Dedicated locality research platform

Dedicated locality research platform

Enter your email address and you will receive

a link to reset your password

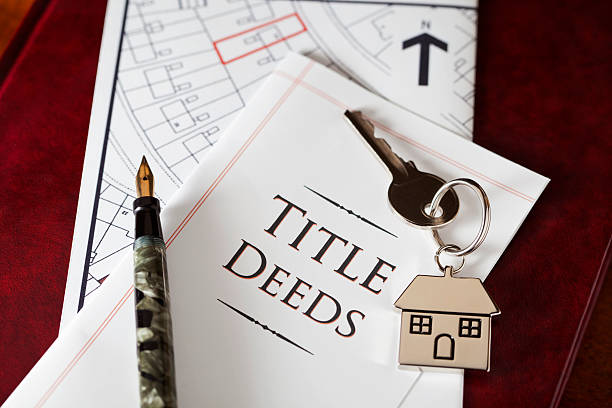

The Income Tax Appellate Tribunal (ITAT) in Delhi has ruled that if a sale deed doesn’t specify the percentage of a husband and wife’s ownership in a house property, then both spouses will be considered equal owners. The ruling was made in the case of Shivani Madan, which has resulted in her requiring to pay Rs 9.8 lakh in taxes for the 2014-15 financial year. Although it is common practice to include a wife’s name in the sale deed of a property, the court felt in her case, being a salaried individual, she was liable to pay for her share of the property.

The cluster development policy, which aims to promote the redevelopment of old wadas and smaller properties in the Peth areas of Pune, has been stuck at the state level for around six years, despite being cleared by the Pune civic body. While the state government has approved the development plan for civic areas, the policy has not been given the green light. This has led to concerns among residents and officials in the area, who believe that the redevelopment of these properties is necessary for the safety and development of the Peth areas.

Last week, the administration of Jammu and Kashmir announced that property tax will be imposed on municipal areas in the Union Territory beginning April 1. The notification stated that residential properties will be taxed at five percent of taxable annual value (TAV), while commercial properties will be taxed at six percent. Any person liable to property tax must furnish particulars of their property and tax due to the officer authorized to receive them by May 30 of the financial year. Failure to pay the tax will result in a penalty of Rs 100 or one percent, and the maximum penalty will not exceed Rs 1,000.

The Unitech group, a beleaguered real estate company, has been in the news lately for the 6,000 homebuyers who are waiting for their flats and villas. The Supreme Court has directed the Noida Authority to approve revised layouts of 10 projects of the company in the city without insisting on upfront payment of nearly Rs 10,000 crore in dues. The revised layouts focus on utilizing unused land parcels, which would provide much-needed capital to the new Unitech board to complete the projects in sectors 96, 97, 98, 113 and 117, giving hope to the homebuyers.

The Department of Town and Country Planning has released a public notice regarding maintenance charges in affordable housing societies. The notice details all the maintenance and upkeep activities to be undertaken by the developers and seeks suggestions and objections on the issue from the public. This move comes in response to complaints from homebuyers of affordable housing projects who have reported that developers are charging upkeep fees in violation of the Affordable Housing Policy 2013.

Residential property prices in 50 cities in India showed a significant increase of 7.1% year-on-year in the quarter ended on December 31, 2022, compared to 4.5% a year ago, according to the National Housing Bank (NHB) Residex, which publishes three housing price indices. The "HPI at assessment prices" index tracks residential property prices movement in 50 cities quarterly, with the base year being FY 2017-18, and it is based on property valuation prices collected from primary lending institutions.

The Kolkata Metropolitan Development Authority (KMDA) has initiated a campaign to reclaim its plots that have been encroached upon in Kasba and Patuli near the EM Bypass. The authorities have launched a demolition drive to bring down the illegal constructions on the plots and fence off the land. The KMDA plans to auction off the parcels of land after the removal of the unauthorized structures, generating substantial revenues for the state coffers.

Despite the COVID-19 pandemic and rising construction costs, the premium residential real estate market in Bengaluru is experiencing strong growth, according to a report by Savills India. The average capital and rental values of premium housing properties have grown at an average of 4 percent YoY. Central Bengaluru has the highest average capital values at around Rs 19,000 and Rs 15,500 for completed and under-construction projects, respectively. South Bengaluru had the highest YoY increase in premium housing prices at around 8 percent in 2022.

Saudi Arabia has revealed plans for a proposed cube-shaped building called “The Mukaab” in Riyadh, the capital city, that can hold 20 Empire State Buildings. The structure will be 400 meters high and 400 meters long on each side covering 19 square kilometres. The completed structure will have over 100,000 residential apartments, 9,000 hotel rooms, 1.4 million square meters of office space, and an additional 980,000 square meters of retail space. It will also feature community facilities, hospitality hubs, and tourist attractions. The project is backed by the Public Investment Fund.

According to an analysis conducted by UK company Buildworld, Canberra has been designated as the world’s capital city with the largest average home size, which stands at an impressive 256.3 square metres. This is a considerable 560% larger than the average home size in Moscow, which ranked last with an average size of just 45.5 square metres, and 36% larger than Cairo, which ranked second with an average size of 188 square metres.

Mahindra Lifespace Developers, a real estate company, announced in a filing to the Bombay Stock Exchange that its Managing Director (MD) and Chief Executive Officer (CEO), Arvind Subramanian, has resigned. The Board of Directors also approved the appointment of Amit Kumar Sinha as an additional director, effective February 23, 2023. Sinha will also serve as the Managing Director (Designate) of the company until May 22, 2023. Starting on May 23, 2023, he will take on the role of full-time MD & CEO for a period of five years until May 22, 2028.

The Maharashtra Real Estate Regulatory Authority (MahaRERA) has recently reduced the registration fees for individual real estate agents to INR 10,000 from INR 1 lakh. This move came after real estate agents and their associations in Maharashtra raised concerns over the high registration fees. The registration fee charged by MahaRERA is valid for five years. This decision has come as a relief to almost 40,000 real estate agents who are registered with MahaRERA.

The Maharashtra Real Estate Regulatory Authority (MahaRERA) has issued an order requiring real estate agents with an annual turnover of over Rs 20 lakh to disclose information about their principal officer and designated director. This is in line with the Prevention of Money Laundering Act, 2002 (PMLA) and Prevention of Money Laundering (Maintenance of Records) Rules, 2005 (PMLR). According to a MahaRERA official, agents are required to provide information about their transactions, including the fees they charge as well.

Residents of Malibu Towne in Gurgaon, India, have taken to the streets to protest a blanket ban on the registration of properties in the township. The ban was imposed in December 2022 by the Haryana State Pollution Control Board (HSPCB), following a complaint by an RTI activist and resident of the colony, Raman Sharma. The HSPCB issued a closure notice to the developer, alleging that environmental norms were violated during the construction of the township.

Earlier this month, in a huge victory for over 1,000 homeowners, the Supreme Court ordered Bengaluru-based developer Mantri Castles Pt Ltd to deliver the apartments of the Mantri Serenity project, which has been delayed for five years, by 13 March 2023. The Mantri Serenity project's apartments were seized by the Enforcement Directorate (ED) following complaints that the developer had allegedly misappropriated funds. According to the SC order, the flat buyers who have paid 100 percent of their outstanding dues in accordance with the buyer’s agreements will be eligible to receive possession of their flats before the next date of listing.

Real estate developer M3M has secured a debt facility of Rs 1,500 crore (approximately $200 million) from alternative investment firm PAG Credit & Markets to fund portfolio growth. The funds will be provided in four tranches and paid back within 18 months. M3M plans to use the funds for expansion, including new acquisitions. M3M aims to build a portfolio of 10 million square feet in one year with a top line of $2 billion. The company is expected to close FY23 with sales of Rs 10,000 crore.

ASK Finance, the non-banking financial company (NBFC) division of the ASK Group, has announced the closure of a debt transaction of INR 40 crore with Sowparnika Projects & Infrastructure, a prominent affordable housing builder based in Bangalore. The investment has been made in Sowparnika Ashiyana, a mid-income affordable housing project located near Whitefield, Bangalore, that boasts over 750 homes. Sources indicate that the capital raised will be utilized for the project's construction and to enable Edelweiss to exit its investment.

According to a regulatory document filed with the U.S. Securities and Exchange Commission last week, a subsidiary of Brookfield Corp, the asset manager, is unable to repay loans associated with two buildings in Los Angeles, California. The Brookfield DTLA Fund Office Trust Investor owns two properties, which are the 777 Tower and Gas Company Tower, and both buildings have outstanding debts of approximately $290 million and $465 million, respectively.

The average home rental cost in Singapore has now surpassed that of Hong Kong, which has long been known for its notoriously expensive real estate market. Singapore's political stability, successful management of the pandemic, and influx of multinational companies have all contributed to the increase in rental costs. However, analysts do not expect rental prices to skyrocket again in 2023. On the other hand, they predict that Hong Kong's rental market may rebound this year, given the lifting of its anti-pandemic measures.

According to official data released earlier this month, home prices in China increased in January for the first time in a year. This rise in prices was attributed to the end of the zero-COVID policy, property policies that were favourable, and market expectations of additional stimulus measures, all of which increased demand. Based on data from the National Bureau of Statistics (NBS), new home prices rose by 0.1% on a month-on-month basis in January, compared to a 0.2% decline in December.

The Noida Authority has released a new structural audit policy that appears to be a fitting response to the alarming number of buildings with substandard structural integrity in the city. The policy will make it mandatory for developers of multi-storey buildings to obtain a structural audit report from an empanelled institute to obtain an occupancy certificate. The policy also requires existing buildings to undergo structural audits if defects are reported by at least 25% of homebuyers within five years of obtaining an occupancy certificate. Noida Authority has asked 17 technical institutions such as IIT-Kanpur, MNIT Prayagraj, BITS Pilani, NIT Jaipur, and CBRI-Roorkee to become empanelled members of the audit team.

The Maharashtra Real Estate Regulation Authority announced this week that 313 significant projects throughout the state have received show-cause notices as a result of a report from an external auditor that identified a number of issues. The watchdog hired a reputable audit firm as part of its duty to examine projects at a micro level and the letters have been given to projects that the firm red-flagged, according to an official statement.

REITs and InvITs in India have approached the government to reconsider the proposal in the Union Budget for 2023-24 to tax income distribution through the mode of repayment of debt. While REITs have emphasized their attractiveness and steady rise in acceptance by retail investors, tax experts believe that the government is attempting to bring parity in taxation of incomes for investors of REIT and InvIT by widening the tax bracket. As India has witnessed robust investor interest in REITs from a diversified investor base, the proposed tax change could have an impact on the growth of the market.

The National Capital Region (NCR) in India has long been a popular destination for developers seeking to acquire land. In 2022, 23 transactions totalling nearly 745 acres of land were transacted, valued at INR 7,000 crores (USD 875 million) in the area. Gurgaon recorded the most transactions, with 12 deals, followed by Noida with six major land deals. Residential development was the primary use, with 15 out of 23 transactions, totalling nearly 665 acres, acquired for proposed residential developments.

Oberoi Realty's consolidated net profit increased by 50.27% during the quarter that concluded on December 31, 2022. Its profit after tax (PAT) was Rs 702.57 crore in the third quarter of FY23 as opposed to Rs 467.53 crore in the equivalent quarter of the previous fiscal. Its profit after tax (PAT) was Rs 702.57 crore in the third quarter of FY23 as opposed to Rs 467.53 crore in the equivalent quarter of the previous fiscal, the business stated in a BSE filing.

After 13 rounds of intensive bidding, the three-winning bidders of the now-defunct Rajesh LifeSpaces hotel property in Mumbai bidders are the hospitality and restaurant conglomerate Sankalp Recreation from Ahmedabad, Shri Ram Multicom from Kolkata and Rare Asset Reconstruction Co. The valuer chosen by the banks will now assess the three bidders' varied strategies. Lenders will put the best plan up for voting based on the net present value in accordance with the valuer's report.

Max Estates, a real estate development company, has entered into a joint development agreement (JDA) with Namo Realtech Private Ltd to develop a group housing project on Dwarka Expressway in Gurgaon, India. Max Estates will develop approximately 2.5 million square feet on an 11.8-acre land parcel in sector 36A Gurgaon. The company expects revenue of ?3,200 crore from the project. This will be Max Estates' first residential project in Gurgaon, while its first residential project in Noida is expected to be launched in the first half of 2023.

Godrej Fund Management, a private equity firm in the real estate sector that operates under the Godrej Group, has reportedly put up two of its main investee assets for sale. These marquee assets include a total of 200,000 sq ft of office space spread across three floors in the Godrej BKC commercial project, and the G: Corp Tech Park, an information technology park project located in Thane's Ghodbunder Road area. The combined estimated value of these assets is believed to be around Rs 1,500 crore based on the current office property rates in the areas.

As a result of significant gains following years of rising housing prices, homeowners are increasingly drawing on their equity. According to TransUnion data, homeowners took out 333,537 home equity loans in the third quarter of last year. The credit bureau reported that this is the highest number of home equity loans on record dating back to 2010 and represents a 47% rise from the same quarter in 2021. Banks also extended 405,646 home equity lines of credit, or HELOCs, to borrowers in the third quarter, up 41% from a year earlier.

According to IBC Focus, a construction market research specialist, the construction industry experienced a 20% yearly growth in 2022, totalling 29,719 projects in the country Romania. The private residential segment accounted for 31.2% of all projects and marked a 17.3% increase from the previous year. The industrial segment followed closely behind, with a 15.33% share and 5,960 projects, compared to 5,347 in 2021. The hotel and recreation segment came in third place, with 4,615 projects, or an 11.87% share. Investments in infrastructure, which showed the fastest annual growth, came in at sixth place with 3,093 projects in 2022.

The state of Maharashtra in India is reviewing a draft bill called the Maharashtra Transfer of Title in Real Estate Project Bill, which is expected to replace the existing Maharashtra Ownership of Flats Act (MOFA), 1963. The new bill is aimed at dealing with conveyance deeds of housing societies not covered under the Real Estate (Regulation and Development) Act (RERA). The proposed bill emphasizes the execution of conveyance deeds by developers within three months, and it includes a mandatory occupancy certificate (OC) for carrying out conveyance deeds.

The West Bengal government has announced an extension of the existing 2 percent rebate on stamp duty and 10 percent rebate on circle rates of land/property for another six months, until September 30, 2023. The extension of the rebates is intended to benefit homebuyers and stimulate growth in the real estate sector. The reduction of stamp duty and circle rate had resulted in a record number of registrations, particularly by small flat holders, reaching 34,44,070 between July 2021 and December 2022.

The district of Gautam Budh Nagar emerged as the top destination for investors during the Uttar Pradesh Global Investors Summit 2023, attracting approximately one-third of all the proposed investments by value. Companies such as Ikea, the Lulu Group, and Adani Group were among the major players that committed to investing INR 10.3 lakh crore in various projects across the state. More than 60% of the investment proposals are for manufacturing projects, while the remaining ones are for real estate, retail, institutional, logistics, banking, and horticulture, among others.

.jpg)

The Delhi Development Authority (DDA) has announced that people owning a flat or plot of land measuring less than 67 square metres in Delhi are now eligible to apply for newly constructed flats offered by the urban body. This move comes after the Union Ministry of Housing and Urban Affairs approved modifications and relaxations proposed by the DDA in the Housing Regulations of 1968, which were issued under section 57 of the DDA Act of 1957.

Earlier this week, the Indian Competition Commission gave its approval for Nexus Select Trust to acquire 100% of the shares of fifteen entities and indirectly acquire 100% of the shares of two entities through the manager of the acquirer REIT, Select Infrastructure Pt Ltd and Nexus South Mall Management Put Ltd. ICC also approved the purchaser REIT's (acting through its manager) direct acquisition of 50% of the equity shares of ITIPL from its current owners. The Nexus Select Trust REIT is India’s fourth REIT. Its primary sponsor is Wynford Investments Limited, an affiliate of Blackstone Inc.

According to a BSE filling, Prestige Estates Projects’ overall net profit for the quarter ended December 31, 2022, increased by 75%. Its profit after tax (PAT) increased from Rs 92.40 crore in the third fiscal quarter of the prior fiscal year to Rs 161.70 crore in the third fiscal quarter of this year. The company's consolidated total revenue increased by 74.22 percent to Rs 2,347.50 crore in Q3 FY23. The company's combined total revenue for Q3 FY23 was Rs 2,347.50 crore, up by 74.22 percent from Rs 1,347.40 crore in the same quarter of FY22.

MYRE Capital intends to raise Rs 20 crore through a structured debt opportunity that provides qualified investors with senior secured debt that is secured with a loan against property (LAP) via offline distribution channels. The required minimum investment for this offer is Rs 15 lakh with an IRR of 11%. The investment is a four-year structured instrument with monthly interest payments and annual principal repayments of 25%. A SEBI registered debenture trustee will oversee this transaction in its entirety, the company stated.

An unauthorised border crossing south of Montreal has recently seen an increase in asylum seekers coming from the US into Canada's second-most populous province. While Canada's open immigration policy exacerbates a housing scarcity, Prime Minister Justin Trudeau is under pressure to tighten border controls. Public services cannot accommodate all the influx as parts of the country already suffers problems with housing, enrolment in schools and shortage of hospital staff. Even though the government has promised to double the rate of housing development, there is a huge gap between demand and availability.

India's Hiranandani Group-owned Yotta Data Services has announced its partnership with Bangladesh's Shamsul Alamin Group (SAG) to aid in the growth and expansion of its business in the country. Yotta has committed to an investment of over Tk2000 crore to develop its Hyperscale Data Centre Park in Dhaka in the next 4-6 years. The park will feature two hyperscale data centre buildings with 4800 racks and 28.8MW IT power capacity. The first data centre building is slated to go live in Q3 of FY2024.

Co-living is gaining popularity as a cost-effective housing solution for young, single professionals, particularly millennials and Gen Z, who are facing challenges in finding suitable housing options. Traditional landlords often prefer to rent to families, and hostels and PGs (paying guest accommodations) come with a long list of terms and conditions that make them unattractive options. This is where co-living comes in as a reasonable and convenient alternative.

The Maharashtra Real Estate Regulatory Authority (MahaRERA) has issued an order officially permitting developers to proceed and deregister a real estate project subject to conditions laid down by the authorities. The MahaRERA has cited several grounds for developers to deregister a real estate project, including a lack of cash, economically unviable projects, lawsuits filed, disputes/family issues, and changes in planning government/planning authority announcements. If there are homebuyers, deregistration will only be taken into consideration if the developer has resolved all their rights and claims.

The Chandigarh Housing Board (CHB) has begun acting against allottees who have broken the terms and conditions of allocation in the Rehabilitation Programme, Small Flat Scheme, and Affordable Rental Housing Scheme. Through two rigorous surveys conducted CHB found that of the 18,138 apartments allotted only 15,995 were occupied by the original allottees. The rest were either locked or not occupied by the original allottees. The CHB had advised all allottees to surrender their apartments if they decide they no longer wish to live in them, but they may not sell, sublet, transfer, or transfer them to other people.

The redevelopment of 11 chawls in nine defunct National Textiles Corporation (NTC) mills is set to create 18 lakh sq ft of new construction in central Mumbai. Of this, approximately 6 lakh sq ft will be used to rehouse free of cost the 2,062 tenants currently residing in NTC chawls. The remaining 12 lakh sq ft will be given to the successful bidder of the chawls' redevelopment, with the free sale portion expected to be worth more than Rs 5,000 crore.

Last week, the Securities Exchange Board of India (SEBI) announced that it will sell 22 properties owned by MPS Group, Tower Infotech, and four other entities at auction on March 3 for a reserve price of Rs 91 crore to recover investors' money. The regulator has placed the properties of Vibgyor Group, Prayag Group, Multipurpose BIOS India Group, and Waris Finance International Group on block in addition to MPS Group and Tower Infotech. These businesses have obtained money from investors without adhering to legal requirements.

The National Green Tribunal (NGT) appointed committee has issued a show-cause notice to Jaypee Infratech and the insolvency resolution professional (IP) handling the company's insolvency case, asking why an environmental compensation of Rs 5.47 lakh should not be imposed for violating green norms in the Kensington Park-1 project. The move comes in response to a complaint from a resident over violations of green norms, including sewer overflow from manholes, across several blocks of Kensington Park-1 in Sector 133.

According to a BSE filing from the firm, Embassy Office Parks REIT (Embassy REIT) has secured a term loan from Bajaj Housing Finance, a division of Bajaj Finance for Rs 1,000 crore. The corporation will largely use the money raised from this debt raising to pay down existing construction debt as well as for basic business needs. The long tenor loan aids in extending Embassy REIT's debt maturity profile, and the refinance resulted in interest savings of 60 basis points, according to Embassy REIT.

Keystone Realtors declare a consolidated net profit of Rs 5.82 crore during Q3 FY23. Its profit after tax (PAT) was Rs 88.42 crore in the corresponding quarter of the prior fiscal year, the business stated in a BSE filing. The company's consolidated total income in Q3 FY23 was Rs 135.55 crore comparatively to Rs 878.09 crore it reported in the same quarter last year. The company completed its initial public offering (IPO) of 1,17,37,521 equity shares with a face value of Rs. 10 each during the quarter that ended December 31, 2022.

In an announcement made by Godrej Properties, the company disclosed its intentions to acquire land parcels through outright purchases and collaborative ventures with landowners, aiming to double its initial projection of Rs 15,000 crores for FY 2022-23. The company has so far added 15 new projects to its portfolio this fiscal year with a total estimated saleable area of 23.42 million square feet and an anticipated total booking value of Rs 27,500 crore.

Hong Kong's government is facing criticism over its $3.4 billion temporary housing plan aimed at easing the city's chronic housing shortage. Hong Kong's Chief Executive, John Lee, pledged to construct 30,000 units of 'Light Public Housing' within five years, with the hope of reducing the waiting time for public housing from six years to four and a half years. However, critics have slammed the scheme as a 'band-aid solution' and have questioned its high cost. The scheme has also been criticized for its proposed location. Some of the planned sites are in faraway urban areas, making the homes inaccessible to many people.

Real estate firm Ivanhoé Cambridge and property management company Mapletree have formed a strategic partnership to develop, own and operate technology-focused workplaces in India. The joint investment platform has a capacity of over CAD 2.5bn ($1.97bn) and the partners have already identified properties and projects to meet this target. The investment strategy will focus on development of Grade A office assets in key economic hubs.

According to CBRE India, Mumbai has been ranked as the seventh most preferred destination for cross-border investment in the real estate sector in the Asia Pacific region. The consultant's '2023 Asia Pacific Investor Intentions Survey' revealed that Mumbai ranks ahead of Shanghai, Hanoi, and Seoul on the list. This is the first time in the last two years that any Indian city has been included in the list. The survey found that Tokyo topped the chart for the fourth consecutive year as the target market for cross-border investment, followed by Singapore.

The Maharashtra Real Estate Regulatory Authority (MahaRERA) is taking a proactive approach in reviving lapsed housing projects in the state. The authority has reached out to six developers' organizations seeking suggestions and assistance in bringing 624 lapsed projects back to life. These include 309 from Mumbai, 220 from Pune, 20 from Nagpur, 29 from Aurangabad and 41 from Nagpur. The six developers' organizations are the National Real Estate Development Council (NAREDCO), CREDAI-MCHI, CREDAI Maharashtra, the Builders Association of India, the Marathi Bandhkaam Vyavasik Association, and the BrihanMumbai Developers' Association.

The National Green Tribunal (NGT) has imposed a fine of more than 113 crore rupees on Uppal Chadha Hi Tech Developers Pvt. Ltd. for violating environmental norms in its Hi-Tech Township across 14 villages in Ghaziabad and Gautam Buddha Nagar districts of Uttar Pradesh. The environmental compensation was calculated at 0.75% of the total project cost, and the NGT ordered the PP deposit the money with the Uttar Pradesh Pollution Control Board (UPPCB) within three months. The NGT expressed disappointment with the ED's lack of action in the matter and criticized the Central Pollution Control Board (CPCB) for being "very lenient" towards violators.

Vanke Co Ltd, a major property company in China, intends to raise as much as CNY 15 billion ($2.2 billion) by offering a private placement of it’s shares. This capital increase is aimed at financing 11 real estate projects and increasing its capital reserves. The company stated in a filing to the Shenzhen Stock Exchange that it aims to sell up to 1.1 billion A-shares, which is equivalent to 9.46% of its total share capital, to up to 35 potential investors.

The National Company Law Tribunal (NCLT) has granted a significant relief to the Maharashtra Housing and Area Development Board (MHADA) in the Patra Chawl redevelopment case. The NCLT allowed MHADA's plea to exclude its entire 47-acre property known as 'Siddharth Nagar' from the liquidation estate of Guruashish Construction. Under a Joint Development Agreement (JDA), Guruashish was supposed to construct permanent rehabilitation homes for 672 tenement holders and in lieu could build and sell free-sale component at its own risk. MHADA terminated the JDA in January 2018 due to the builder's default in completing construction within its stipulated timeline.

The Haryana state government has suspended the Deen Dayal Jan Awas Yojna (DDJAY) scheme, which aimed to provide affordable plotted housing to low- and middle-income families in Gurgaon and Faridabad, due to high land costs and lack of benefit for the target demographic. Prime Minister Narendra Modi launched the DDJAY scheme in Haryana in November 2016 to address the problem of unauthorised colonies while offering affordable housing options to low- and middle-income families.

The Mormugao Municipal Council (MMC) has made the decision to take enforcement action against dangerous structures under its purview. Thirty-two residential structures have been listed by municipal officials as being unfit for habitation. Majority of these structures are in Vasco town, with the remainder spread among the Baina, Mundvel, Maimollem, Vaddem, and Headland-Sada regions.

Axis Commercial Real Estate Fund has announced its first close after raising nearly INR400 crore through a strategic partnership between Axis Asset Management and global real estate firm Tishman Speyer, according to anonymous sources. The fund is a category II alternate investment fund (AIF) that will develop greenfield commercial projects across eight key markets in India, including Chennai, Ahmedabad, Kolkata, Hyderabad, Pune, Mumbai, the National Capital Region, and Bengaluru, with a focus on sustainability, safety, and serviceability

It has been reported that multiple beneficiaries of the Bruhat Bengaluru Mahanagara Palike's (BBMP) standalone home scheme are falling victim to fraud committed by local middlemen, who are taking advantage of the scheme to extort money from unsuspecting applicants. The scheme is designed to provide financial aid of Rs 5 lakh to economically weaker sections of society, with an annual income of less than Rs 3 lakh, to build their own homes.

The Mysore Urban Development Authority (MUDA) is proposing to develop residential areas on approximately 1,000 acres of land through a joint agreement with farmers and landowners. After encountering some obstacles with their original plan to develop sites at Ballahalli, MUDA has now selected 250 acres in Daaripura village in Jayapura hobli and 750 acres in Bommenahalli village in Yelwal hobli. Many farmers have agreed to participate in the development project with MUDA under a 50:50 ratio.

The Haryana Real Estate Regulatory Authority in Gurugram has issued an arrest warrant for the directors of Shree Vardhman Infrahome Private Limited for failing to transfer ownership of a unit to the assigned individual. The warrant was issued on February 7 by the adjudicating officer’s court following a complaint from the allottee. The court had previously issued a show-cause notice to the directors in connection to the matter but received no response despite proper service.

The City of Helsinki, Finland has initiated a bidding process to sell the historic Old Customs House in Katajanokka for redevelopment purposes. The tender competition was initiated after the Urban Environment Committee gave its approval for the same. The deadline for submitting the tenders is April 28, 2023. Potential bidders are required to present a versatile plan for the building with functions such as business spaces, offices, workspaces, restaurants, meeting rooms, or art and cultural facilities.

Brigade Enterprises' consolidated net profit decreased by 8 percent during the quarter ending on December 31, 2022. Its profit after tax (PAT) was Rs 42.68 crore in the third quarter of FY23 as opposed to Rs 46.41 crore in the same period of the previous fiscal, the business stated in a BSE filing. The company's consolidated total income for the second quarter of FY23 was Rs 858.63 crore, down 7.99% from Rs 933.19 crore it earned in the same quarter of FY22.

The Maharashtra Real Estate Appellate Tribunal (MREAT) has overturned a MahaRERA ruling from 2020 and ordered the promoter of Runwal Greens to pay interest on a homebuyer’s down payment for two years from 2016 to 2018 as well as pay a fine of Rs 20,000 for the delay in taking possession of the property. The homebuyer had booked an apartment in the project in 2012 by paying a sum of Rs 28lacs as downpayment. The promoter had promised possession by December 2015 but eventually gave it only in July 2018.

Apeejay Surrendra Park Hotels Ltd (ASPHL) is a hotel company that operates under two brands: The Park and Zone by The Park. The company is set to revive its fundraising activities with a decision to go public with an initial public offering (IPO) of Rs 1500 crore by September of this year. Axis Bank, JM Financial, and ICICI Securities are the lead managers for the IPO. ASPHL is expected to be valued at Rs 5000 crore, and about 30% of the company's stake will be offered in the IPO, which will be a mix of primary and secondary sale of equity.

A decree from the Maharashtra Urban Development Department has now placed 19.7 hectares of prime railway land located in Dharavi slums under the jurisdiction of the Slum Rehabilitation Authority. The state government is said to have paid Rs 800 crore to the Indian Railways in 2019 to purchase a total of 47.5 acres of land, which includes the 19.7 hectares to be included in the rehabilitation of Dharavi. Due to the 19.7 hectares of property owned by the railways and not under the control of the state government, efforts to rehabilitate Dharavi had previously failed. Adani Realty placed the highest bid at Rs 5, 069 crore, winning the much-coveted Dharavi redevelopment project.

.jpg)

The Bombay High Court has ruled in favour of the state government on a petition filed by Godrej & Boyce challenging the acquisition proceedings initiated by the Maharashtra government and the National High Speed Rail Corporation Limited (NHSRCL) in Mumbai's Vikhroli area for the project. The court stated that the project was of unique importance and that the collective interest of the public would take precedence over private interests, such as those claimed by Godrej & Boyce. The court noted that the provisions of the Fair Compensation Act empower the government to carry out the acquisition proceedings to their conclusion.

The Godrej Air residential project in Sector 85, Gurgaon, has become a source of trouble for around 500 homebuyers and investors as the landowner, Orris Infrastructure, has taken legal action against the developer, Godrej Properties. Orris has filed a complaint with the economic offence wing (EOW) of the Gurgaon police, alleging that Godrej Properties has engaged in cheating, criminal breach of trust, and criminal conspiracy. In December 2022, the court of an additional district judge ordered the freezing of 16 bank accounts of the project after Orris filed a petition alleging that Godrej Properties was siphoning funds.

According to state cooperation department officials in Maharashtra, a housing society does not need to possess an Occupancy Certificate (OC) to apply for and receive deemed conveyance. The officials cited a government resolution (GR) from 2018 that allows for both online and offline applications for deemed conveyance for societies without OC, but with a catch. The society must submit a self-declaration form that affirms that it will pay the necessary dues and obtain the OC from the local authority at a later date.

The Nashik Municipal Corporation (NMC) has discovered 1.3 lakh residential and commercial properties that have been built without obtaining proper approvals from the organization. The NMC is now issuing notices to the owners of these properties to hear their side of the story. If their explanations are not satisfactory, the NMC will impose additional property tax, which will result in an estimated additional revenue of Rs25 crore from these unauthorized constructions.

CRC Group, a real estate developer located in Noida, disclosed that it would invest Rs 810 crore to build a commercial property in the area. The project, which has the potential to create 9,000 jobs, has already been authorized by the Uttar Pradesh government under the Invest UP programme. The company intends to build over 12 lakh square feet of office space, 3 lakh square feet of retail space, and one lakh square feet (102 units) of service apartments as part of the project.

.jpg)

The Bombay High Court has overturned a decision to cancel 517 slum development projects that were left unfinished since 2014. The court, consisting of Justices G S Patel and S G Dige, determined that the notice for cancellation was “not in accordance with the law and lacked a legal basis.” The court referred to the Maharashtra Slum Areas (Improvement, Clearance and Redevelopment) Act of 1971 and stated that the provisions clearly require that every defaulting developer must be given notice and a chance to be heard.

The Maharashtra Housing and Area Development Authority (MHADA) has announced plans to construct 231 earthquake-resistant independent houses for the victims of the disaster, which claimed the lives of over 80 people. These 2-bedroom homes, measuring approximately 600 square feet, are being built in the Taliye village in Raigad district and are being constructed to provide a safe and secure living environment for the affected individuals. The cost of the project is estimated to be Rs 77 crore, with each house costing Rs 20 lakh, and will be fully funded by MHADA. The government agency is working to ensure that possession of 66 houses is given by April 2023, with the remaining houses being given in phases.

Last week, the Supreme Court ruled that a builder of a housing complex remains responsible for obtaining a completion certificate for the structure, regardless of whether the flat owners have taken possession of their homes before the issuance of such a certificate. This ruling came as a relief for 36 flat buyers in a Kolkata housing complex who have been litigating against RNR Enterprise, the builder, since 2006.

Taurus Investment Holdings, a Boston-based private equity and development fund, is seeking to develop retail-led, mixed-use properties in India. The firm is targeting tier 1 and high-growth tier 2 cities in the South and West regions of India due to high demand in these markets. The first project, Taurus Downtown, will be located in Trivandrum, with Taurus investing INR 1,000 crore in the 1.3 million square feet development. In addition to Trivandrum, Taurus also plans to focus on secondary cities such as Visakhapatnam, Coimbatore, Bhubaneshwar, and Trichy.

JMS Infra Realty Private Limited's bank guarantees have been forfeited by the Haryana Real Estate Regulatory Authority (H-RERA), Gurugram, since the promoter was late in submitting its project's zoning plan and authorised service plans and estimates. JMS Infra Realty Pvt. Ltd had applied for RERA registration certificate for the creation of a plotted community called "The Nation" under the Deen Dayal Jan Awas Yojana (DDJAY) scheme in Sector 95.

The redevelopment of three GPRA colonies in India, Sarojini Nagar, Kasturba Nagar, and Sriniwaspuri, have been delayed due to a lack of permission from the city government for tree transplantation and the presence of encroachments. In a letter to the Lok Sabha, the Union Minister has outlined the current status of each project and the challenges they are facing, providing a clearer understanding of the situation. While the progress of the projects has been slow, the government claims to remain committed to ensuring that the redevelopment of these colonies takes place smoothly and successfully.

.jpg)

The Supreme Court recently rejected a special leave petition (SLP) filed by Avarsekar and Sons, a builder, against a ruling from the Bombay High Court. The ruling, made in December of 2022, allowed residents of a prime Prabhadevi building to form a cooperative housing society (CHS), instead of a condominium. The decision came after a petition was filed by Rusabh Shah, the chief promoter of the New Pushpanjali Co-operative Housing Society (proposed) in Prabhadevi, against the builder in 2018.

Earlier last week, an official representing the Uttar Pradesh Government announced that the Yamuna Expressway Industrial Development Authority (YEIDA) will now include 55 villages from the Khurja and Secunderabad tehsil divisions in the Bulandshahr district. The YEIDA now has 1,242 villages that have been notified in total. The Dedicated Freight Corridor (DFC), New Noida and the railway between Delhi and Howrah have all been included to the authority's domain.

The National Green Tribunal (NGT) has recently imposed an environmental compensation of INR 113.25 crore (approximately USD 15.2 million) on the developer of Wave City, a residential project located along National Highway 9 in Ghaziabad, Uttar Pradesh, India. The developer has been given three months to deposit the fine with the Uttar Pradesh Pollution Control Board (UPPCB). A three-member bench of NGT, led by Chairperson Adarsh Kumar Goel, passed the order after a report was submitted by a joint team of UPPCB, Central Ground Water Board, and the forest department officials.

According to the updated deadline established by the Centre, the Maharashtra State Government is set to construct 3.75 lakh homes throughout Maharashtra under the Pradhan Mantri Awas Yojana-Urban (PMAY-U) by December 2024. These 3.75 lakh units are a component of the state's 15.82 lakh sanctioned units from 2015, of which 6.93 lakh, or 44%, have been finished.

BCD Group has recently made a foray into the Chennai market with its maiden turnkey residential project. The company's entry into the Chennai market is part of its plan to diversify its exposure to turnkey projects across the country, by offering comprehensive services from design consultation to handover. The project is a semi-luxury apartment development called Ayana 95, and will comprise 2, 3, and 4 BHK-style units, spread across 2.5 acres. Construction is set to begin in the first quarter of 2023, with an expected completion date of the first quarter of 2025.

The trend of sustainability in real estate is rapidly growing in India. In the past five years, the market has witnessed a 37% rise in the supply of certified buildings. The cost difference between conventional and green buildings has decreased, making it easier for developers to maintain profitability while incorporating green building practices. Also, homebuyers today are becoming increasingly aware of the importance of sustainability, which in turn is driving the shift towards a more sustainable real estate market in India.

The Government of India has blocked 232 apps run by foreign entities, including those from China, due to their involvement in activities such as betting, gambling, and providing unauthorized loans. According to sources, LazyPay, IndiaBulls Home Loans, and Kissht have been included in the list of websites that have been blocked by the Ministry of Electronics and IT. The Ministry issued the blocking orders on Saturday in response to an emergency request from a nodal officer of the home ministry.

Homebuyers of Expressway Towers in Sector 109 in Gurugram held a meeting with a senior town planner and called for action against the developer for the prolonged delay in completing the housing project. The project, which was meant to be an affordable housing initiative by Ocean Seven Buildtech Pvt Limited (OSB), was launched in 2017 with a promise of handing over possession to buyers by 2021. However, due to the COVID-19 pandemic, the deadline was pushed to 2023

In 2001, a developer and tech company SRA Systems obtained a sanction plan for the construction of residential apartments along with an IT in the common area but failed to procure necessary permissions which led to the developer constructing another residential building in place of it. The Madras High Court recently ordered the developer to rectify the sale deed with the correct undivided share of interest (UDS) within three months and asked the CMDA to hand over the vacant non-Floor Space Index (FSI) building to the resident welfare association. The court noted that the conveyance of an undivided share in the land, along with a non-FSI block to a private company by the developer was highly irregular and against the sanctioned planning permission.

Savvy Group, an Ahmedabad-based real estate developer, is expanding into the Mumbai property market and plans to invest more than INR 2,000 crore ($274 million) over the next few years. To start, Savvy Group will invest around INR 750 crore to develop two projects it has recently acquired: a mixed-use project and a residential redevelopment project in the city's western suburb of Andheri and the central suburb of Ghatkopar, respectively.

Although cost of construction remains high, the Kerala government's most recent financial allocations which include support programmes for affordable housing comes as a huge relief for the poor. The State Budget has set up Rs. 1,436 crores for Life Mission programmes which will enable the completion of 71,861 homes and 30 housing complexes in the upcoming fiscal year. Some of the programs that have received aid are the Grihasree programme of the Kerala State Housing Board and Aswas Rental Housing Scheme.

The Gurugram branch of the Haryana Real Estate Regulatory Authority (H-Rera) has resolved over 25,500 complaints from allottees since it was established in 2018.The Haryana Real Estate Regulatory Authority’s Gurugram branch has passed more than 7,000 judgments and overseen the transfer of 2.5 lakh units during this time. The authority has received a total of 25,509 complaints to date, out of which 12,640 cases were taken to court and the rest were resolved between the parties with the regulator’s intervention.

In a drastic step to caution property tax defaulters, the Nagpur Municipal Corporation (NMC) has attached 794 properties, all of which are open plots. The total amount owed to the body is said to be approximately Rs 55 crore. The plot owners have been warned that if they do not pay the NMC tax within the next 21 days, all open plots will be put up for auction.

The Economic Survey of India has reported that the country's housing market has witnessed a recovery in the current fiscal year due to the release of pent-up demand, despite rising interest rates on home loans and appreciation in property prices. According to the survey, which was tabled in Parliament, housing sales have increased and the demand for housing loans has picked up, leading to a decline in unsold housing inventories and an increase in housing prices.

At a recent auction held by the Greater Noida Authority, the civic body responsible for development in the region, real estate developers were able to purchase three plots of land for a total sum of around Rs 300 crore. The authority had invited bids for eleven land parcels, and nine developers expressed interest in three of those properties in December. The bid opened at Rs 200 crore.

In accordance with the poll promise of providing financial assistance for poor landowners in the state, the chief minister of Telangana K Chandrashekar Rao finalised the state’s budget allocation for the financial year 2023-24. In its annual budget, the state government has committed Rs 7,890 crore to implement the scheme. The state will provide a sum of three lacs as financial aid in the form of a grant to land owners need not repay in any way. The first phase of the scheme is expected to cover up to two thousand beneficiaries from all one hundred and nineteen legislative constituencies.

Max Ventures & Industries Limited (MaxVIL) recently completed the acquisition of the remaining 2.39% equity share capital of Acreage Builders Private Limited (ABPL) for an enterprise value of INR 322.50 crores, making ABPL a step-down wholly owned subsidiary of the company. New York Life Insurance joined as an equity investor, committing INR 290 crores in ABPL. As a result, MEL and New York Life will be 51:49 shareholders, respectively, in ABPL, which holds a license to develop a commercial project covering 7.15 acres. The project has a revenue potential of INR 160-200 million per year and is located at Golf Course Extension Road in Gurugram.

The recent budget proposal by the Indian government to limit the tax deduction on long-term capital gains (LTCG) investment in residential property under sections 54 and 54F of the Income Tax Act 1961 to Rs 10 crore is expected to have a significant impact on the demand for super-luxury real estate in the country. The cap on the offset of capital gains from the sale of a residential unit or another long-term asset, except for a residential unit, is anticipated to affect high-value transactions by high-net-worth individuals (HNIs).

The Bombay High Court has raised an important question to the Maharashtra government regarding the ability of the state's housing regulator, the Maharashtra Real Estate Regulatory Authority (MahaRERA), to identify, classify, and rate private developers. The purpose of this is to provide societies and other relevant parties with the information they need to make informed decisions when choosing a builder.

In 2012, Delhi-based Wave Mega City promoter promised possession of 2,300 flats in Noida within four years of booking, in turn collecting more than INR 1,400 crore ($171 million) from prospective buyers. However, a decade later the promoter tried to absolve itself of all responsibilities by filing for insolvency under Section 10 of the Insolvency and Bankruptcy Code (IBC), 2016. The National Company Law Tribunal (NCLT) dismissed the builder's move on the grounds of malicious intent, but the case has set a dangerous precedent. Other smaller builders are now planning to use the same route to rid themselves of their responsibilities, which has made Insolvency Law Committee consider revising the section.

The Greater Cochin Development Authority (GCDA) has partnered with South Indian Bank's software division to create a new software that will allow GCDA to manage the allocation and rental of its shops more easily, as well as create a database of its rent management activities. Renters will receive notifications and reminders for rent payments via SMS. Officials will be able to closely monitor the system and act if any renters fall behind on their payments. According to a recent submission to the Kerala legislative assembly, the amount of rent arrears owed to GCDA is nearly 7 crores.

The Mahindra Group's real estate and infrastructure development company, Mahindra Lifespace Developers has stated that its net consolidated profit increased by 37.17% in the quarter ending December 31, 2022. Its profit after tax (PAT) increased to Rs 34.10 crore in Q3FY23 from Rs 24.86 crore the prior year's similar quarter. The company's net consolidated income for Q3FY23 was Rs 198.14 crore, up by 494.66% from Rs 33.32 crore it reported in the same quarter last year. The company generated revenues of Rs 1,452 crore with a saleable area of over 1.73 million square feet in the residential business during the first nine months of FY23.

The Economic Offences Wing (EOW) and the Powai police have closed an alleged cheating case against builder Pashmina Realty and its directors. The complaint was filed by Ekta Housing, Pashmina's partner in a joint venture project called Lake River in Powai. Ashok Mohanani, the chairman of Ekta Housing, accused Pashmina and its directors of inducing him to redevelop the property by presenting a false picture and then cheating and defrauding him by extracting huge sums of money and misappropriating funds. As a result, Ekta Housing suffered a loss of Rs 165 crore.

The National Green Tribunal (NGT) has taken serious action regarding the deforestation and hill-cutting for a real estate project in Una, Himachal Pradesh. The NGT has ordered the local administration to investigate and has asked the officials, including the deputy commissioner, divisional forest officer, and others, to submit their replies within a month. This action was taken after a complaint was filed by Una resident Bhavak Parasher in November of last year.

The Maharashtra Real Estate Appellate Tribunal has overturned a decision made by the Maharashtra Real Estate Regulatory Authority (MahaRERA) regarding the registration of property portals as real estate agents. The tribunal has instructed the authority to reconsider the matter. In 2019, the real estate authority had ordered the web portals to register as real estate agents. However, the web portals contested this ruling, claiming that they simply provide information to the public through advertisements and do not participate in any sales.

Over the weekend, the Gujrat State Revenue Department made an announcement regarding the revision of ‘Jantri’ rates in the state. After a twelve-year hiatus, the Gujarat government has finally raised the 'Jantri' or annual statement of rates (ASR) for immovable properties. This was done to correct the current pricing and give homeowners their fair market worth. ASR rates are used as a benchmark for determining the value of a property for tax and other purposes.

Godrej Properties (GPL) recorded an increase in its net consolidated profit of 44.54 percent for the quarter that concluded on December 31, 2022. In a BSE filing, the company stated that its profit after tax (PAT) increased to Rs 56.40 crore in Q3 FY23 from Rs 39.02 crore the prior year's corresponding quarter. Its booking value increased by 111% to Rs 3,252 crore and its 9M FY23 bookings increased by 77% year over year to Rs 8,181 crore. Under the Employee Stock Grant Scheme (ESGS), the company granted 30,869 additional shares of stock to qualified workers during the nine months that ended on December 31, 2022.

A car and bike rally protest were conducted this Sunday at Char Murti Chowk by disgruntled allottees who claim to be waiting for as many as 13 years for possession of their flat. More than one lac homebuyers from over 25 housing projects are affected. Homebuyers in Greater Noida now intend to send a large number of postcards to the President after protesting ceaselessly for 10 Sundays over the delay in receiving possession of and registration of their flats.

Kotak Realty Fund has recently made a major investment in hospitality company Bharat Hotels. This marks the fund's first investment in the hospitality sector in over 14 years. The investment, which totals over INR 1,100 crore, was made through debt with a five-year tenure and will be used to repay existing lenders, including public and private sector banks. This transaction has brought Kotak Realty Fund's total investments in FY23 to a record high of over INR 5,500 crore, surpassing their previous best for any fiscal year.

Real estate major DLF Ltd reported a solid financial performance in Q3 of the fiscal year 2022, with a 36.8% increase in its consolidated net profit, reaching Rs 519.2 crore ($71.6 million), up from Rs 379.4 crore ($51.7 million) in the previous year. New sales bookings for the residential business reached Rs 2,507 crore ($342.7 million) in the quarter, reflecting a YoY growth of 24%. DLF's total income declined from Rs 1,686.92 crore ($230.1 million) in the previous year to Rs 1,559.66 crore ($211.3 million) in the recent quarter. The company is said to be working towards further deleveraging, and its net debt decreased to Rs 2,091 crore ($285 million) at the end of the quarter.

Dubai has seen a surge in the number of branded residential projects in the latter half of 2022, and this trend is expected to continue as demand from international high-net-worth buyers continues to boom. At the end of the year, there were a total of 71 branded residence schemes in Dubai, including well-known luxury brands such as Lamborghini, Armani, Bulgari, and Four Seasons. This is a significant increase of 22% compared to the first half of the year and an additional 42 branded residences are currently under construction.

Earlier this week, the Additional District Consumer Disputed Redressal Commission in Thane ordered SBI General Insurance Ltd to pay the claim amount of Rs 30 lacs within 45 days to a complainant for damages to his flat due to a slab collapse. The insurer has initially denied the claim. However, the commission rejected the insurer’s reasoning, stating that before issuing a policy, it is the responsibility of the insurance company to carefully verify all documents and assess the life of the structure. The commission also ordered the insurer to pay a sum of Rs 50,000 to the complainant for expenses incurred for litigation proceedings.

The Maharashtra Real Estate Regulatory Authority (MahaRERA) has set up a counselling centre offering online and offline in-person sessions at their office in BKC, Mumbai to assist homebuyers and developers in understanding the modalities and operations of the authority. Their goal is to help homebuyers in retrieving information about the construction progress of their purchase, filling complaints, and seeking redressal. Their counsellors will help developers clarify their issues regarding the regulatory requirements as mandated by the RERA Act 2016.

Gurugram based Chintels, who is the developer of the apartment building Paradiso, has sent a letter expressing his exasperation to the district administration after a fourth reevaluation of flats in Tower D took place. The evaluations are being done to compensate the residents previously living in Tower D which was declared unable to live in following a structural audit conducted by IIT-Delhi. The developer initially offered Rs 5,500 per sq ft as compensation. However, the residents have rejected this rate and subsequent evaluations by the district administration’s team.

According to its BSE filling, the net consolidated profit of Ajmera Realty and Infra India increased by 9.58% during the three months ending December 31, 2022. Its profit after tax (PAT) increased to Rs 10.64 crore in Q3 FY23 from Rs 9.71 crore in the equivalent period of the previous fiscal. The company's total consolidated income increased by 14.87% to Rs 80.57 crore in Q3 FY23 from Rs 70.14 crore which it reported in the same quarter the previous year. The company claims to have deleveraged their debt by Rs 38 crore during the quarter.

Credent Global Finance is looking to tap into the growth potential of second-tier cities in India through the launch of its new real estate fund, Credent Estate Multiplier Fund. This fund will invest in mid-income residential projects through equity, and will be divided into two AIFs, one focused on second-tier cities and the other on independent housing. The company is looking at cities such as Indore, Chandigarh, Lucknow, and Baroda to make their investments.

The real estate market in Mumbai saw an increase in property registrations in January 2023, with a total of 8,694 units registered, according to Knight Frank India. This is a 7% year-on-year increase, with 84% of these properties being residential and the remaining 16% being non-residential. The data encompasses both primary and secondary market transactions, covering all property types, including residential, commercial, and others. Despite a 7% decrease compared to December 2022, which saw 9,367 units registered, the strong consumer inclination towards purchasing homes has driven the residential property sales in Mumbai.

3D printing technology has the potential to revolutionize the construction of houses and make them more affordable, especially for low-income families. However, two largest players in the field in Unites States of America, Mighty Buildings and Icon, have delivered fewer than 100 houses between them. In 2022, venture capital groups invested nearly $400 million in 30 building construction companies, which is eight times more than the amount raised in the previous five years combined.

Brookfield Asset Management, a Canadian alternatives asset manager, is in negotiations with Singapore's sovereign wealth fund, GIC, to sell half of its stake in a special purpose vehicle that holds its office assets in Powai, Mumbai. The 4.2 million square feet of office and retail space was acquired by Brookfield in 2016 from the Hiranandani group for $1 billion in one of the largest real estate deals at the time. GIC was among the interested parties in the race for the assets, along with other global investors like Blackstone Inc.

The state cooperative department in Maharashtra has recently expressed disappointment over the low number of deemed conveyance applications received from newly registered housing societies in 2022. Despite a targeted effort by the department to promote the process, only 101 applications were received. The department has directed its deputy registrars to reach out to the societies individually, encouraging them to apply for deemed conveyance. The state housing federation has also initiated an awareness drive, which is scheduled to in the Pimple Saudagar area in the coming week.

The Nagpur division of the Bombay High Court has recently raised concerns about the sluggish pace of illegal structure removal in the city. The court directed the three civic bodies - NMC, NIT, and NMRDA - to expedite the process of removal and also called for the police to provide security teams during these operations. The court's directives were made during a hearing for a suo motu public interest lawsuit (PIL No.1/2022), which brought to light that only 227 of the 4,668 unauthorized structures in the city have been demolished since June of the previous year.

After Finance Minister Nirmala Sitharaman announced raising the PM Awas Yojana (PMAY) spending by 66% to Rs 79,000 crore for the upcoming fiscal year, shares of real estate businesses fell by 4% on last week. Sunteck Realty shares plunged 5.67% to close at Rs 345 a share on the NSE and Indiabulls Real Estate shares fell 3.81% to close at Rs 69.50 per share. Other real estate companies including DLF which fell 2.85%, Prestige Estates Projects which fell 2.39%, Sobha which lost 1.94%, Godrej Properties which fell 1.88% and Oberoi Realty which was down by 0.11%.

Pre-sales for the December quarter at Sunteck Realty Ltd. increased by 12% YoY. The pre-sales jumped to Rs 396 crore from Rs 352 crore during the same period last year. Pre-sales increased 33 percent to Rs 1,066 crore during the nine-month period ending in December 2022 compared to Rs 800 crore during the same period last year. Additionally, the company's collection efficiency increased from 81 percent for the same period in the previous fiscal to 86 percent for the nine-month period ending in December 2022.

The Union Budget 2023 has several positive proposals for the real estate and infrastructure sector. The Pradhan Mantri Awas Yojana (PMAY) outlay was enhanced by 66% to over INR 79,000 crore. The Budget proposed changes in the provisions for computing capital gains in the case of joint development of property. It also proposed to establish an Urban Infrastructure Development Fund (UIDF) to create urban infrastructure in Tier 2 and Tier 3 cities. In addition, it focused on promoting green growth initiatives, such as green buildings, green energy, green mobility, and green farming.

Mindspace Business Parks Real Estate Investment Trust (REIT) reported strong financial results for the quarter ending December. The company's net operating income increased by 22% to INR 455 crore ($62 million) compared to INR 373.7 crore ($50 million) in the same period last year. Mindspace REIT also announced a distribution of INR 284.6 crore ($38 million) to unitholders, demonstrating the company's commitment to returning value to its investors.

In 2022, there was an 8% year-on-year increase in demand for industrial and warehousing space, totalling 24.5 million square feet across India's top 5 cities. The average quarterly leasing was strong, reaching 6.1 million square feet, up from 5.7 million square feet in 2021. Third-party logistics companies were the biggest occupiers of warehousing space, making up 44% of total demand in the sector. The growing consumer demand has led to more leasing by 3PLs, e-commerce, and retail companies. Meanwhile, there has been a rise in demand for space from engineering firms as well. Positive market sentiment is expected to continue.

The real estate market in Kolkata Metropolitan Area has shown growth over the past 18 months since the introduction of the stamp duty rebate, with a 61% increase in the number of residential properties registered compared to the previous 18 months. Despite a 17% decrease in the number of registrations in December 2022 compared to the previous year, the overall trend is positive, and the recent extension of the stamp duty incentive is expected to provide further encouragement for potential buyers.

In a statement released on Thursday, the Maharashtra Real Estate Regulatory Authority (MahaRERA) claims to have recovered over Rs 100 crore from developers via follow-ups on compensation orders previously doled out. So far, a total of 594 warrants have been issued for recovery of approximately Rs 414 crore from developers of Mumbai City, Mumbai Suburbs, Pune, and Raigad. Follow-up actions since December 2022 have resulted in developers across MMR, Pune and Raigad to cough up almost Rs 101 crore in relation to 118 defaulting projects.

In a bid to encourage and regulate green construction and technology, the Uttar Pradesh Government is set to create a specific set of guidelines and a framework to recognize energy-efficient buildings. The green building code will require buildings to adhere to specific norms, which will be formulated and approved by the Housing and Urban Planning Department. At present, the Indian Green Building Council provides ratings for green buildings in Uttar Pradesh. The council has already audited, examined, and certified over 130 buildings in the state as green building projects, with the majority being in the cities of Noida, Greater Noida, and Ghaziabad.

Paranjape Construction Company and its partner have been ordered by the Thane District Consumer Disputes Redressal Forum to compensate 45 individuals who purchased apartments in their scheme at Vasai in 1986 with Rs 30,000 each for the failure to execute sale deeds in connection with those purchases over the course of the intervening years. The adversaries did not present a defence or show up for the hearings, stating that the allegations made by the complainants have been proven to be false.

The Bengal government is taking steps to modernize a 68-year-old law, The West Bengal Land Reforms Act 1955, to allow for commercial and industrial use of government land. In an effort to increase revenue for the state, the government is expected to introduce a bill in the state assembly during the budget session that would offer lifelong possession of land parcels to commercial entities, instead of the previous norm of 99-year leases. The proposed bill is expected to unlock government land for the industry, with the exception of khas land (used for personal cultivation) and land under bargadari.

Earlier last week, the Bombay High Court directed the State Environment Impact Assessment Authority (SEIAA) clear out the back log of pending approvals for real estate projects that have been stuck for years due to the deferral of environmental clearance requests by the State authority. The High Court has given the body eight weeks to do the needful, providing much relief to builders and homeowners of these deferred projects. The High Court has directed SEIAA to consider and decide each proposal by applying the provisions of DCPR 2034 or UDCPR and to make a decision on the merits of the proposals.

Macrotech Developers Limited, that sell their real estate projects under the brand name Lodha has announced it hopes to reduce its net debt by over 40% to roughly Rs 5,000 crore by the end of current calendar year. They hope to do so with the aid of extra cash flow from robust home sales experienced in 2022. For the company, the fiscal year of 2022-23 started off with voluminous sales bookings and cash flows which led to a reduction in debt of Rs 753 crore in the December quarter to Rs 8,042 crore.

The Haryana Real Estate Regulatory Authority (H-RERA) has recently issued a ruling that directs ISH Developers to refund the money of a buyer along with interest for failing to deliver a commercial unit according to the terms of the builder-buyer agreement. The buyer had made the purchase in September 2013 and was promised delivery of the unit within four years. In October 2020, the buyer finally approached the real estate regulator, expressing a desire to withdraw from the delayed project.

According to experts, the most recent expansion of the metro network in the western suburbs is likely to improve accessibility, cut travel time in half and improve connectivity in the area. Line 2A runs from Dahisar to DN Nagar and Line 7 runs from Dahisar to Gundavali, Andheri (E). Experts believe that will these new lines now functional, the demand in the nearby micro markets will experience a 2-5% price increase. Some of the biggest builders in Mumbai such as Kanakia Spaces, Lodha Group, Adani Realty and more have ready and under construction projects along close to these metro stations.

K Raheja Corp Homes, the residential development arm of the Realty developer K Raheja Corp, has entered into an agreement to develop a 1-million-square-foot luxury housing project in South Mumbai's Mahalaxmi neighbourhood. The project will be developed on a prime 3-acre land parcel currently owned by Modern India, which has business interests in infrastructure, power generation, and real estate. As part of the agreement, Modern India will receive a consideration for the sale of the land in the form of a percentage of sales revenue. The project will consist of two superstructure towers and will be completed by 2028.

The Bank of Baroda's stressed assets recovery branch has taken partial possession of the Nirmal Mall located in Mumbai's Mulund area on January 24, 2023, due to the mall's failure to repay a loan amount of Rs 161 crore. On December 6, 2019, the bank issued a demand notice to the mall and its Managing Director, Dharmesh Jain, calling for the loan to be repaid within 60 days. The partial possession was carried out under the Sarfaesi (Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest) Act, 2002.

The Chennai Metropolitan Development Authority (CMDA) in Tamil Nadu is considering a proposal to increase the floor space index (FSI) for properties located along the Chennai Metro Rail and MRTS corridors. For the first time in the state, the FSI is being proposed to be raised to 6.5, which is a significant increase from the previous maximum permissible limit of 4.87. This move is aimed at promoting commercial development along transit lines, improving accessibility and mobility for employment, and creating affordable housing opportunities in transit-oriented development zones.

The Mumbai state government has proposed a change that has sparked controversy and opposition from environmental activists. The government wants to delete the reservation of a 1,375 square meter plot adjacent to Byculla Zoo and convert it into a residential zone. The plot was previously reserved for a garden and zoo in the development plan of 2034, but the government claims that it was not being acquired by the BMC for the expansion of the zoo and that no garden or zoo existed there. The proposal was approved by the BMC in December 2022 and public suggestions and objections are now being invited by the development plan department.

Propscience is India’s dedicated property news portal. We cover the latest events, news, trends, deals, new launches and more.

All our services and tools are completely free of cost and available 24X7!

We use cookies to give you the best possible service while using our website, please click accept and carry on browsing if you're happy with this. For more information see our Privacy Policy.

Okay, Got it!

This disclaimer ("Disclaimer") is applicable to the entire Site. Upon entering the Site it is recommended that you immediately read the Terms and Conditions and Privacy Policy listed therein. Your continued usage of this Site will indicate your unconditional acceptance of the said Terms and Conditions and Privacy Policy. You hereby agree that Propscience reserves the right to modify at any time, the Terms and Conditions and Privacy Policy governing this Site without prior notification. Your usage of the Site implies that you will be bound by any such modification. You agree and acknowledge that it is your responsibility to periodically visit the Site and stay updated with the Terms and Conditions and Privacy Policy of the Website.

The information contained in this Site has been provided by Propscience for information purposes only. This information does not constitute legal, professional or commercial advice. Communication, content and material within the Site may include photographs and conceptual representations of projects under development. All computer-generated images shown on the Site are only indicative of actual designs and are sourced from third party sites.

The information on this Site may contain certain technical inaccuracies and typographical errors. Any errors or omissions brought to the attention of Propscience will be corrected as soon as possible. The content of this Site is being constantly modified to meet the terms, stipulations and recommendations of the Real Estate Regulation Act, 2016 ("RERA") and rules made thereunder and may vary from the content available as of date. All content may be updated from time to time and may at times be out of date. Propscience accepts no responsibility for keeping the information in this website up to date or any liability whatsoever for any failure to do so.

While every care has been taken to ensure that the content is useful, reliable and accurate, all content and information on the Site is provided on an "as is" and "as available" basis. Propscience does not accept any responsibility or liability with regard to the content, accuracy, legality and reliability of the information provided herein, or, for any loss or damage caused arising directly or indirectly in connection with reliance on the use of such information. No information given under this Site creates a warranty or expands the scope of any warranty that cannot be disclaimed under applicable law.

This Site provides links to other websites owned by third parties. Any reference or mention to third party websites, projects or services is for purely informational purposes only. This information does not constitute either an endorsement or a recommendation. Propscience accepts no responsibility for the content, reliability and information provided on these third-party websites. Propscience will not be held liable for any personal information of data collected by these third parties or for any virus or destructive properties that may be present on these third-party sites.

Your use of the Site is solely at your own risk. You agree and acknowledge that you are solely responsible for any action you take based upon this content and that Propscience is not liable for the same. All details regarding a project/property provided on this Site are updated on the basis of information available from the respective developers/owners/promoters. All such information will not be construed as an advertisement. To find out more about a project / development, please register/contact us to visit the site you are interested in. All decisions taken by you in this regard will be taken independently and Propscience will not be liable for any such loss in connection with the same. This Site is for guidance only. Your use of this Site - including any suggestions set out in the Site and or any use of the resources available on this Site, do not create any professional - client relationship between you and Propscience. Propscience cannot accept you as a client until certain formalities and requirements are met.

We use cookies to give you the best possible service while using our website, please accept it and continue browsing if you're happy with this. For more information see our Privacy Policy