinum Hub in the prestigious DLF Cyber City of Gurugram, a prime location for businesses. This marks their sixth workspace in Gurugram and 11th in the National Capital Region, aligning with Gurugram's growth as a primary business destination. Reports from Cushman & Wakefield and Knight Frank indicate Gurugram's dominance in the Delhi-NCR workspace market. This expansion brings their total workspaces in India to 28, offering top-notch design, comfort, and customization options.

Operator of co-living spaces Settl is getting ready to open ten new locations in Chennai, which will involve a major expansion. Settl, which currently oversees 3,500 beds in Bengaluru, Gurugram, and Hyderabad, is meeting the increasing need for high-quality, completely managed rental properties. Chennai is an unexplored market with a ton of opportunity for co-living communities. By the conclusion of the fiscal year, the corporation hopes to have increased the number of beds in the city from 300 to 1,000. Their well-placed closeness to major business areas seeks to facilitate hassle-free managed living while cutting down on working professionals' commuting hours.

The Enforcement Directorate (ED) has arrested Rajpal Walia, director of Pushpanjali Realms and Infratech Limited, under the Prevention of Money Laundering Act (PMLA) for cheating flat buyers in Dehradun. The ED's intervention stemmed from an FIR filed against the company for fraudulent activities. The investigation revealed the diversion of advance payments from flat buyers for other purposes, totalling Rs 31.15 crore. The ED has attached the proceeds of the crime in the form of immovable properties. This action underscores the authorities' commitment to justice, emphasising the need for due diligence in real estate transactions.

The real estate development in Maharashtra's coastal zones is set to receive a significant boost as the state government permits local authorities to approve construction plans within certain limits without seeking permissions from the Maharashtra Coastal Zone Management Authority (MCZMA). Maharashtra is among the first states to implement this directive, allowing local authorities to grant approval for self-dwelling residential developments up to 3,229 sq ft space without MCZMA recommendations, potentially reducing approval timelines. This decision will facilitate previously stalled coastal development, promoting tourism-related activities along the shoreline. Projects like plotted developments and villa constructions, which have gained traction in recent years, will benefit from this move.

Pune's Slum Rehabilitation Authority (SRA) has issued notices to 22 developers for significant project delays, ranging from five to seven years. Developers attribute the delays to landowner resistance and commit to resolving issues through renewed negotiations. The SRA emphasises developers' responsibility for initial house repair and maintenance post-rehabilitation, actively securing insurance policies for support. With 166 ongoing projects and 61 completed, over 10,800 slum dwellers have been rehabilitated. Challenges persist due to resistance and spatial allocation concerns, but ongoing efforts underscore Pune's commitment to inclusive housing solutions and sustainable urban development.

Mumbai's real estate market has been rattled by a controversy involving fake seals. Five people were detained in August on suspicion of using fake paperwork to develop 55 residential buildings and deceiving buyers since 2015. Among the suspects were a rubber stamp manufacturer, real estate brokers, developers, and a home loan services provider. From sub-registrar offices, architects, and the Vasai Virar Municipal Corporation, among others, they had obtained 115 counterfeit seals. There are now more builders implicated in this fraudulent activity, according to additional investigations, which raises questions about the scope of this forgeries in Mumbai's real estate industry.

_ 1.png)

The Jharkhand government has approved a Rs 16,320 crore project, 'Abua Awas Yojna (AAY),' to build 8 lakh houses for the needy by March 31, 2026, as pledged by Chief Minister Hemant Soren. The project is divided into phases, with a focus on providing clean and decent three-room houses to marginalized communities. It aims to benefit families living in inadequate housing conditions and includes criteria to prioritize the neediest while excluding certain groups, such as those with existing permanent residences or significant land holdings.

The High Court of Karnataka has ordered the Chief Commissioner of the Bruhat Bangalore Mahanagara Palike (BBMP) to digitize all property documents, including old records, and restrict access to authorized officers. The directive, prompted by a petition from Aslama Pasha regarding a building construction dispute, emphasizes that BBMP should serve as the custodian of records and coordinate access within its departments. The court encourages efficient information sharing among BBMP departments, and collaboration with the government's e-Governance Department to create a consolidated repository of property documents. This move modernizes document access, enhances transparency, and streamlines property-related matters, ultimately expediting transactions and dispute resolution.

The Calcutta High Court has instructed the Bidhannagar Municipal Corporation to demolish an unauthorized construction in Shantinagar, Salt Lake Sector V, setting a 1 pm deadline for completion, alongside the disconnection of power and water supplies. The order, issued by Justice Abhijit Gangopadhyay, came after the builder failed to comply with a previous court summons. Residents were granted the right to approach the court for rehabilitation. While the demolition process began, it faced resistance from locals, echoing previous attempts to demolish illegal structures. The court's ruling signifies a critical step in addressing safety, infrastructure, and urban development concerns associated with unauthorized constructions.

The Chennai Metropolitan Development Authority (CMDA), in partnership with Cushman and Wakefield, has initiated a comprehensive study titled 'Housing Demand and Supply within Chennai Metropolitan Area (CMA).' This study aims to address the complexities of housing development in the Chennai Metropolitan Area through data-driven decision-making. The study covers various growth corridors within the CMA and examines multiple demand drivers, including floor space index (FSI) increases and the transfer of development rights. The recent expansion of the Chennai Metropolitan Area's footprint to 5,904 square kilometres has prompted the CMDA to formulate both the third master plan for the original area and a strategic regional plan for the newly added regions.

The ASK Group, which is supported by Blackstone, has unveiled a new property fund worth Rs 1,500 crore, building on the success of their earlier real estate fund. The group intends to complete fundraising by March and make approximately 8 to 10 investments across India's top five cities. The fund manager, ASK Property Investment Advisors, has a track record of raising over Rs 6,100 crore from a diverse set of investors, including family offices, high-net-worth individuals, and institutions. They are significantly contributing to the growth of India's real estate sector, with PE investments in the sector projected to reach $5.6 billion in 2023.

Under the visionary leadership of Deputy Chief Minister and State Finance Minister Ajit Pawar, the state government is launching an award scheme to celebrate and incentivize conscientious property taxpayers. This initiative recognizes the remarkable dedication of 660,785 property owners who have diligently fulfilled their tax obligations, resulting in collections exceeding 300 crores. A total of 45 rewards amounting to Rs 1 crore will be distributed to lottery winners, fostering a culture of on-time tax payments. Pune Municipal Corporation (PMC) initiated this commendable endeavour, setting a property tax collection target of Rs 2,318.1 crore for 2023–24, with innovation and vision at its core.

Can Fin Homes report an 11.54 percent growth in net profit to Rs 158.07 crore for Q2 FY24. Total income from operations surged by 32.47 percent to reach Rs 871.03 crore, and net interest income increased by 26.1 percent to Rs 316.8 crore. An internal fraud incident in the Ambala branch resulted in a fund defalcation of Rs. 39.67 crore, prompting Can Fin Homes to file an FIR and fully provide for the amount, with a post-tax impact of Rs. 29.69 crore. As of September 30, 2023, the company showcased a strong financial position with a net worth of Rs 3,961.32 crore, a debt-equity ratio of 7.73, and NPAs.

Afcons Infrastructure has completed the 13.1 km section of India's Samruddhi Expressway between Thane and Nashik, officially called Package 14, ahead of schedule. This achievement includes constructing the nation's widest tunnels, measuring 17.6 meters in width, along the Igatpuri-Kasara Ghat route. The tunnels have modern safety features and are equipped with advanced ventilation and fire protection systems. Additionally, a 1.2 km viaduct bridge with a height of 60 meters, spanning 29 spans, was successfully constructed. The project was carried out under pandemic restrictions between March 2020 and May 2021 and despite facing significant challenges due to heavy rainfall in the region, the project has been completed ahead of schedule.

The Kopri rail overbridge (ROB) in Mumbai, intended to ease traffic congestion in Thane, has deteriorated in less than nine months since its inauguration. Cracks, uneven patches, and potholes have appeared, revealing subpar construction by the Mumbai Metropolitan Region Development Authority (MMRDA) and Central Railway authorities. The bridge, which cost over 250 crore to build, has experienced recurring issues despite repair work in July. Concerns have been raised about construction quality and the use of the Ultra-Thin White Topping (UTWT) method, which may not provide the durability required for long-lasting infrastructure. The focus on contractor-led projects over engineer-led initiatives has also been criticised.

Surinder Chawla, the MD and CEO of Paytm Payments Bank, invested Rs 20 crore in two duplex apartments within the Indiabulls 'Sky Forest' tower in Mumbai's Lower Parel. These apartments span 2516 square feet across the 42nd and 43rd floors and come with four parking spaces. The apartments are valued at over Rs 57,300 per sq. ft, including rights to 972 sq. ft of exclusive area. The transactions were completed in August, incurring a stamp duty of Rs 60 lakh each. Chawla's investment is part of a growing trend among bankers and tech leaders diversifying their wealth through substantial real estate acquisitions in Mumbai, a city with a thriving real estate market.

"• A residential flat spanning 578 square feet on the 1st floor sold in Veena Serene in Chembur for INR 1.45cr. • A residential flat spanning 1586 square feet on the 15th floor sold in L&T Seawoods in Seawoods, Navi Mumbai for INR 5.30cr "

DLF and Shapoorji Pallonji (Chinsha Property) have entered into a legal dispute with their partner, Hubtown, and Punjab National Bank Housing Finance Limited over a defaulted Rs 800-crore loan for a slum redevelopment project in Tulsiwadi, South Mumbai, valued at Rs 10,000 crore. DLF and Shapoorji Pallonji proposed to pay Rs 1,450 crore for the entire joint venture shareholding, including Chinsha and Hubtown, but received no response from Punjab National Bank Housing Finance Limited. The bank transferred the loan to Omkara Asset Reconstruction Company Ltd, which subsequently sold the pledged shares to an undisclosed third party, leading to the ongoing legal conflict between the parties involved.

Man Infraconstruction Limited (MICL) Group has increased its equity stake in Atmosphere Realty Private Limited (ARPL) by acquiring an additional 12.5 percent for Rs. 12.5 crore. As a result, MICL's equity holding in ARPL has risen from 17.5 percent to 30 percent. ARPL is overseeing two projects, Atmosphere 02 and Atmosphere Tower G, located in Mulund West, Mumbai. Atmosphere 02, comprising three 47-storey residential towers and an 18-storey commercial tower, is nearly 90 percent sold out. Atmosphere Tower G, with 3.2 lakh sq. ft. of RERA carpet area, has seen approximately 30 percent of its inventory sold.

Mindspace REIT has achieved a historic milestone by becoming the first entity in India to score a perfect 100/100 in the Global Real Estate Sustainability Benchmark (GRESB) for Office Development. This achievement earned them the title of 'Global Sector Leader.' Mindspace REIT now stands as the top company in Asia and India's commercial business development sector, surpassing nine listed competitors. GRESB, a respected independent organization in Environmental, Social, and Governance (ESG) performance data and benchmarks, has endorsed Mindspace REIT's commitment to transparency, innovation, and sustainable growth. They also received a 5-star rating for the second consecutive year and demonstrated excellence in the standing investment benchmark.

Lalit Goyal, Managing Director of Ireo Group, was granted bail on October 13 after the special PMLA court in Haryana highlighted breaches by the Enforcement Directorate (ED) during his arrest. The decision came in the wake of a recent Supreme Court ruling that granted bail to M3M directors, emphasizing adherence to the Prevention of Money Laundering Act (PMLA) provisions during arrests. Goyal's defence pinpointed ED's neglect in informing him of the grounds for his arrest, a contention backed by the court's findings. The case underlines the judiciary's stance on ensuring rights and procedures during detentions.

Thailand-based real estate developer, Magnolia Quality Development Corporation (MQDC), inaugurates its second co-working space, Whizdom Club India, in Gurugram's Golf Course Road area. Spanning 42,000 sq. ft. across multiple floors, the facility accommodates over 450 professionals, emphasizing well-being and sustainability. Featuring private cabins, meeting rooms, and an open terrace, the space incorporates advanced air-conditioning systems and emphasizes safety protocols. MQDC plans similar features in future projects. The move aligns with Gurugram's booming co-working sector, reflecting MQDC's dedication to transformative, innovative workspaces amidst rising demand for commercial real estate in India.

MahaRERA has deregistered seven real estate projects in Maharashtra, including three in Mumbai and one in Pune. Developers cited reasons such as lack of buyers, registration anomalies, and the need for fresh approvals. MahaRERA initiated the move in February 2023 to enable the deregistration of financially troubled and unviable projects. A total of 170 projects, including 63 from Pune, applied for deregistration. The decision restricts developers from advertising, selling, or inviting buyers for the affected projects. Real estate industry experts have welcomed the option, provided claims are settled transparently. This initiative demonstrates MahaRERA's adaptability and sets a precedent for dynamic real estate regulation.

The Sabarmati Riverfront Development Corporation Limited (SRFDCL) recently received approval for its "Sabarmati Riverfront Land Disposal Policy 2023." This policy marks a departure from prior norms, enabling SRFDCL to sell and lease land along the Sabarmati River, fostering a new era of development and transformation. The policy, inspired by the successful GIFT City model, divides the riverfront into eight distinct value zones, offering developers the chance to acquire land development rights. The land's value will be determined by factors like building footprint, providing flexibility to developers. The policy also allocates plots for public facilities, contributing to the city's vibrancy. Overall, it promises to bring growth and transformation to the Sabarmati Riverfront.

Mazgaon's Matharpacady village in Mumbai faces controversy over a proposed cluster redevelopment that threatens its historic charm. Residents, proud of their centuries-old neighbourhood with vintage houses, fear the irreversible loss of architectural treasures. They received a letter from Shreepati Build Infra Heritage Pvt Ltd, which they believe lacks reasonable justification for the project. Concerns are growing about the potential erasure of the neighbourhood’s historical value. While the developer has approvals and offers to residents, the community emphasizes the need to balance development with preservation of their unique heritage.

The Yamuna Expressway Industrial Development Authority (YEIDA) conducted a draw on October 18, 2023, to allocate 1,184 residential plots in three sectors, aiming to generate approximately Rs 698 crore in revenue. YEIDA witnessed a massive response to this scheme, with 1.4 lakh applicants competing for the limited plots available in sectors 16, 17, and 20. These plots were offered in seven size categories and priced at Rs 24,600 per square meter, ranging from Rs 29.5 lakh to Rs 4.92 crore. The list of allottees will be published on YEIDA's official website shortly.

The Ahmedabad Municipal Corporation (AMC) has suspended the HR Exeter-2 construction project in Ambawadi following the tragic death of a girl on-site. An immediate inspection revealed a lack of safety measures, including the absence of essential gear for workers. Engineers Chitrarth Parani and Anjana Kumari Chaudhary have had their licences revoked for not enforcing safety regulations. Developer Utsav Patel and engineer Bhargav D Patel face potential licence cancellations, with AMC seeking explanations for the glaring safety omissions. This incident underscores the vital importance of rigorous safety protocols in construction.

The Pune Metropolitan Region Development Authority (PMRDA) plans to submit the final arbitration report for the Mhalunge Maan town planning scheme to the state for approval in November 2023. The scheme, initiated in 2018, involves 510 plots and 5,800 beneficiaries receiving 50% of their land area in the township. After almost five years, PMRDA officials are progressing towards the arbitration report submission. They have presented the status of all six town planning schemes in Pune to the guardian minister, Ajit Pawar. The Centre has allocated Rs25 crore for infrastructure funding for each of these projects, while PMRDA has already allocated Rs175 cr from its own budget.

In the last 15 years, the Belagavi Urban Development Authority (BUDA) has refrained from launching any new residential layouts, resulting in a substantial escalation in land prices across the city. Notably, the Ramtirth Nagar layout was the most recent residential project initiated by BUDA, but it's underwhelming performance has since placed immense pressure on the authority to move forward with the Kanabargi project. With increasing land costs and a growing demand for housing, the forthcoming Kanabargi project is seen as a critical step for BUDA to meet the city's housing needs and alleviate the mounting cost burdens on residents.

Faering Capital has infused $30 million into Vastu Housing Finance Corporation (Vastu), a significant boost for the housing finance sector. This investment involves a secondary sale with funds managed by Multiples Alternate Asset Management and other shareholders. Vastu, a digital retail affordable housing finance company, manages around $900 million in assets across 15 Indian states and over 200 markets. It boasts advanced technology, including the PULSE platform, and an expansion into vehicle and MSME finance through Vastu Finserve. Vastu focuses on lending to the low-middle-income segment, holding top-tier ratings and strong relationships with over 40 banks. Faering Capital anticipates substantial progress in affordable housing finance.

Supreet Sachdev, a partner at BSR & Co LLP, has been hit with a significant penalty of Rs 5 lakh by the National Financial Reporting Authority (NFRA) for professional misconduct and errors in the audit of Sobha Ltd for the fiscal years 2017–18 and 2018–19. In May 2021, the Securities and Exchange Board of India (SEBI) expressed concerns, which led to this action. Sachdev was hit with this hefty fine because he neglected to disclose doubts about unsecured land advances and to adhere to auditing norms. The steps taken by the NFRA highlight how crucial it is to keep India's financial transparency and auditing standards at the highest level.

MLC Satyajeet Tambe led a delegation of Nashik's industrial leaders in discussions with Municipal Commissioner Ashok Karanjkar to address local industry concerns. Karanjkar agreed to enforce government guidelines for property tax collection within the industrial category. Industrial property tax rates are set to commence on April 1, 2024, primarily impacting industries in the Ambad and Satpur industrial estates under MIDC. The delegation also highlighted issues concerning poor road conditions and drainage infrastructure, receiving assurances of forthcoming road repairs, and the inclusion of drainage projects in Kumbh Mela preparations. The President of AIMA, Nikhil Panchal, was also part of the delegation.

Six years after launching a Geographic Information System-based building reassessment drive, the Greater Chennai Corporation (GCC) has assessed only a fraction of buildings with deviations. Out of 310,139 identified buildings, only 30,000 have been reassessed and added to property tax records, leading to a revenue loss of Rs 250–300 crore. Revenue officials attribute the delay to various tasks, such as addressing Covid-19, elections, and welfare schemes. Universities, marriage halls, and commercial buildings are among the major violators. A dedicated team and expedited reassessment are proposed solutions. Deputy Commissioner R. Lalitha pledges to resume the drive.

India's largest multiplex operator, PVR Inox, has reported a profit for the latest quarter, marking the third consecutive financial report since the merger of PVR and Inox. The profit of 166 crore for the July-September quarter was driven by the success of Hollywood movies like "Barbie" and "Oppenheimer" and popular Bollywood films, leading to higher theatre attendance. The company also expanded by opening 37 new screens during the quarter, contributing to a 53.3 percent sequential increase in consolidated revenue. The average ticket price and customer spending on food and beverages both increased, offsetting higher expenses. PVR Inox's shares rose in the September quarter.

The Brihanmumbai Municipal Corporation (BMC) has taken a proactive step in addressing the escalating concerns over air pollution in Mumbai by issuing comprehensive pollution control guidelines to approximately 6,000 construction sites within the city. These measures are aimed at curbing the dispersal of dust and pollutants during the construction process, ensuring a concerted effort to mitigate the environmental impact and prioritize the health and well-being of the residents. By implementing these guidelines, the BMC seeks to foster a cleaner and more sustainable construction environment while maintaining the city's air quality standards.