Dedicated locality research platform

Dedicated locality research platform

Enter your email address and you will receive

a link to reset your password

Global Capability Centres (GCCs), also known as global in-house centres or captives (GICs), are offshore centres established by firms to provide various services to their parent organisations. These centres operate as internal organisations within the global corporate structure, providing specialised capabilities such as IT services, research and development, customer support, and other business tasks. GCCs and GICs are critical in leveraging cost efficiencies, accessing talent pools, and encouraging collaboration between parent businesses and their offshore affiliates.

Bollywood actress Mrunal Thakur and her father have acquired two adjoining apartments in Oberoi Springs, Andheri West, Mumbai, for a total of INR 10 crore from Kangana Ranaut's family members. The spacious flats, spanning 1017 and 997 sq ft, are undergoing renovations to meet the actor's specifications. Known for its celebrity residents, Oberoi Springs offers luxurious amenities like pools and gyms. The purchase signifies the rising allure of Andheri as a prime residential locale, boasting upscale towers and convenient access to amenities. The move towards a jodi flat reflects a trend towards expansive living spaces in Mumbai's bustling entertainment hub.

<p>&bull; A residential flat spanning 3,111 square feet sold in Oberoi Elysian Tower C,D &amp; E in Goregaon East for INR 12.10 crores<br /><br /> &bull; A residential flat spanning 983 square feet sold in Hiranandani Fortune City - Helios in Rasayani for INR 97 lakhs</p>

Raagam Phase 1 by TATA Housing in Bengaluru was a remarkable success, selling out in less than a week after it opened and bringing in over INR 650 crores. Situated on 140 acres, the project, which is a part of the Tata Carnatica township, offers innovative planned developments. Raagam Phase 1, which has a total area of 9 lakh square feet and 576 sold plots, is a testament to Tata Housing's dedication to quality and innovation. The project's quick success is attributed to strategic marketing initiatives, a focus on customer happiness, and a variety of living options. These factors have raised the bar in Bengaluru's real estate market.

The Maharashtra Real Estate Appellate Tribunal (MREAT) directed the new developer of Mumbai's Palais Royale project to maintain status quo on a home buyer's flat, preventing third-party rights until the final appeal hearing against a MahaRERA order. The project, stalled due to legal issues, saw a change in ownership under the SARFAESI Act. MahaRERA initially dismissed the buyer's complaint regarding delayed possession. However, the MREAT granted interim relief, emphasising the validity of the buyer's agreement with the former developer and affirming RERA's applicability. The ruling ensures the buyer's rights amidst the project's tumultuous legal proceedings.

The Uttar Pradesh Real Estate Regulatory Authority (UP-RERA) has introduced stringent guidelines governing mutual settlements between homebuyers and developers, aiming to enhance transparency and accountability in the real estate sector. These guidelines, effective from this month, mandate settlements to be formalized on non-judicial stamp paper, notarized, and uploaded onto UP-RERA's web portal for verification. These measures seek to address issues of non-compliance and disputes, ensuring adherence to established norms and fostering an environment conducive to successful resolution of proceedings. By standardizing the settlement process and imposing strict compliance measures, UP-RERA aims to enhance trust and efficiency in the state's real estate market.

Scheduled for March 5th, the Delhi Development Authority (DDA) plans to auction Phase III of its Diwali Special Housing Scheme, featuring 257 flats located in Dwarka. This phase includes penthouses, high-income, and middle-income group residences, with tentative prices ranging from INR 1.44 crore to INR 5 crore. Registration for the e-auction and submission of earnest money deposits closes on February 28. Notably, the scheme provides parking spaces for purchasers, and previous phases offered over 2,000 flats across Dwarka. The DDA, established under the Delhi Development Act, is responsible for urban development and infrastructure projects in the National Capital Territory of Delhi.

ASK Property Fund announces a INR 120 crore investment in TREVOC's luxury housing project in Gurugram, enhancing its prime location and revenue prospects. TREVOC will contribute INR 80 crore to the venture, underlining their commitment to crafting a unique living space. The investment, drawn from ASK Real Estate Special Opportunities Fund IV, underscores ASK Property Fund's focus on high-potential micro markets in India's top 6 cities. With over 175 residential units spread across a two-acre plot, the project anticipates an aggregate revenue potential of INR 800 crore over five years, signaling confidence in Gurugram's real estate landscape and the luxury housing sector's growth.

The Brihanmumbai Municipal Corporation (BMC) has released property tax bills for 2023-24 without any hike in taxes, with a payment deadline of March 31st. The issuance of bills was delayed due to legal complexities and delayed government approval. The corporation has collected INR 708 crores so far out of the targeted INR 4,500 crores for this fiscal. The decision to not hike taxes provides relief to property owners, but the BMC faces revenue challenges due to exemptions and deferred revisions. The last property tax revision was in 2015, and the BMC will need to consider raising rates in the future to improve and maintain city infrastructure.

Amid prolonged delays in Gurugram's affordable housing projects, the Department of Town and Country Planning (DTCP) has stepped up its actions. Directives have been issued to developers of 50 projects to submit comprehensive status reports, emphasizing adherence to timelines. Concerns over sluggish progress have prompted DTCP to convene a review meeting with developers, aiming for compliance with licensing terms and project milestones. Escalation to higher authorities is planned for unresolved delays. Simultaneously, the Municipal Corporation of Gurugram (MCG) is cracking down on property tax defaulters, sealing properties and disconnecting utilities. Despite challenges, these proactive measures signal a concerted effort to address housing delays and boost revenue collection, fostering optimism among stakeholders.

Brigade Group collaborates with PVP Ventures Ltd for a major project in Chennai, constructing a sprawling 2.5 million sq ft residential complex in Perambur, expecting INR 2,000 crore revenue. Chennai's diverse industries make it an ideal market. Managing Director Pavitra Shankar emphasizes Chennai's significance alongside Bengaluru and Hyderabad. With over 12 million sq ft land bank, Chennai is their second-largest market. Brigade Group diversifies into hospitality, leasing a 250-room resort along East Coast Road. Plans include adding 1200 keys in four years. Additionally, they aim to expand commercial real estate, adding 3.15 million sq ft of office space by FY25, driving sustainable growth across key markets.

Leading private equity firm KKR & Co. is stepping up its attention to India's infrastructure market, hoping to commit a sizable chunk of its USD 6.4 billion Asia-Pacific fund to renewable energy, roads, and highway projects. With USD 3 billion in current investments, KKR views India as a critical area for expansion alongside other Asian economies. The company's approach demonstrates its faith in India's economic growth trend and reform-focused methodology. Partnerships with the Vedanta Group demonstrate KKR's dedication to accelerating the switch to renewable energy sources and bolster the company's standing in India's changing infrastructure market.

The luxury real estate market in Hong Kong faces significant challenges ahead, as indicated by data from Spacious.hk. Inquiries for homes priced at $10 million or more have dropped by 45% over the past year, reflecting a broader trend of declining interest in high-end properties. Meanwhile, inquiries for homes priced below $1.3 million and those between $1.3 million and $3.2 million also saw notable decreases. The price index for private homes hit a seven-year low by the end of 2023, underscoring the subdued state of the housing market in Hong Kong amidst economic uncertainties and shifting buyer preferences.

The Maharashtra Real Estate Regulatory Authority (MahaRERA) has released its Quarterly Progress Report (QPR) for June, showing a significant improvement in compliance with project reporting requirements. Out of 633 projects, 333 (52.6%) submitted all required forms before the due date, a significant increase from January's 0.03% compliance rate. However, since the start of the year, overall, 557 developers (62.86%) remain non-compliant, despite penalties and notices. MahaRERA remains concerned about this indifference and aims to continue to take strict action, including project suspensions and financial penalties, to enforce compliance. The QPR system provides homebuyers with up-to-date information on project progress, enabling them to make informed decisions, and is thus significant for the MahaRERA.

<p>&bull; A residential flat spanning 346 square feet sold in UVK Sai Akshi in Bhandup West for INR 63 lakhs<br /><br /> &bull; A residential flat spanning 150 square feet sold in Nina Fortune Rise in Bhuleshwar for INR 30 lakhs</p>

Asset Homes, a leading real estate developer in Kerala, has partnered with Columbia Pacific Communities to introduce luxury senior living projects, branded as 'Young @ Heart', across Kerala. This collaboration combines Asset Homes' local expertise with Columbia Pacific's global experience to set new standards in design, amenities, and services. With India's senior population expected to grow, Asset Homes plans to launch four projects initially in Thiruvananthapuram, Kottayam, Kochi, and Kozhikode, catering to diverse preferences. These projects, slated for Q1 2024-25, aim to provide retirees with a vibrant lifestyle. The partnership reflects a commitment to meet the evolving needs of seniors while promoting positive aging and community living.

State-owned NBCC received approval from the Greater Noida Authority to develop five Amrapali projects worth INR 10,000 crore. These projects include Centurian Park, Golf Homes, Leisure Park, Leisure Valley, and Dream Valley. In December 2023, NBCC announced sales of 5,000 units for INR 2,900 crore across several residential projects of Amrapali. As per Supreme Court direction, ASPIRE was formed to complete stalled projects through NBCC. NBCC is tasked with completing 38,159 units and pending common facilities across 25 housing projects, with an estimated cost of INR 8,266 crore. NBCC aims to complete all projects by March 2025, prioritizing home buyers' ownership dreams.

The Bombay High Court has delivered a decisive verdict in favour of developers Godrej Properties and Shelton Infrastructure, allowing them to retain plots in Sanpada, Navi Mumbai, originally allocated by CIDCO. The dispute arose when CIDCO sought to revoke the allotments, citing concerns over potential financial losses. However, the High Court deemed CIDCO's actions arbitrary and discriminatory, emphasizing the developers' right to equality before the law. Represented by seasoned legal counsels, the developers argued vehemently against the cancellations, leading to a landmark ruling reinforcing the importance of due process and legal diligence in matters of public land allocation and development.

The Jaipur Development Authority (JDA) is set to utilize the Land Pooling Scheme Act of 2016 for the first time, acquiring 164 hectares of land for the Shivdaspura township project. This marks a departure from previous land acquisition methods, such as the "land for land" policy introduced in 2018. Under the land pooling scheme, landowners contribute land for urban infrastructure development in exchange for developed parcels with amenities like roads and parks. Meetings with landowners are underway, targeting 166 hectares along Tonk Road for mixed-use development. This aligns with Jaipur's 2025 master plan, prioritizing satellite townships to ease population pressures and emphasizing sustainable urban growth.

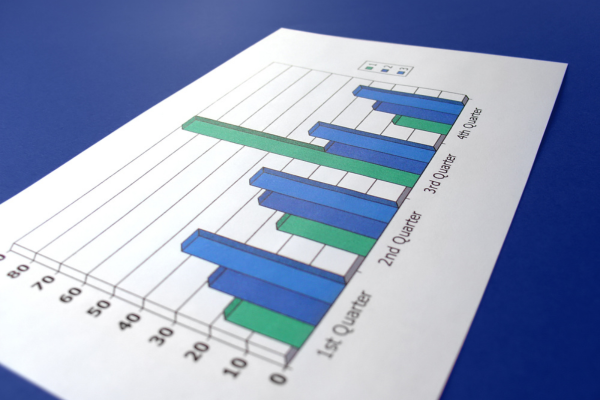

Over the next two years, Global Capability Centres (GCCs) in India are set to secure leases for 45–50 million square feet of office space, driving 40% of office space demand across the nation's top six cities. Despite challenges like the pandemic and geopolitical issues, GCC expansion persists, supported by improving business sentiments. Colliers reports a 14% year-on-year increase in GCC leasing activity in 2023, highlighting their pivotal role in shaping India's commercial real estate landscape. With foreign companies drawn by cost-effectiveness and talent access, GCC demand is expected to remain robust. Sectoral diversification, particularly in engineering and healthcare, promises further growth, with Bengaluru and Hyderabad emerging as key GCC hubs. Sub- and near-dollar micro markets will continue to drive GCC space acquisition, reflecting a positive economic outlook for India's office market.

Motilal Oswal Alternates (MO Alts) achieves a milestone raising over INR 1,250 crore for its India Realty Excellence Fund VI (IREF VI), targeting INR 2,000 crore. Investing in mid-income and affordable housing across eight Indian cities, diverse investors show confidence in MO Alts' expertise and real estate prospects. With a track record of over 150 investments and INR 7,500 crore funding, MO Alts is strategically positioned amidst rising land acquisition demand and promising opportunities.

Jubilant FoodWorks Limited (JFL) introduces Popeyes to New Delhi's Chandni Chowk, marking its expansion into the national capital region after its initial entry into India in 2022. With plans to open stores in other key locations, including Jasola, Faridabad, and Gurugram, Popeyes aims to leverage its own delivery fleet and partnerships with food aggregator apps. JFL targets INR 1,000 crore in sales from Popeyes, capitalising on India's significant non-vegetarian market. The move reflects JFL's strategic expansion efforts and highlights the growing demand for fried chicken in India's quick service restaurant (QSR) sector.

Spyre PropTech Venture Fund, backed by Venture Catalysts and NeoVon, aims to raise INR 400 crore in the first phase of an INR 800 crore proptech sectoral fund, with support from CREDAI. The fund, granted approval by SEBI, plans to invest in over 30 Indian proptech startups at various stages of development. Venture Catalysts, India's first multi-stage venture capital firm, is the seed investor and co-sponsor of Spyre, bringing significant expertise and experience to the fund, which is set to play a crucial role in fostering technological innovation in the Indian real estate sector.

Mumbai is set to bid farewell to the 112-year-old Sion Road Over Bridge as it closes on February 29 to make way for a new, modern structure. Set to undergo demolition due to its deteriorated condition, the bridge's reconstruction aims to facilitate railway expansion and is expected to last 18-24 months. The project will extend the bridge's span to accommodate additional railway lines, enhancing urban mobility. Traffic congestion is anticipated on alternative routes, with measures like no-parking zones being implemented to mitigate the impact. This marks a significant step in Mumbai's infrastructure development, promising improved connectivity upon completion.

Saudi Arabia's economic transformation under Prince Mohammed's leadership is marked by ambitious initiatives like the $48 billion property development and global airline establishment. However, cash reserves have dropped significantly, prompting plans for a substantial Saudi Aramco stock sale. Social liberalization measures, including integrating women into the workforce, accompany assertive foreign policies. Gigaprojects like Diriyah and Neom showcase futuristic city planning. The Public Investment Fund's assets surged to $2 trillion, but the government faces a $21 billion budget deficit and increasing debt, necessitating additional fiscal risk. Despite economic challenges, Riyadh aims to raise funds through Aramco stock sales and bond offerings to sustain its transformative vision.

Alternate Investment Funds (AIFs) is a privately pooled investment vehicle that collects funds from India and abroad for investing into asset classes with a defined policy. The concept was first introduced in India in 2012. Under AIF regulations issued by SEBI, funds can be classified into three categories. Real estate AIFs fall under category II.

Cricketer Yashasvi Jaiswal invests INR 5.38 crore in a Mumbai apartment at Ten BKC, Bandra East. Developed by Adani Realty, the project offers luxury living with great connectivity. The project is slated for completion this year. Bandra East has gained popularity due to its proximity to Bandra Kurla Complex and upscale gated communities, attracting developers like Rustomjee and Kalpataru. Jaiswal's move echoes the trend of cricketers investing in prime real estate, joining the likes of Kapil Dev and Virat Kohli, who've acquired properties in Mumbai and Alibaug. This underscores the allure of Mumbai's real estate market for both celebrities and investors alike.

<p>&bull; A residential flat spanning 814 square feet sold in Romell Diva Phase 1 in Malad West for INR 1.48 crores<br /><br /> &bull; A residential flat spanning 1736 square feet sold in Ellora Apartment in Kalina for INR 8.15 crores</p>

Raymond Realty, the real estate arm of Raymond Group, ventures into Mumbai's real estate market with 'The Address by GS, Bandra', a luxury residential project spanning 2.74 acres. Formed through joint development agreements (JDAs), it offers 2, 3, and 4 BHK apartments alongside a 16,000 sq ft clubhouse and high-street retail spaces. Strategically located in Bandra East, it ensures connectivity to prime locales like Bandra-Kurla Complex and Bandra-Worli Sea-Link. With a RERA carpet area of 0.7 million sq ft and a revenue projection exceeding INR 2,000 crore, it's poised to redefine luxury living. Raymond Realty's expansion beyond Thane signifies a strategic move towards maximizing Mumbai's real estate potential.

Mahindra Lifespaces Developers Limited (MLDL) launched its second plotted development project for FY-24, 'Green Estates by Mahindra,' at Mahindra World City in Chennai. Spanning 27 acres, the development offers plots ranging from 750 sq. ft. to 2400 sq. ft., emphasizing customized living amidst lush green open spaces. Situated against the scenic Paranur Hills backdrop and adjacent to three lakes, the project integrates seamlessly with nature. With a captivating 1.2-acre central park and nature-inspired amenities, it aims to foster community living.

The Yamuna Expressway Industrial Development Authority (YEIDA) is contemplating the reinstatement of a land parcel to Jaiprakash Associates Ltd (JAL) on the condition that the developer clears INR 200 crore in dues upfront. This is part of a potential rehabilitation package for JAL's 14 stalled residential complexes and aligns with the state government's relief measures introduced in December 2023. The proposed reinstatement involves a 1,000-hectare land allotment originally designated for Jaypee International Sports, a subsidiary of JAL, in 2009-10, under a Special Development Zone (SDZ) scheme.

Smiti Agarwal, director at Wesbok Lifestyle Pvt Ltd and spouse of V Bazaar CMD Hemant Agarwal, secures a sprawling apartment at The Camellias by DLF, Gurugram, for Rs 95 crore. The opulent 10,813 sq. ft space comes with five parking spots. The transaction, completed on January 18, 2024, underscores the allure of prime properties in the region while the recent surge in property values at The Camellias echoes a broader trend across DLF's Golf Links projects. With 15% of buyers upgrading from nearby complexes. It marks a milestone in Delhi-NCR's upscale real estate market, reshaping luxury living standards in Gurugram.

GIFT City, India's first smart city, is witnessing a remarkable real estate upsurge with a record bid of INR 3,870 per sq feet for a residential project against the base price of INR 1600 per sq feet. Prices for residential apartments have risen steeply by 30% to 35% in recent months. Despite the increase, developers report selling 70% to 80% of their inventory prior to project completion. Majority of the buyers currently are investors, especially NRIs, who anticipate higher rental income from these properties. With its world-class infrastructure and growing interest from global banks and tech giants, GIFT City is emerging as a thriving hub of residential and commercial activity.

In 2023, India's entertainment sector saw a staggering 179% year-on-year surge in retail space leasing, doubling its uptake to 660,000 square feet. This trend, encompassing movie theatres, gaming arcades, and play areas, reflects a shift in consumer behaviour towards shared experiences and leisure activities. CBRE data reveals the entertainment segment's share of overall retail leasing increased from 5% to 9%, with Bengaluru leading the charge at 330,000 square feet, followed by Chennai and Delhi-NCR. Other cities also contributed significantly, marking substantial growth compared to 2022 figures. This surge underscores the rising importance of entertainment experiences in retail spaces, driven by technological advancements and evolving consumer preferences.

Adani Realty emerges as the highest bidder for MSRDC's 24-acre Bandra Reclamation land, outbidding Larsen & Toubro. With a potential development area of 45 lakh square feet, valued at around INR 30,000 crore, the project aims to blend commercial and residential spaces. Adani Realty's win, amidst stiff competition from industry giants, underscores their prominence in Mumbai's real estate. The revenue-sharing model ensures mutual benefits, with Adani Realty obligated to pay INR 8,000 crore or 22.79% of gross revenue to MSRDC. This collaborative effort, akin to the Dharavi Redevelopment Project, promises to reshape Mumbai's skyline while fostering sustainable and efficient urban development.

TDR certificate/ Development Rights Certificate (DRC) is a certificate issued by the competent authority to an owner or a lessee of the land on surrender of the gross ‘area’ of the land which is required for public purpose. Such ‘area’ of land must be free of cost and free from all encumbrances. The certificate comprises of the details such as FSI/FAR credit in square meters of the built-up area to which the owner or lessee is entitled, the place from where it is generated and the rate of that plot as prescribed in the Annual Statement of Rates issued by the Registration Department or other concerned department for the concerned year.

The Bombay High Court has raised concern over the handling of eviction notices by the Slum Rehabilitation Authority (SRA), stressing the need for a more compassionate approach towards slum dwellers' welfare. Amidst concerns over short eviction notices issued after two decades of promises for "permanent alternate accommodation," the court directed the Apex Grievance Redressal Committee to promptly review and potentially stay the eviction orders. The case, concerning slum dwellers near Worli Dairy in Mumbai, reiterated the importance of the Slum Act's welfare intent. The court's rebuke extended to the AGRC's conduct, emphasizing the importance of humanity over monetary concerns in such matters. The intervention underscores the court's commitment to protecting vulnerable communities' rights and well-being.

CREDAI-MCHI, in collaboration with CIDCO, organized a workshop on an amnesty scheme for Navi Mumbai residents, addressing Maveja and Additional Lease Premium (ALP) issues. Chief Minister Eknath Shinde's directive to delink CIDCO permissions from pending dues is expected to benefit over 1,000 housing societies. Five key concerns were identified, leading to a committee chaired by Ex-chief secretary Shri Sanjay Kumar to address challenges. The government accepted most recommendations, separating Maveja/ALP recovery from occupancy certificates issuance. A 50% amnesty on payable amounts until March 31, 2023, under the Abhay Yojana, aids projects facing delays. These efforts align with CREDAI-MCHI's commitment to fostering sustainable development in the Mumbai Metropolitan Region.

<p>&bull; A residential flat spanning 760 square feet sold in Samata CHS in Goregaon West for INR 1.25 crores<br /><br /> &bull; A residential flat spanning 539 square feet sold in Zen Gardens in Dahisar West for INR 1.05 crores</p>

Brigade Group, a real estate developer headquartered in Bengaluru, is unveiling an extensive strategy to fortify its presence across South India's commercial, retail, and hospitality sectors. Spearheaded by Nirupa Shankar, the joint managing director, the company aims to significantly augment its office space, retail portfolio, and hospitality offerings. By focusing on tailored expansions in key cities such as Bengaluru, Chennai, and Hyderabad, Brigade Group seeks to solidify its position as a premier player in the region's dynamic real estate landscape.

Tamil Nadu's DMK government recently unveiled a seven 'grand Tamil dreams' in its 2024–25 budget, highlighting social justice and fiscal prudence. Central to the budget was "Kalaignarin Kanavu Illam," a housing scheme aimed at constructing 0.8 million concrete houses by 2030, with a budget of INR 3,500 crore. Despite revenue constraints, the state plans to reduce its deficit marginally and maintain fiscal discipline. Following the Fifteenth Finance Commission's recommendations, Tamil Nadu will adopt a fiscal consolidation strategy, gradually reducing the deficit. Despite challenges, the state anticipates revenue growth and increased expenditures, with debt projected to remain stable relative to GSDP. Overall, Tamil Nadu's budget underscores its commitment to inclusive growth and citizen well-being.

Luxury housing in India experienced a remarkable surge in 2023, with sales soaring by 75% year-on-year, according to CBRE South Asia Pvt. Ltd. The luxury segment, encompassing units priced at INR 4 crore and above, witnessed a substantial 45% increase in unit launches. Notably, the luxury sector's share of overall residential unit sales doubled from 2% in 2022 to 4% in 2023. Delhi-NCR led the growth with a staggering 197% year-on-year surge, followed by Pune, Hyderabad, and Mumbai. The market's resilience was further evident in the balanced sales and launches during the last quarter of 2023.

Sundaram Alternates Assets (SAA), a subsidiary of Sundaram Finance Group, is spearheading a fundraising campaign to secure around INR 1,000 crore from international investors for green real estate ventures in India. With a focus on high-yield credit funds and a robust Environmental, Social, and Governance (ESG) framework, SAA aims to attract capital from diverse global sources, including NRIs in the Gulf region. The company anticipates the Series IV fund's closure within the INR 1,000-1,200 crore range, reflecting strong investor interest from regions like the GCC, North America, and Southeast Asia. SAA's proven track record and broad investor base highlight its potential to drive sustainable real estate initiatives in India.

Oberoi Realty teams up with Marriott International to redefine luxury living in Mumbai, unveiling plans for two prestigious properties: JW Marriott Hotel Thane Garden City and Mumbai Marriott Hotel Sky City in Borivali. Expected by 2027-2028, these projects promise unparalleled urban experiences. Chairman Vikas Oberoi underscores the integrated developments' grandeur, showcasing Oberoi Garden City and Sky City as prime locations. Leveraging Thane's allure and Borivali's vibrancy, Oberoi Realty emphasizes lifestyle enhancement through luxury residences, expansive malls, and seamless connectivity. This partnership cements Oberoi Realty's commitment to pioneering upscale urban communities, blending opulence with community well-being and sustainability, reshaping Mumbai's real estate landscape.

India's hospitality sector is poised for substantial growth, with Crisil Ratings projecting an 11-13% revenue increase in 2024-25, buoyed by robust recovery post-Covid-19. Domestic demand and rising overseas visitors are expected to drive growth to 15-17% this fiscal year. Strong operating performance and minimal capital spending will bolster profitability and credit profiles. Domestic travel demand, supported by economic activity, will sustain industry development, albeit at a slower pace due to a high base effect. While foreign tourist numbers remain below pre-pandemic levels, their gradual increase will boost hotel demand, especially in the MICE category. Favourable supply dynamics will further fuel industry resilience, with brands favouring management contracts to minimize upfront capital costs amidst sector challenges.

Crib, a property management app founded in 2021 recently introduced Crib Plus, a premium version aimed at the burgeoning student housing and co-living markets in India. With an investment exceeding USD 1 million, Crib Plus intends to target the burgeoning rental market that is expected to surpass USD 20 billion by 2024. Offering streamlined operations and cost reduction benefits, Crib Plus aims to empower operators with comprehensive management tools and enhance brand presence. With over USD 2 million in funding from esteemed investors, including Vijay Shekhar Sharma and Kunal Shah, Crib is poised for continued growth and innovation in the real estate tech sector.

The Maharashtra Industrial Development Corporation (MIDC) is nearing the completion of land acquisition for new industrial estates near Nashik. Covering 348 hectares across Maparwadi and Rajur Bahula, MIDC aims to finalise the process by April's end, enabling infrastructure development. Local farmer cooperation indicates a smooth settlement process. Land rates are set at Rs 94 lakh per acre for Rajur Bahula and Rs 52 lakh per acre for Maparwadi. Industry experts, like Manish Rawal, commend the move, envisioning Nashik's growth as a manufacturing hub. The state government's commitment to industrial expansion is evident, poised to fuel economic development and job opportunities.

Japan has pledged a significant 232.21-billion-yen loan (about USD 1.55 billion) to bolster infrastructure and development across India, spanning crucial sectors like road construction, climate change mitigation, and agriculture. The agreement, signed by officials from both nations, strengthens their long standing bilateral cooperation dating back to 1958. Key projects include enhancing road connectivity in India's North-east, constructing the Dhubri-Phulbari bridge, and upgrading the Phulbari-Goeragre highway. Additionally, investments are allocated for the Chennai peripheral ring road, dedicated freight corridor, start-up promotion in Telangana, sustainable horticulture in Haryana, climate change response in Rajasthan, a teaching hospital in Nagaland, and urban water supply improvement in Uttarakhand.

China has implemented a significant reduction in its benchmark mortgage reference rate to stimulate economic activity and rejuvenate the property market. The five-year loan prime rate (LPR) was cut by 25 basis points, signalling policymakers' commitment to providing stimulus support. While impacting financial markets and boosting property stocks, the move aims to stabilise confidence, promote investment, and support real estate market development. Despite challenges, China remains focused on fostering stability and growth in the sector.

The Maharashtra Housing and Area Development Authority (MHADA) is a flagship housing scheme established under the Maharashtra Housing and Area Development Act, 1976. It came into existence in the year 1977. It is a lottery system under which certain housing units are allotted in some specified areas each year, especially for the people who fall under lower and middle-income groups. Currently, it provides affordable housing options under the Pradhan Mantri Awas Yojana (PMAY).

Bandhan Bank expands its footprint in Mumbai's commercial heart, BKC, securing 12 office spaces in INS Tower for INR 135.64 crore. This strategic move aims to elevate its Mumbai corporate office, replacing the current Platina tower location. Real estate experts note a slight premium due to high demand for Grade A spaces in the BFSI hub, with monthly rentals exceeding INR 50 per sq ft. The acquisition involves four sellers and grants exclusive access to 31 car parking slots. This expansion aligns with Bandhan Bank's growth strategy, evidenced by its robust financial performance and workforce expansion, reaffirming its commitment to key financial sectors.

<p>&bull; A residential flat spanning 401 square feet sold in Shivam Galaxy in Psivali for INR 36.5 lakhs<br /><br /> &bull; A residential flat spanning 417 square feet sold in Raj Urbania in Ambarnath for INR 22.55 lakhs<br /><br /> &nbsp;</p>

Godrej Properties Ltd (GPL), a prominent Indian real estate developer, has taken a proactive and customer friendly approach in tackling the problems concerning the Godrej Summit project in Gurugram. Following concerns over construction quality, over 100 homeowners recently opted for a buyback offer extended by the company. In addition, GPL is said to have earmarked INR 155 crore for repairs, addressing chloride-related corrosion in concrete. The company has extended repair deadlines to ensure a thorough completion by December 2024 under the guidance of IIT Delhi. GPL has vowed to prioritize resident satisfaction, engaging with residents and collaborating with experts to ensure project quality and safety.

DRA Homes, a prominent real estate developer in Chennai, unveils a strategic investment plan of INR 2000 crore for FY 2024-25, with a INR 500 crore commitment for Chennai's development. Funding will be sourced from equity, internal accruals, family offices, and structured debt. Targeting the mid-segment market, the company plans to introduce commercial developments, villas, and layout stocks. Over the next 3-4 months, projects spanning 1.2 million sq ft will be launched, projecting a turnover of INR 750 crore. Ranjeeth Rathod, MD of DRA Homes, emphasises confidence in Chennai's real estate potential amid robust commercial and residential demand, supported by accolades for excellence and innovation.

The Uttar Pradesh State Government, guided by recommendations from a committee led by former Niti Aayog member Amitabh Kant, is streamlining flat registration in projects where developers accept recalculated dues under a rehabilitation plan. Special Sunday camps aim to hasten registration, aiding about 40 projects in Noida and Greater Noida. The deal offers a two-year interest and fine waiver on COVID-related dues upon 25% upfront payment. Officials anticipate a boost in revenue collection, aiming for INR 4,728 crore from Noida alone. However, only 13 of 57 developers have responded positively, prompting a deadline extension. Proactive measures aim to enhance developer participation and revenue, aligning with rehabilitation goals.

Under Chief Minister Siddaramaiah's leadership, the Karnataka Government has unveiled a holistic plan to revamp Bengaluru, positioning it as a premier urban centre. Key initiatives include digitizing property tax records for all 20 lakh properties, aiming for a 'record' tax collection of INR 4,300 crore in the current fiscal year. To plug tax leaks, strategies have been devised, while additional revenue streams are to be targeted through revised advertisement policies and a premium Floor Area Ratio (FAR) policy. Infrastructure enhancements focus on road development, traffic decongestion, and the transformation of the Peripheral Ring Road (PRR) into the Bengaluru Business Corridor under a PPP model. Sustainability efforts include establishing captive solar parks, reinforcing Bengaluru's image as an eco-conscious metropolis.

witness rapid growth in fiscal year 2023.png)

Affordable Housing Finance Companies (AHFCs) witnessed a remarkable resurgence in growth during FY23, expanding by 27% year-over-year, as per a CareEdge Rating report. Forecasts suggest a sustained growth trajectory, with a projected 29% growth in FY24 and a further 30% in FY25 for AHFCs. Despite elevated costs and margin pressures, asset quality remains stable with a GNPA ratio around 1.2%. The report also anticipates a rise in the non-housing segment share to 27% by March 31, 2024, amidst high competition.

Walmart, the global retail giant, plans to triple its sourcing from India, targeting USD 10 billion per year by 2027. At the Walmart Growth Summit, the company emphasized supporting Indian MSMEs and entrepreneurs, already training 50,000 individuals under its Walmart Vriddhi initiative. CEO Doug McMillon and President Kathryn McLay highlighted India's potential, aiming to contribute to its USD 4 trillion economy. The summit facilitates global market access for Indian manufacturers, focusing on diverse categories. Walmart's partnerships in India, including Flipkart and initiatives like Flipkart Wholesale, PhonePe, and Walmart Global Tech India, showcase a holistic approach to fostering growth and innovation.

OYO properties & Homes is branching out into the sports hospitality market, choosing 100 properties in 12 locations, including Bangalore, Chennai, and Delhi. The change is intended to accommodate major sporting events by offering players, referees, and spectators end-to-end solutions. OYO provides a variety of lodging alternatives, customised packages, and group booking choices with an emphasis on quality and creativity. The company also intends to offer transportation, catering, and round-the-clock support via control rooms at event locations. This strategic growth, which demonstrates OYO's dedication to seamless and inclusive hospitality, comes after successful participation in significant sporting events in 2023.

The Maharashtra Government has allocated INR 145 crore from the district planning committee to develop infrastructure in rural towns of Nashik like Sinnar, Manmad, Bhagur, and others. An additional comprehensive plan of INR 813 crore for the district's development has been approved for fiscal year 2024-25. This funding aims to address critical infrastructure needs and promote balanced development across urban and rural areas, reflecting the government's commitment to enhancing the region's overall growth and prosperity.

America's office market is experiencing notable changes, with Morgan Stanley analysts predicting further price declines due to ongoing challenges, primarily driven by remote work trends. Office property prices have already dropped by about 20% from their peak, with vacancies reaching record highs. Concerns also arise from the impending debt refinancing in the commercial real estate sector, posing additional hurdles. As distress mounts, stakeholders must adapt to evolving dynamics and seek innovative solutions to navigate the challenges ahead.

NTT Ltd., a leading IT infrastructure company, announces its inaugural data centre campus in Paris, spanning 14.4 hectares with a capacity of 84 MW across three centres. Located strategically near digital infrastructure, the site in Le Coudray-Montceaux and Corbeil-Essonnes signifies Paris's importance in NTT's global expansion. CEO Doug Adams highlights collaboration with local entities and the site's significance in meeting rising data demands. Logistics Capital Partners facilitated site acquisition and will aid in development. This move aligns with global expansion plans amid growing data needs, complementing recent ventures in the US and India, showcasing NTT's substantial investment exceeding USD 10 billion.

Affordable Rental Housing Complexes( ARHCs) is a sub-scheme under the Pradhan Mantri Awas Yojana – Urban (PMAY-U) scheme, initiated by the Ministry of Housing & Urban Affairs. It aims to provide affordable rental housing to urban migrants and poor. The ARHCs will comprise of a mix of single bedrooms and dormitory style units along with common facilities and amenities. These spaces will be leased for a minimum period of 25 years. Under the ARHC scheme, government funded vacant houses will be converted to ARHCs and new structures will be erected on available vacant land for this purpose which will managed through Public Private Partnership or Public Agencies.

Ramabai Ambedkar Nagar, one of the oldest slums in Mumbai, is set for redevelopment by the Mumbai Metropolitan Region Development Authority (MMRDA). Covering a vast area of 75 acres, the redevelopment project aims to transform a significant portion of the land into a mixed residential-commercial zone. Through the project, the MMRDA plans to extend the Eastern Freeway to Thane, thereby making the redeveloped area to be seen as a very strategic location. The project envisions creating 81 lakh sq ft of rehabilitation area for 15,000 tenements and generating 75 lakh sq ft of commercial space, targeting an overall estimated revenue of INR 10,000 crore.

• A residential flat spanning 900 square feet sold in Kabra Primera in Vikhroli East for INR 3.62 crores<br /> • A residential flat spanning 938 square feet sold in Kalpataru Srishti - Wing F CHS in Mira Road for INR 1.7 crores

Awfis, a prominent provider of flexible workspaces in India, achieves a significant milestone, surpassing 100,000 seats across its nationwide centres. From its inception in 2015 with one centre in New Delhi, Awfis now spans 16 cities, ranking among the top 5 players in the sector as per CBRE. With a presence in over 150 centres across Tier-I and Tier-II cities, Awfis holds the largest share in Tier-II cities among top operators. Serving diverse industries, including IT and finance, notable clients include Lenovo and Capgemini. Awfis' journey continues to redefine office dynamics, empowering businesses in an evolving work landscape.

Kolte-Patil Developers had revealed a INR 9,000 crore project launch plan over 14 months, bolstering its presence in Pune, Mumbai, and Bengaluru. Pune's growth, driven by infrastructure and economic activities, will witness unveiling of projects worth INR 6,400 crore. Strategic micro-market positioning includes Kiwale, Pimple Nilakh, Baner, Kharadi, Hinjewadi, and NIBM Road. The company intends of investment INR 2,500 crore by FY25 in Mumbai. The company is aiming for a sales target of INR 3,500 crore in FY25 and INR 4,500 crore in FY26, backed by partnerships like Marubeni Corporation. With 26 million sq. ft developed and ongoing projects spanning 33.5 million sq. ft, Kolte-Patil eyes a Gross Development Value of INR 25,000 crore, emphasizing technology-driven growth across key markets.

Haryana's Real Estate Regulatory Authority (H-Rera) has issued a stern warning to banks in Gurugram against allowing developers to withdraw funds from the regulator's accounts in violation of prescribed norms. In a letter dated Feb 12, H-Rera emphasised non-compliance with the Real Estate (Regulation and Development) Act 2016, where developers must deposit 70% of collected funds into separate accounts for specified project expenses. The authority stressed the importance of banks ensuring compliance and notified developers of potential penalties, including up to 5% of the project's cost, for violations.

The Housing and Urban Development Department is launching a web-based House Allotment System (HAS) to ensure transparency in allotting houses to the urban poor. Under Model I of the Housing for All Scheme, private developers must reserve 10% of housing units for Economically Weaker Sections (EWS). The system's standardized procedure outlines eligibility criteria, registration steps, and roles of stakeholders. Beneficiaries register on HAS to apply for EWS house allotment. Development authorities monitor the process, ensuring compliance. With 1,500 EWS housing units in Bhubaneswar set for allocation, the HAS promises a transparent and accountable approach to housing distribution.

HDFC Bank's home loan book reached INR 6.84 lakh crore in December, nearing SBI's INR 6.94 lakh crore. SBI had surpassed HDFC in February 2021 with a market share of 23.5% to HDFC's 17%. Despite HDFC Bank's rapid growth post-merger, it lost market share. However, HDFC Bank's sequential growth outpaced competitors at 3.6%. SBI aims for a INR 10 lakh crore home loan book in five years. HDFC Bank focuses on reducing loan processing time and increasing cross-selling opportunities. They plan to introduce home refurbishment loans and a home saver product to enhance customer offerings and digital connectivity.

Despite economic uncertainty and decreased investment, the warehousing and logistics industry demonstrated resilience in 2023, with warehouse space usage increasing by 21% to 37.8 million sq ft, surpassing pre-pandemic levels. Institutional investment decreased by 65%, totalling USD 646 million, as investors adopted a cautious approach. Third-party logistics (3PL) firms played a crucial role, representing 44% of total absorption. Mumbai led in absorption, while Kolkata experienced a decline due to warehouse shortages. NCR saw a 21% rise in absorption, driven by its strategic location and e-commerce growth. Southern cities remained significant players despite challenges. While 2024 poses uncertainties, long-term growth prospects remain optimistic, with a predicted CAGR of 10%-13% driven by e-commerce expansion and infrastructure development.

Udhayam theatre, a historic cinema hall in Chennai, is scheduled for demolition to pave way for a residential complex on its 1.31-acre property in Ashok Nagar, Chennai. Established in 1983 as one of the city's initial multiplexes, the theatre complex, housing Udhayam, Mini Udhayam, Suriyan, and Chandran theatres, will be replaced by a residential development. The decision to replace the iconic structure with a residential complex comes in light of low profitability and financial constraints. The closure has stirred nostalgia among cinema enthusiasts, reflecting a broader trend of traditional theatres facing challenges and closures amid the growing popularity of online streaming platforms.

The Brihanmumbai Municipal Corporation (BMC) engaged Manori residents in discussions about the Marve-Manori flyover, part of a broader initiative to improve connectivity in Mumbai's western suburbs. Local fishermen and farmers raised objections over potential ecological damage and threats to traditional livelihoods. Concerns heightened due to the lack of basic amenities in nearby villages, questioning the infrastructure's prioritization over essential services. Deputy Municipal Commissioner Vishwas Shankarwar noted diverse opinions among stakeholders during the consultation, where feedback was solicited. The BMC aims to ease congestion on key routes like SV Road and the Western Express Highway with six major bridges, despite Maharashtra Coastal Zone Management Authority's concerns about mangrove impact.

NBCC Ltd has secured a INR 262 crore project to redevelop the Ministry of External Affairs Housing in Delhi. The project, inaugurated on February 14, 2024, includes constructing 54 Type-VI Quarters, 18 Type-IV Quarters, and 18 Transit Quarters. Key attendees included Y K Sailas Thangal, Nidhi Anand, and K P Mahadevaswamy. This initiative aims to enhance infrastructure and create a conducive living environment for residents, underscoring the commitment of both MEA and NBCC. NBCC, engaged in Project Management Consultancy and real estate, continues to spearhead transformative endeavours in infrastructure development.

The United Kingdom has set a historic precedent by enforcing mandatory biodiversity net gain (BNG) rules for housing developers. Effective immediately, all new major housing projects must deliver a minimum 10% benefit for nature. Smaller developments will follow suit in April, while rules for national infrastructure projects are expected in 2025. The move reflects the UK's commitment to halt species decline by 2030. Investors, including Gresham House, foresee substantial opportunities in the emerging market for nature, estimated to be worth hundreds of millions annually. The initiative aims to harmonise development with nature conservation, transforming communities sustainably.

The Slum Rehabilitation Authority (SRA) is a planning authority formed under the Slum Rehabilitation Act in December 1995. It was established to serve as a planning authority for all slum areas in the jurisdiction of Municipal Corporation of Greater Mumbai. The SRA authority undertakes activities such as assisting slum dwellers in forming co-operative societies, assisting in certification of eligibility of slum-dwellers, taking punitive action on non-participating slum-dwellers obstructing the scheme, survey, and measurement on slum lands grant of building permissions, leasing of rehabilitation plots and free-sale plots and updating of property cards (PR cards) and more.

Godrej Properties has entered the Hyderabad real estate market by acquiring 12.5 acres in Rajendra Nagar. The development on this land parcel is expected to yield a 4 million sq. ft. saleable area, focusing on premium residential apartments with an estimated revenue potential of INR 3,500 crore. The Rajendra Nagar area offers robust infrastructure, schools, hospitals, and connectivity to key hubs. Godrej Properties aims to cater to discerning homebuyers in Hyderabad, following its recent acquisition of land parcels in Bengaluru. With a target of multiple land acquisitions, the company aims to generate around INR 15,000 crore in revenue post-development this fiscal year.

<p>&bull; A residential flat spanning 348 square feet sold in JSB Nakshatra Primus in Naigaon for INR 26 lakhs<br /><br /> &bull; A residential flat spanning 1031 square feet sold in CIDCO Celebration CHS in Kharghar for INR 1 crore<br /><br /> &nbsp;</p>

Pushpam Group, renowned for its upscale resort homes, has unveiled 14 exquisite Bali-themed studio suites at Balibaug in Alibaug. Priced at INR 59 lakh and above, these meticulously crafted suites offer residents a tropical retreat with panoramic views from their verandas. Dr. Sachin Chopda, Managing Director of Pushpam Group, emphasised the suites' addition to their luxury villa offerings, highlighting the project's appeal for investors seeking monthly rental income. Balibaug, situated along Alibaug's scenic coastline, promises a serene escape reminiscent of 'Mini Goa', just a short drive from Mumbai and the forthcoming Navi Mumbai International Airport.

County Group plans to invest INR 5,000 crore over five years in Ivory County, an ultra-luxury housing project in Noida's Sector 115. With 2,372 units spread across 28 acres, the project includes 'Ivory County' and 'Ivory County Gold' segments. Phase one's 1,500 units are already sold out. Offering 3, 4, and 5-BHK apartments ranging from 2,034 to 6,939 sq ft, prices start at INR 14,000 per sqft for Ivory County and INR 16,000 per sqft for Ivory County Gold. With a revenue potential of INR 7,500 crore, the project targets buyers from within County Group's existing projects for a lifestyle upgrade.

In a recent ruling, the Lucknow bench of the Allahabad High Court addressed a key issue regarding eligibility under the state's slum policy. The court highlighted that those with commercial establishments in slum areas cannot be equated with traditional 'slum dwellers,' sparking debate. The case, focusing on the Akbarnagar demolition, saw the court directing authorities to provide details of slum dwellers filing GST and Income Tax returns. This underscores the court's intent to assess each case individually. The outcome of this legal battle will likely influence future urban development strategies and legal interpretations concerning slum rehabilitation policies.

The state cabinet approved the redevelopment of 25 buildings in Sion Koliwada, Mumbai, housing Sindhi, Sikh, and Punjabi families displaced during Partition. The redevelopment, costing INR 3,000 crore, will be overseen by MHADA, providing 1,200 families with larger homes free of cost. A high-powered committee will monitor the project, ensuring at least 51% tenant consent. The buildings, erected in the 1950s and '60s for refugees, faced demolition notices from BMC in 2011. The initiative, long overdue, aims to address housing needs and marks MHADA's role as a special planning authority. Residents welcome the decision after years of efforts and displacement.

The National Housing Bank (NHB) of India has launched an initiative to bolster the housing finance market, focusing on Residential Mortgage-Backed Securities (RMBS) in collaboration with the Reserve Bank of India. The plan includes forming the RMBS Development Company Limited (RDCL), with NHB as the major shareholder and significant investments from insurance companies, private banks, and Housing Finance Companies (HFCs) like Grihum Housing Finance Ltd (Grihum). With India's housing finance market expected to double soon, especially in catering to economically weaker sections, lower-income, and middle-income groups, this initiative aims to drive economic growth, financial inclusion, and affordability while diversifying funding sources for HFCs.

The Indian commercial office sector is experiencing a substantial surge, as per the latest findings from ICRA, a leading credit rating agency. Their report indicates a remarkable potential for Real Estate Investment Trusts (REITs) within the office market. The report reveals that the REIT-ready office supply market could boost the office REIT market size by 6.0-6.5 times, with Bengaluru leading the way at 31% of the supply. Presently, three listed office REITs in India represent about 9% of the total office supply. Despite challenges like high vacancies in SEZ space, office REITs maintain a healthy 84% occupancy rate. ICRA projects a revival in SEZ attractiveness, supporting a stable outlook for India’s commercial office sector due to its appeal to global capability centers.

Private equity giants Bain Capital, Advent International, and CVC Capital, along with Warburg Pincus, vie for Shriram Housing Finance Ltd (SHFL), a subsidiary of Chennai's Shriram Finance. Initial offers fell short of Shriram's INR 6,500 crore valuation, prompting renewed talks after last year's unsuccessful stake sale. SHFL's impressive growth has driven the need for capital infusion, aiming to reach INR 20,000 crore assets under management by FY25. The company's focus on affordable housing attracted investor interest amidst India's booming market. The potential acquisition signals a transformative shift in India's housing finance landscape, offering promising opportunities for growth and innovation.

Bengaluru-based Prestige Group plans to develop 9 million sq ft of retail space across Mumbai and Delhi-NCR, expanding its mall business. In 2021, they sold 4.4 million sq ft of retail space valued at Rs 9,000 crore. Rebranding their malls aims to attract international brands and enhance customer experiences. Ali emphasised the rarity of malls generating Rs 100 crore monthly revenue, highlighting their Forum mall's success. Upcoming malls will feature destination retail, live music, cinemas, and technology-enabled experiences. With strong retail portfolio growth, including 102% YoY sales increase in Q2FY24, Prestige Group aims to join India's elite mall league.

The Brihanmumbai Municipal Corporation (BMC) is concreting roads in Mumbai's eastern suburbs, with a tender worth INR 1,224 crore covering 261 roads, augmenting ongoing work on 182 roads. Chief Minister Eknath Shinde's directive aims to eliminate potholes and enhance road quality within two years. Initially, tenders worth INR 5,800 crore for 400 kilometers were floated, later cancelled due to a lacklustre response. Fresh tenders of INR 6,080 crore for 397 kilometers were issued, but challenges persisted, leading to cancelled contracts and new tenders. Concerns about pace and quality remain, underscoring the need for addressing contractor performance and project execution issues.

Houston's ultra-luxury home market witnessed a remarkable 75% surge in sales for properties priced over USD 10 million, totaling USD 78 million in 2023, according to Compass' Ultra-Luxury Report 2023. While sales of homes over USD 1 million dipped 8.4% in 2022, effective marketing strategies, including private jet and yacht promotions, contributed to the present success. Experts predict sustained demand for large properties in prime locations, emphasizing health-focused features in the properties. Areas like Dallas-Fort Worth exhibited significant growth, with a 125% increase in sales, reaching a total volume of USD 104 million, driven by rising demand and new luxury constructions.

Base FSI is the basic FSI permitted by the competent authority as a matter of right without any cost. Chargeable or Premium FSI is the FSI available by additional payment to the competent authority as per the applicable rules. Maximum permissible FSI is the FSI that includes the base and chargeable FSI.

Former Indian cricket team captain, Kapil Dev, expands his real estate portfolio with the acquisition of a 16-acre land in Mograj village, Karjat taluka, marking his second significant purchase in the area. Secured from farmer Mohan Gaikar, the transaction, valued at INR 8 crore, was facilitated smoothly by a sub-registrar from Panvel. This acquisition, kept confidential until registration, underscores Karjat's growing appeal for property investors, fuelled by its proximity to tourist spots like Solanpada dam. Kapil Dev's continued interest in the region, alongside Bollywood actor Suniel Shetty's luxury villa project, further cements Karjat's status as a premier destination for second homes, stimulating local real estate development and interest.

<p>&bull; A residential flat spanning 424 square feet sold in East Syde in Ghatkopar East for INR 82.67 lakhs<br /><br /> &bull; A residential flat spanning 1025 square feet sold in Lodha Bellissimo Mulund Project Tower T2 in Mulund East for INR 2.69 crores</p>

Squarefeet Group launched India's first Millennial Housing Project in Thane, strategically situated opposite the expansive Grand Central Park. The project, unveiled by Maharashtra Chief Minister Eknath Shinde, is a pioneering venture aimed at redefining urban living for millennials. The Grand Central Park, spanning 20.5 acres, offers a diverse range of cultural themes and lush landscapes. The housing project promises a five-star hotel-like living experience with tailored amenities including culinary delights, housekeeping, and automated laundry services. Innovative features such as dedicated health experts and hybrid gyms ensure holistic well-being.

Ashiana Housing, based in Delhi, reported a robust Q3 FY23-24, with a net profit of INR 27.80 crore, surging 207.18% year-on-year. Total income rose to INR 189.25 crore, a significant 39.86% increase. The company's success lies in tailored residential developments across key cities like Gurugram and Jaipur, catering to evolving buyer needs. Additionally, its focus on the senior living segment has strategically positioned it amidst rising demand. With a debt-equity ratio of 0.18 and current liability ratio of 0.88, Ashiana is well-equipped for sustained growth, driven by customer-centric strategies and a commitment to excellence.

Starting April 1, property developers with a minimum of 50 housing units can register properties with MahaRERA at their own offices. Rajagopal Devara, the additional secretary of revenue, shared the Maharashtra state government's target to increase annual stamp duty registration revenue from INR 50,000 crore to INR 75,000 crore within two years. The decision on maintaining or changing ready reckoner rates, which impact stamp duty fees and property values, will be taken following a review. The government has also allowed property registration from any office in Pune and Mumbai, with this facility to be extended to buyers in Kolhapur district as well.

The National Company Law Tribunal (NCLT) in New Delhi has issued a verdict on a legal dispute between Supertech Realtors and Indiabulls Housing Finance. The case concerns Supertech Realtors' accusation that Indiabulls Housing Finance improperly deducted INR 6,150 crore from its loan account, exceeding the legitimate amount owed of INR 5,873 crore. Supertech alleges that this financial discrepancy not only breaches their contract but also has broader implications for public interest, potentially affecting their ability to deliver properties to customers. However, Indiabulls Housing Finance presented a Reserve Bank of India (RBI) order characterizing the dispute as a bilateral matter, to be resolved through contractual obligations. The NCLT ruling favoured Indiabulls Housing Finance, highlighting the complexities of corporate disputes, particularly in the real estate sector.

Property registrations in Pune surged by 46% year-on-year in January 2024, totaling 17,700 units compared to 12,166 in January 2023, according to the Maharashtra government’s Department of Registrations and Stamps. Stamp duty collections for the same period also witnessed substantial growth, reaching INR 589 crore compared to INR 441 crore in January 2023. Notably, residential units priced between INR 50 lakh and INR 1 crore dominated transactions with a 32% market share, followed closely by units priced between INR 25 lakh and INR 50 lakh at 31%. The data reflects a thriving real estate sector in Pune across various price ranges, apartment sizes, and buyer demographics.

In a noteworthy decision, the Income-tax Appellate Tribunal (ITAT), Delhi bench, ruled in favor of a non-resident taxpayer regarding the taxation of the variance between the stamp duty value and the agreement value of a property in Mumbai. The case of Shyamkumar Madhavdas Chugh highlighted the discrepancy between the agreement and registration dates, leading to differing values. The ITAT held that this difference cannot be deemed 'Income from other sources,' citing Section 56(2)(vi)(b) and emphasizing the importance of considering the stamp duty value on the agreement date. This ruling sets a significant precedent in clarifying tax treatment for property transactions, especially concerning timing disparities.

Phoenix Mills, a retail-led mixed-use asset developer, reported a 69% year-on-year rise in Q3 FY24. Consolidated net profit rose to INR 297 crore, with operating profit reaching INR 552 crore. Retail collections surged 30% to INR 700 crore, and rental income from retail grew 33% to INR 447 crore. The malls owned by the developers are operating at lifetime high lease occupancy and trading levels. The company also recorded robust leasing in commercial offices and maintains strong Average Room Rates (ARR) in hotels. Consolidated net debt stands at INR 2,230 crores. Residential sales show improvement, with gross sales of INR 515 crores in the first nine months of FY24.

The Adani Group has unveiled plans to invest INR 60,000 crore in a diverse array of infrastructure projects, spanning green hydrogen, copper smelting, power, transmission, and roads over a five-year period. With funds secured from Indian public and private sector banks, including the State Bank of India, the consortium includes five public sector banks and three private sector banks, with PSBs contributing 56% of total loans. Interest rates range from 9% to 11%, with the majority of funds to be allocated towards the green hydrogen project, showcasing the Group's commitment to sustainable energy. Additional investments target copper projects, transport, logistics, power assets, and coal-to-PVC ventures, reflecting the Adani Group's strategic vision to foster domestic finance and propel India's infrastructure agenda forward for sustainable growth.

The Ministry of Road Transport and Highways (MoRTH) is contemplating an extension of the defect-liability period within engineering-procurement-construction (EPC) contracts to 10 years, aiming to reduce road maintenance costs for the government and incentivize contractors to enhance construction quality. The initiative is part of efforts to curtail road accidents by ensuring improved road durability. While the proposal is under consideration, concerns have been raised about potential risks for contractors, who could face claims beyond their control during an extended defect-liability period.

Owens Corning has agreed to acquire Masonite International Corp. for USD 3.9 billion, aiming to diversify its residential building product offerings amidst challenges in the US real estate market. The deal is expected to yield USD 12.6 billion in revenue with USD 125 million in annual cost savings. Masonite, with 64 facilities primarily in North America, will operate as a separate segment post-acquisition, maintaining its brand and presence in Tampa, Florida. The announcement led to a surge in Masonite's stock by 34.2%, while Owens Corning's shares fell 8.5%.

TDR is a technique of land development, which separates the development potential of a piece of land from the land and allows the development rights to be used elsewhere in the city as permissible by the state law. Under this method, the owner of the land can sell the development rights of his land to another entity or individual. The receiving plot can use this TDR over and above the usual FSI available to it in accordance with the prevailing laws and regulations. This is generally used for redevelopment of inner-city zones and re‐development projects.

The Maharashtra Real Estate Regulatory Authority (MahaRERA) has partnered with the Advertising Standards Council of India (ASCI) to crack down on developers advertising projects without registration numbers and QR codes. The collaboration involves using Artificial Intelligence to identify such advertisements across various media platforms. MahaRERA Chairman, Mr. Ajoy Mehta, emphasized the importance of having a MahaRERA registration number and QR code in advertisements to ensure transparency and protect homebuyers' interests. This move aims to curb misleading advertisements and uphold RERA guidelines, which mandate registration for projects exceeding certain size thresholds. Homebuyers are encouraged to verify the presence of a registration number and QR code before investing in any real estate project.

<p>&bull; A residential flat spanning 362 square feet sold in Chhotalal Bhuvan in Fort for INR 54.58 lakhs<br /><br /> &bull; A residential flat spanning 496 square feet sold in Lodha Quality Home Tower 7 in Majiwade for INR 84.71 lakhs</p>

Casagrand, a leading real estate developer in South India, has launched Casagrand Medora, a premium residential project in Chennai's Korattur area, offering 155 luxurious apartments with 40+ amenities. Strategically located near Anna Nagar, the project stands out with an attractive price of INR 6999 per sq.ft., providing a holistic living experience in the heart of the city. Casagrand Medora emphasizes convenience, elegance, and functionality, featuring architectural finesse, world-class amenities, and meticulously crafted residences, demonstrating the developer's commitment to upscale urban living in Chennai.

Sobha Limited's Q3-FY24 financial results demonstrate strong sales and operational growth, with record-breaking collection, realization, and sales values. Quarterly sales hit INR 19.52 billion, up 37.0% YoY and 13.2% from Q2-FY24, driven by Bengaluru's highest-ever quarterly sales of 1.25 million sq ft., valued at INR 14.99 billion. Two new projects totaling 3.84 million sq ft. were launched, contributing to the highest-ever quarterly real estate collection of INR 12.93 billion, up 11.8% YoY. With positive cash flow, net debt/equity ratio reduced to 0.54. 9-month FY24 revenue rose to INR 24.26 billion, and Q3-FY24 profits reached INR 153 million, reflecting growth strategies focused on new launches and effective execution.

In response to public outcry, the Brihanmumbai Municipal Corporation (BMC) has scrapped a controversial draft policy concerning open spaces, confirmed by BMC Commissioner Iqbal Chahal. The policy, introduced in September 2023, aimed to lease playgrounds and recreation grounds to private entities and NGOs for up to five years, sparking widespread opposition. With concerns raised over potential exploitation and loss of control, the BMC has opted to maintain the existing adoption policy, allowing leases for eleven months. Chahal highlighted citizen concerns and stressed the importance of elected representatives shaping city policies. The decision, applauded by activists, signifies a victory for citizen engagement and the preservation of Mumbai's public spaces.

The Greater Noida Industrial Development Authority (GNIDA) has initiated an e-auction for eight group housing plots, spanning 3.5 to 10 acres each, in various sectors of Greater Noida. Developers have a 90-day window to complete payment for the land and are required to adhere to the approved layout plan, obtaining an occupancy certificate within seven years. Sector Mu offers a 4.5-acre plot, Omicron 1A a 7.5-acre plot, and Eta 2 a 7-acre plot, among others. Interested parties must apply by Feb 27 and submit documents by March 1. Land rates range from INR 36,500 to INR 48,300 per sqm, with a total reserved price exceeding INR 970 crore. Allotments are on a leasehold basis for 90 years, with restrictions on amalgamation or subdivision. Consortiums are allowed, with a designated lead member responsible for project completion. Previous transactions, like Prasu Infrabuild's acquisition of a 6-acre plot in Sector Zeta 1, reflect investor confidence in Greater Noida's real estate market.

The Magicbricks Rental Update for October-December 2023 highlights a robust 17.4% YoY surge in rents across 13 major Indian cities, led by Gurugram (31.3% YoY), Greater Noida (30.4% YoY), and Bengaluru (23.1% YoY). Rental demand modestly increased by 1.6% YoY, with Greater Noida, Ahmedabad, and Chennai witnessing the highest growth. However, rental supply decreased by 16.9% YoY, particularly in Noida, Hyderabad, and Greater Noida. Economic expansion, job markets, rising incomes, and migration to Tier 1 cities drove rental demand, while interest rates surpassing rental yields deterred investors. Millennials constituted 67% of rental demand, with 2 BHK units dominating the market at 41%.

India Shelter Finance Corp Ltd. demonstrates robust performance in Q3 FY24, with a 42% year-over-year increase in Asset Under Management (AUM) and a notable 55% surge in Profit After Tax (PAT) to INR 62 Crores. As of December 31, 2023, Gross and Net Stage 3 NPAs improved to 1.2% and 0.9%, respectively, from 2.3% and 1.8% in December 2022. The company's Net Worth reached INR 2,209 crore with a liquidity reserve of INR 1,488 crore. Despite market challenges, the company maintains a stable cost of funds and enhances Return on Assets (RoA) and Return on Equity (RoE). Significant reductions in Non-Performing Assets (NPAs) underscore resilience and growth potential in the housing finance sector.

Apeejay Surrendra Park Hotels, popularly known as 'The Park' Hotels, recently filed for an Initial Public Offering (IPO) amounting to a staggering INR 920 crores. The IPO comprised INR 600 crores in fresh shares and an Offer for Sale (OFS) of INR 300 crores, with a significant portion allocated to repay borrowings, bolstering the company's financial standing. The IPO, open from February 5th to February 7th, witnessed exceptional demand, with oversubscriptions of 75.14 times from Qualified Institutional Buyers (QIBs), 52.41 times from Non-Institutional Investors (NIIs), and 30.35 times from retail investors. The gray market indicated a premium of 20-25%, and upon listing on February 12th, the stock soared by over 31%, affirming investor confidence and signaling a bright future for Apeejay Surrendra Park Hotels in the luxury hospitality sector.

Landeed, a leading prop-tech startup, has unveiled India's premier AI Property Analyzer feature, a tool set to revolutionize property title analysis in the country. This technology provides a detailed ownership history of properties, simplifying title flow and enhancing accessibility for brokers, landlords, and landowners. By automating document analysis and retrieval, including Encumbrance Certificates and 7/12 records, Landeed's AI analyzer empowers users to navigate complex property documents effortlessly, saving time and minimizing errors. With overwhelming traction and positive reviews since its launch, Landeed is poised for further success in reshaping the Indian real estate landscape.

The Indian government has committed INR 6,000 crore to construct the Frontier Highway in Arunachal Pradesh, enhancing connectivity along the India-Tibet-China-Myanmar border. This strategic infrastructure, covering 1,748 kilometres just 20 km from the international border, is set to begin construction by April. Aimed at bolstering border security and regional economic growth, the project will be developed in collaboration with multiple agencies and is expected to generate significant local employment. Road Transport Minister Nitin Gadkari highlighted the project's role in facilitating economic development and supporting strategic defence initiatives, marking a significant step towards national security and prosperity.

Germany's commercial property sector faces unprecedented challenges, with data from the VDP banking association revealing a historic 12.1% drop in prices in Q4 2023, marking the largest decline ever recorded. This crisis, exacerbated by setbacks in recent years, saw prices plummet by 10.2% throughout 2023. The downturn stems from rapid expansion fuelled by declining interest rates, abruptly halted by rising rates and building costs, leading to insolvencies and stalled transactions. Amidst a global trend of property market challenges, Germany's plight underscores economic uncertainty, prompting calls for emergency aid and highlighting the need for proactive measures to navigate towards recovery.

Capital assets are significant pieces of property such as homes, cars, investment properties, stocks, bonds, and even collectibles or art. Any profit arising from the sale of a ‘capital asset’ is referred to as a capital gain. This gain or profit is considered as ‘income’ and therefore applicable to be taxed. Capital gains tax can be short-term or long term and must be paid within the same year as the transfer of asset. In India, assets received as gifts or by way of a will or inheritance is exempt from taxation. However, if the individual inheriting the asset choses to sell it, capital gain tax will be applicable.

Zomato CEO Deepinder Goyal has acquired two separate land parcels totaling 5 acres in Mehrauli Tehsil, New Delhi, for a combined sum of INR 79 crore. The first 2.5-acre plot was purchased for INR 29 crore in March 2023, followed by the second 2.5-acre parcel acquired for INR 50 crore in September 2023. The plots in the Dera Mandi village, Chhatarpur area, are attracting affluent buyers interested in farmhouses. A surge in demand for such properties post-COVID has seen prominent figures like JC Chaudhary and Jaguar investing in Delhi's farmhouse areas.

<p>&bull; A residential flat spanning 1291 square feet sold in Raheja Gardens Delphi in Naupada for INR 2.66 crores<br /><br /> &bull; A residential flat spanning 675 square feet sold in RK Royal City in Mankoli for INR 18.90 lakhs</p>

Arkade Developers Ltd., a burgeoning real estate entity in Mumbai, unveiled Phase 1 of Arkade Nest, an upscale residential enclave in Mulund West's Sarvodaya Nagar, spanning a generous 2-acre expanse with six wings, three already operational. Concurrently, Arkade secured redevelopment contracts for Arunachal Co-op HSG Society in Goregaon East's Jay Prakash Nagar and Nutan Ayojan Co-op HSG Society in Malad West's Liberty Garden. These initiatives underscore Arkade's stature in Mumbai's real estate landscape, blending luxury, affordability, and quality craftsmanship while addressing market demands effectively.

In June 2015, the Slum Redevelopment Authority (SRA) issued a circular aiming to regulate transit rent increases for slum dwellers affected by redevelopment projects. However, this directive has remained dormant, causing distress for occupants stuck in temporary accommodations. The Bombay High Court recently intervened following a representation by Wadala slum dwellers, urging the SRA to enforce the circular mandating a 5% transit rent increase. A division bench of justices instructed the SRA to expedite a decision, responding to a petition filed by 78 eligible slum dwellers from Wadala Village Welfare CHSL. Represented by senior advocate Ranjeet Thorat and advocate Yashodeep Deshmukh, concerns were raised regarding the fairness of developers' rent offers, contrasting market rates, and the SRA's inaction, highlighting the need for prompt resolution.

Prime Minister Narendra Modi is scheduled to virtually inaugurate and oversee the ceremony for 131,454 housing units in Gujarat this Saturday, with Chief Minister Bhupendra Patel and State BJP President C R Paatil attending in Deesa, North Gujarat. Beneficiaries from all 182 assembly constituencies will participate virtually, highlighting Gujarat's prominent role in implementing the Pradhan Mantri Awas Yojana (PMAY) and the national objective of housing for all by 2047. The state has already built 13.42 lakh PMAY units, with plans for an additional 65,000 units in urban areas during the 2024-25 fiscal year, reflecting its steadfast commitment to addressing housing needs.

Adani Realty and L&T Realty lead the race for a 24-acre development in Mumbai's Bandra Reclamation, following a stringent tender process by Maharashtra State Road Development Corporation (MSRDC). Originally attracting interest from major players like Godrej Properties and Mahindra Lifespaces, strict eligibility standards narrowed submissions to three contenders: L&T Realty, Adani Realty, and Mayfair Housing. Positioned near the Bandra-Worli Sea Link toll booth, the project holds significant commercial value, estimated at over INR 30,000 crore, with plans for a 45 lakh sq. ft. mini-township and an INR 8,000 crore payment obligation to MSRDC over the next decade-plus. Supervised by JLL, the tender imposed strict criteria, triggering opposition from locals citing environmental concerns and past agreements, potentially leading to legal challenges from groups like BRAVO.